For investors looking to join solid fundamental growth with good technical positioning, a multi-factor screening method can be an effective tool. By selecting for stocks that show strong earnings momentum, a good technical trend, and a helpful chart pattern, the aim is to find companies where fundamental force is matching a possible technical move upward. This method joins the ideas of high-growth momentum investing, which centers on companies showing quickening earnings and sales, with technical study that looks for good entry points during times of pause.

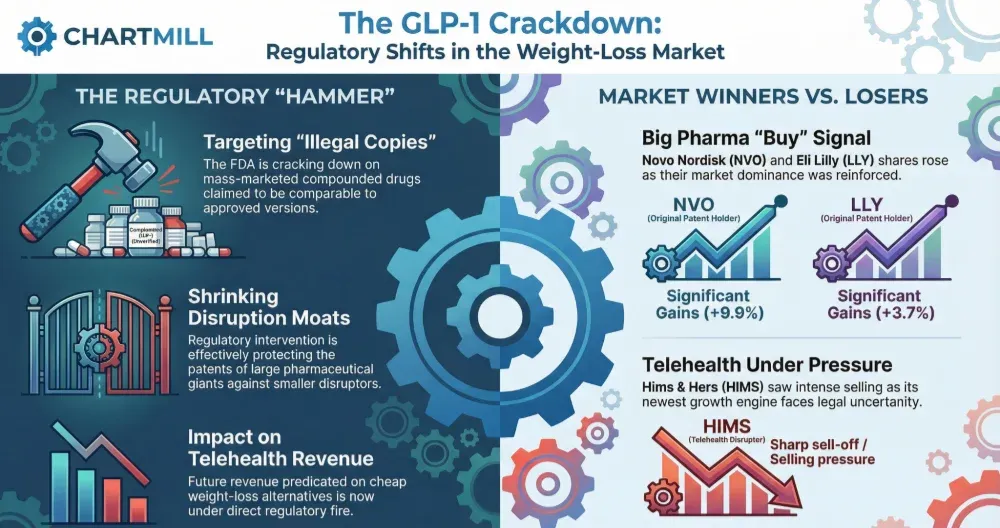

ELI LILLY & CO (NYSE:LLY) appears from such a screen, presenting a notable profile that connects these two fields. The pharmaceutical leader, known for its cardiometabolic and neuroscience groups including drugs like Mounjaro and Zepbound, is now showing the sort of forceful financial results that momentum investors look for.

High Growth Momentum Profile

The heart of a high-growth momentum plan rests in finding companies with quickening business fundamentals. Eli Lilly’s recent financial reports show a time of notable increase, pushed mainly by its new generation of treatments. The given numbers show a company in a major growth period.

- Notable Earnings Growth: The company's earnings per share (EPS) growth over the trailing twelve months is at a notable 116%. Even more telling is the quarterly momentum; EPS growth in the newest quarter compared to the same time last year rose by almost 495%. While this speed is thought to settle, guesses still show a solid 34% growth for the next quarter.

- Forceful and Quickening Sales: Revenue growth is also strong, with TTM sales up more than 45%. Quarterly sales growth has been steadily high, recorded at 54% in the last quarter, after 38% and 45% in the two before. This shows not just force but continued momentum in top-line increase.

- Positive Changes and Surprises: Analyst feeling is supporting this direction. Over the last three months, the average EPS guess for the next fiscal year has been moved up by 4.6%, and revenue guesses have been raised by 3.1%. Also, Lilly has passed EPS guesses in each of the last four quarters, with an average surprise of more than 13%.

- Growing Profitability: The company's profit margin in the last reported quarter was 31.7%, showing a skill to turn rising revenue into large bottom-line results. This operational effect is a main sign of successful growth companies.

These parts add to LLY’s High Growth Momentum Rating of 7, pointing to a good match with the points momentum investors focus on: quickening sales and earnings, positive estimate changes, and steady better-than-expected results.

Technical Force and Setup Quality

While fundamental momentum is key, the timing of an entry is often guided by the stock's technical action. A good trend gives support, while a quality setup gives a clear and lower-risk entry point. According to the detailed ChartMill Technical Report, Eli Lilly does well on both points.

Technical Condition (Rating: 9/10) The stock is in a clear upward trend, confirmed by both its long-term and short-term trends being scored as positive. It is trading near its 52-week high and is above all its main moving averages (20, 50, 100, and 200-day), which are all rising, a clear sign of continued positive momentum. With a technical rating of 9, LLY is grouped with the market's top stocks from a trend view, doing better than 91% of all stocks over the past year.

Setup Quality (Rating: 7/10) The current setup rating of 7 suggests the stock is making a pause pattern inside its larger upward trend. The report states that LLY has been trading in a band between about $977 and $1,112 over the past month and is now placed in the middle of this band. While the setup is not "perfect" because of recent movement, the existence of several set support areas below the present price, including a notable combined support between $1,010 and $1,044, gives a technical base. For a move-upward plan, a rise above the recent band could point to the next step up, with clear support levels present to handle risk.

A Joining Chance

The joining of Lilly's fundamental and technical stories is what makes it a notable candidate. The forceful growth in EPS and sales gives the fundamental "push" that can move a stock. At the same time, the good technical rating of 9 confirms this fundamental force is being seen and kept in the market price. The setup rating of 7 shows the stock is not overly high but is instead pausing or holding, possibly giving a more careful entry point for investors who did not see the first steep rise.

This matches well with the screening idea: to find companies where high-growth momentum is happening inside the setting of a good, set upward trend and a chart pattern that may come before a continuation.

Finding Like Chances

Eli Lilly & Co acts as a main example of how joining growth momentum filters with technical setup screens can reveal notable investment ideas. For investors wanting to find other stocks that meet like points of strong earnings momentum, positive technical trends, and helpful chart patterns, this High Growth Momentum Breakout Setups screen is often updated to show present market states.

Disclaimer: This article is for information only and does not make investment advice, a suggestion, or an offer to buy or sell any security. The study is based on given data and shows states at a specific time. Investing has risk, including the possible loss of principal. Always do your own study and think about talking with a qualified financial advisor before making any investment choices. Past results are not a guide for future results.