Peter Lynch’s investment strategy, described in One Up on Wall Street, centers on finding companies with steady growth at fair prices, commonly known as the Growth at a Reasonable Price (GARP) method. This approach prioritizes strong fundamentals, consistent profits, and low debt, while steering clear of overly hyped or rapidly expanding firms that might falter. By selecting stocks with solid earnings growth, healthy financials, and reasonable valuations compared to their growth potential, Lynch’s strategy seeks to identify long-term successes before they gain widespread attention.

A company that aligns with this model is INMODE LTD (NASDAQ:INMD), a maker of minimally invasive cosmetic medical devices. The stock matches many of Lynch’s key requirements, positioning it as an interesting option for GARP-focused investors.

Why INMD Matches the Peter Lynch Approach

-

Steady Earnings Growth

- Lynch preferred firms with stable, not extreme, earnings growth, usually between 15% and 30% per year. INMD’s 5-year EPS growth of 22.97% fits this range, showing balanced progress without signs of overheating.

- Future earnings projections point to continued, though slower, growth, matching Lynch’s focus on businesses that can sustain performance without overreaching.

-

Reasonable Valuation (PEG Ratio ≤ 1)

- A key part of Lynch’s method is the PEG ratio, which accounts for growth when evaluating price. INMD’s PEG ratio of 0.31 (based on past 5-year growth) indicates the stock is priced low relative to its earnings path.

- A PEG under 1 implies investors are paying less for each unit of growth, a principle Lynch often highlighted.

-

High Profitability (ROE > 15%)

- Return on Equity (ROE) shows how well a company turns shareholder investments into profits. INMD’s ROE of 28.38% surpasses Lynch’s 15% benchmark and ranks among the top in its sector.

- A strong ROE often points to competitive strengths, another factor Lynch valued, suggesting INMD holds an edge in the medical aesthetics field.

-

Sound Financial Position

- Lynch avoided firms with heavy debt, favoring those with balanced leverage. INMD has no debt, a rare trait that removes bankruptcy concerns and allows for reinvestment or buybacks.

- Its current ratio of 8.73 (compared to an industry average near 2) shows it has plenty of liquidity to meet short-term needs, lowering operational risks.

Additional Strengths

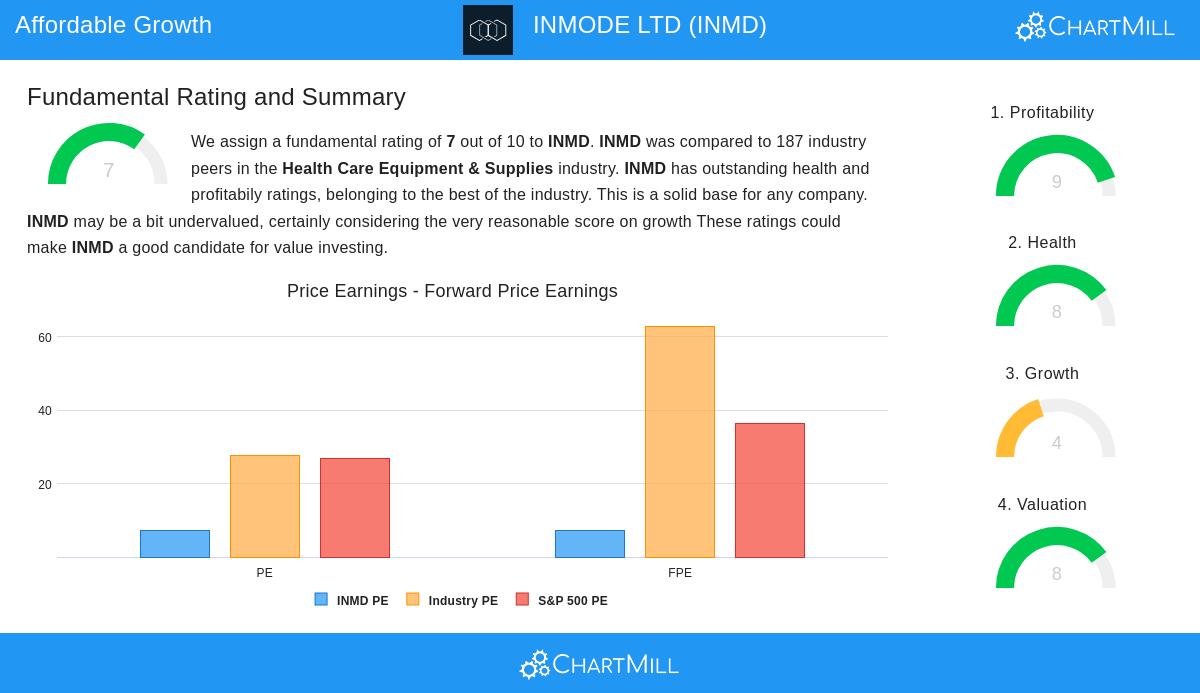

The fundamental analysis report highlights INMD’s appeal:

- Profitability: Outstanding margins (80% gross margin, 44.8% net margin) and top-tier returns on capital (ROIC of 15.86%) reflect efficient management.

- Valuation: With a P/E of 7.23—lower than 97% of healthcare equipment peers—INMD seems undervalued given its past growth.

- Cash Reserves: No debt and strong cash flow provide stability and room for innovation.

Possible Drawbacks

While INMD scores well on Lynch’s metrics, investors should consider:

- Recent revenue drops (-19.76% YoY) and slower EPS growth forecasts (6.28% annually) indicate short-term challenges.

- The medical aesthetics sector is crowded, and new technologies could squeeze margins.

Other Peter Lynch Picks

INMD is one of several stocks that meet the Peter Lynch criteria. For those looking for similar options, the full list can be accessed here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a financial advisor before making decisions.