For investors looking for reliable income, dividend investing stays a key strategy, especially when concentrating on companies that provide good yields and also show financial steadiness and regular earnings. The method used here applies a structured filtering system that favors stocks with good dividend ratings while confirming basic financial health and earnings measures. This even-handed standard aids in finding companies able to maintain and possibly raise their dividend payments over time, instead of only pursuing the highest yields that might point to hidden problems.

Hormel Foods Corp (NYSE:HRL) appears as a notable option from this filtering process, showing several traits that dividend investors commonly want. The company's strong dividend history is clear, with a yield of 4.60% that is higher than both the industry norm and the wider S&P500. Significantly, Hormel has a long history of consistency, raising its dividend for no less than ten years without a cut, a signal of management's dedication to giving value to shareholders. The dividend growth rate of 6.53% each year further strengthens its attractiveness for those focusing on income growth as well as present yield.

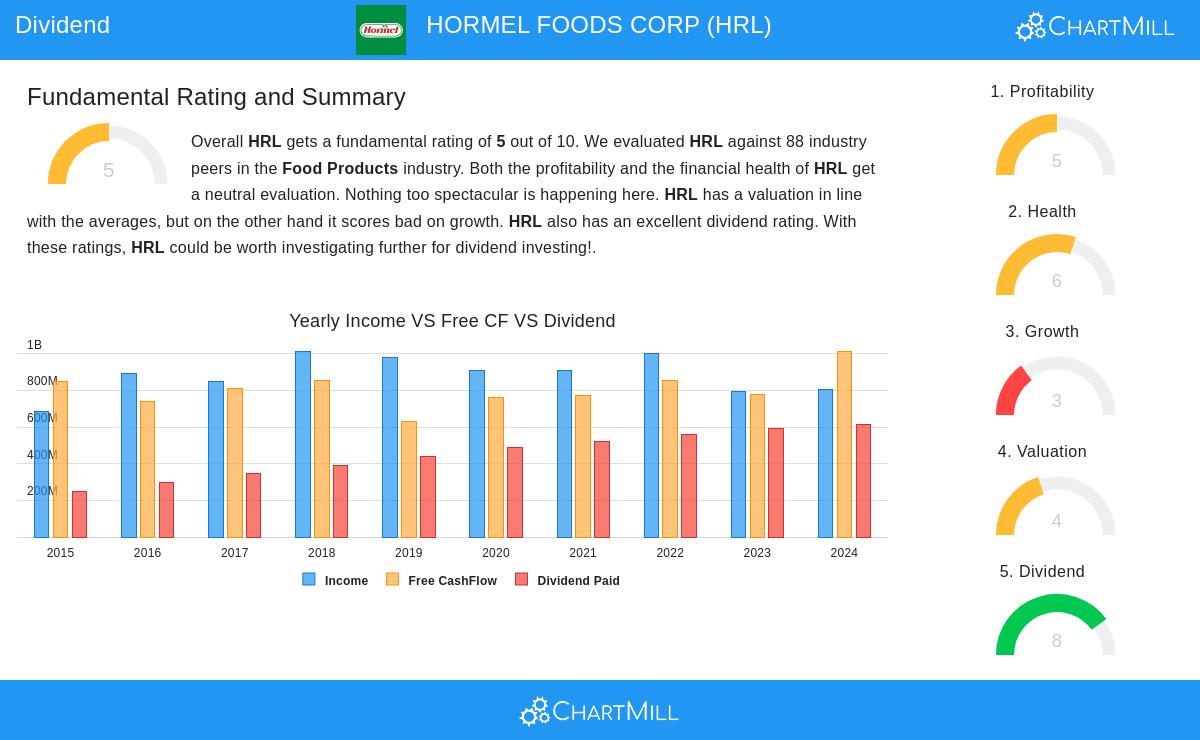

Dividend Sustainability and Financial Health

Although the payout ratio of 83.32% brings up some questions about sustainability, this should be seen within Hormel’s total financial situation. The company keeps a good balance sheet with a sound current ratio of 2.47 and acceptable debt amounts, shown by a debt-to-equity ratio of 0.35. These numbers imply enough cash and stability to handle economic changes while keeping dividend distributions. The Altman-Z score of 3.67 shows a low chance of bankruptcy, giving more assurance about the company’s financial strength.

Profitability and Operational Performance

Hormel’s profitability numbers, while not outstanding, show enough earning ability to uphold its dividend promises. Important measures include:

- Return on assets of 5.59%, doing better than 76% of industry rivals

- Profit margin of 6.26%, putting it in the leading group of its sector

- Operating margin of 8.40%, above 70% of competitors

These statistics, even with some recent narrowing, still show a business creating enough profits to pay for both operations and shareholder returns. The company’s existence in retail, foodservice, and international markets gives variety advantages, possibly balancing performance during economic shifts.

Valuation Considerations

Looking at valuation, Hormel sells at fair multiples relative to both industry norms and the larger market:

- P/E ratio of 17.06 versus industry average of 18.64

- Forward P/E of 13.89 compared to sector average of 17.83

- Enterprise value/EBITDA matching industry standards

While not a large discount, these valuations do not indicate overpaying for the company’s stable qualities, particularly considering its dependable income stream.

Growth Prospects and Analyst Expectations

Future growth outlooks stay moderate but favorable, with analysts forecasting:

- EPS growth of about 5.76% each year

- Revenue growth near 2.22% per year

These forecasts, while not rapid, match the company’s past performance and back ongoing dividend growth at a steady speed. The expected quickening in EPS growth compared to recent years gives more positive feeling for dividend sustainability.

For investors wanting to examine comparable dividend chances, the Best Dividend Stocks screen offers a selected list of companies fitting these balanced standards. More in-depth study of Hormel’s basic features is available in the detailed fundamental report.

Hormel is a standard illustration of the even-handed method dividend investors may think about, giving a good yield with a background of consistency, backed by sufficient financial health and profitability. While having some issues, particularly about payout ratio levels and moderate growth outlooks, the company's varied activities and firm market position supply a sensible base for continued income production.

Disclaimer: This analysis is based on available data and fundamental metrics as of the publication date and should not be considered investment advice. Investors should conduct their own research and consider their individual financial circumstances before making investment decisions. Past performance does not guarantee future results, and dividend payments are subject to company discretion and market conditions.