Investors looking for growth chances at fair prices often use screening methods that find companies showing good expansion potential without high valuations. The "Affordable Growth" method looks for stocks with strong growth features, good profitability, sound financial bases, and appealing prices. This system tries to balance the search for expansion with careful risk control, steering clear of both costly growth stocks and very cheap value traps. By concentrating on companies that show basic strength in several areas, this method works to find lasting growth stories available at reasonable prices.

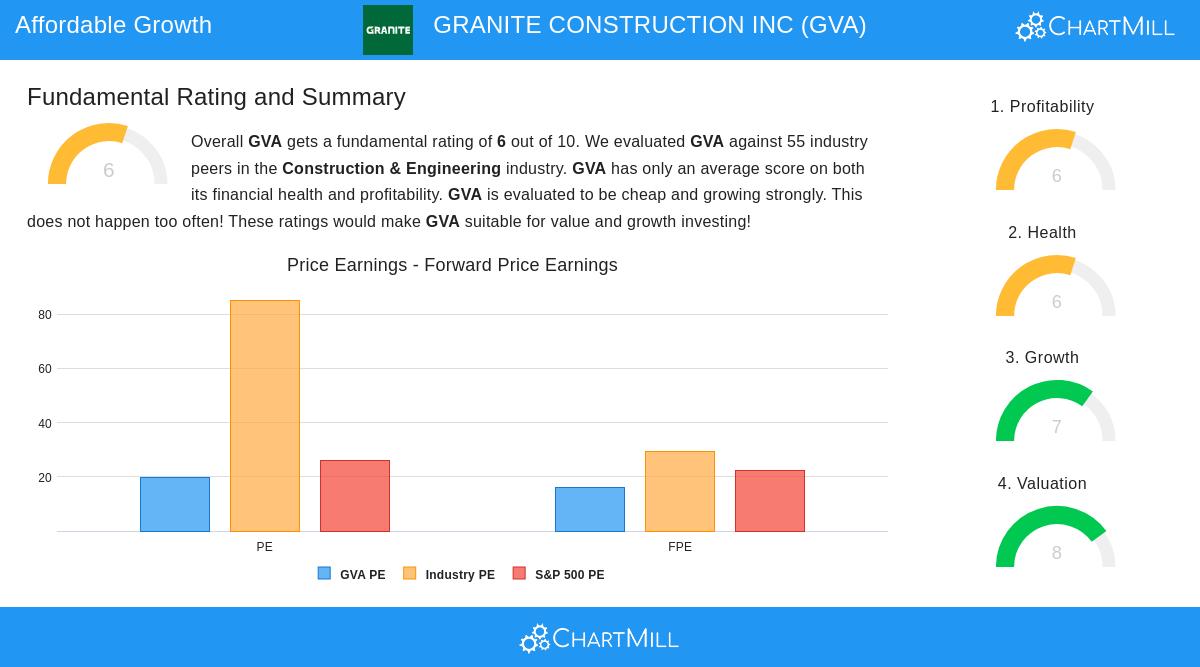

GRANITE CONSTRUCTION INC (NYSE:GVA) appears as an interesting candidate from this screening method, providing infrastructure answers and construction materials throughout the United States. The company's basic profile indicates it has the features looked for by investors seeking growth at fair prices, as explained in its detailed fundamental analysis report.

Growth Path

The company shows notable expansion measures that are central to its affordable growth attraction. Past performance reveals significant earnings momentum, while future estimates point to ongoing growth possibility.

- Earnings Per Share rose 59.63% over the last year, with a five-year average growth rate of 32.75%

- Revenue growth stays positive at 7.18% per year, predicted to increase to 9.43% in future years

- Future EPS growth estimates are at 21.70%, showing continued good performance

These growth measures are especially significant for the affordable growth plan as they indicate the company's capacity to increase earnings without depending only on multiple expansion. The mix of past strength and expected continuation points to lasting business momentum instead of short-term jumps.

Valuation Review

Granite Construction displays a good valuation profile compared to both industry counterparts and wider market measures. The company's present pricing seems fair when weighing its growth outlook and operational size.

- P/E ratio of 19.70 compares well to industry average of 85.21 and S&P 500's 26.19

- Future P/E of 16.03 is lower than industry average of 29.20 and market standard

- Enterprise Value to EBITDA and Price/Free Cash Flow ratios rate better than 83% of industry counterparts

- PEG ratio shows payment for growth stays appealing

For affordable growth investors, valuation discipline stops overpaying for growth outlooks. Granite's valuation measures suggest the market has not completely priced in its growth possibility, making a chance for investors who spot this difference early.

Profitability and Financial Condition

While growth and valuation drive the initial screening, profitability and financial condition give important supporting background for lasting expansion. Granite Construction displays balanced results across these aspects.

Profitability measures show capable operations with space for betterment. The company reaches a 3.89% profit margin that does better than 63% of industry rivals, with margins displaying recent gains. Return on Equity is at 14.91%, putting it in the top third of the construction field. However, Return on Invested Capital at 6.48% stays close to industry average, indicating possibility for improved capital use.

Financial condition presents a varied but generally steady picture. The Altman-Z score of 3.39 shows no immediate bankruptcy worries, while debt levels seem manageable with a Debt to Free Cash Flow ratio of 2.40 years. Current and quick ratios both top 1.4, giving sufficient liquidity coverage. These health measures are important for affordable growth investing because they lower the chance that financial limits will break the growth path.

Investment Points

The mix of solid growth, fair valuation, and sufficient supporting basics makes Granite Construction an interesting example in affordable growth investing. The company's place in infrastructure development brings some cyclical exposure but also possible gain from government spending plans and domestic construction patterns. Investors should observe that while the dividend yield stays modest at 0.50%, the company keeps a dependable payment history going over ten years with sustainable payout ratios.

For investors looking for similar chances, more affordable growth candidates can be found through our specific stock screener that uses similar basic standards to find companies displaying this balanced profile of growth and value features.

Disclaimer: This analysis is based on fundamental data and screening methods for informational purposes only. It does not form investment advice, recommendation, or endorsement of any security. Investors should do their own research and think about their personal financial situations before making investment choices. Past performance does not ensure future results, and all investments carry risk including possible loss of principal.