GILEAD SCIENCES INC (NASDAQ:GILD) was identified as a decent value stock by our screening process. The company shows strong profitability and an attractive valuation, while maintaining reasonable financial health and growth prospects. Here’s why GILD may be worth a closer look for value investors.

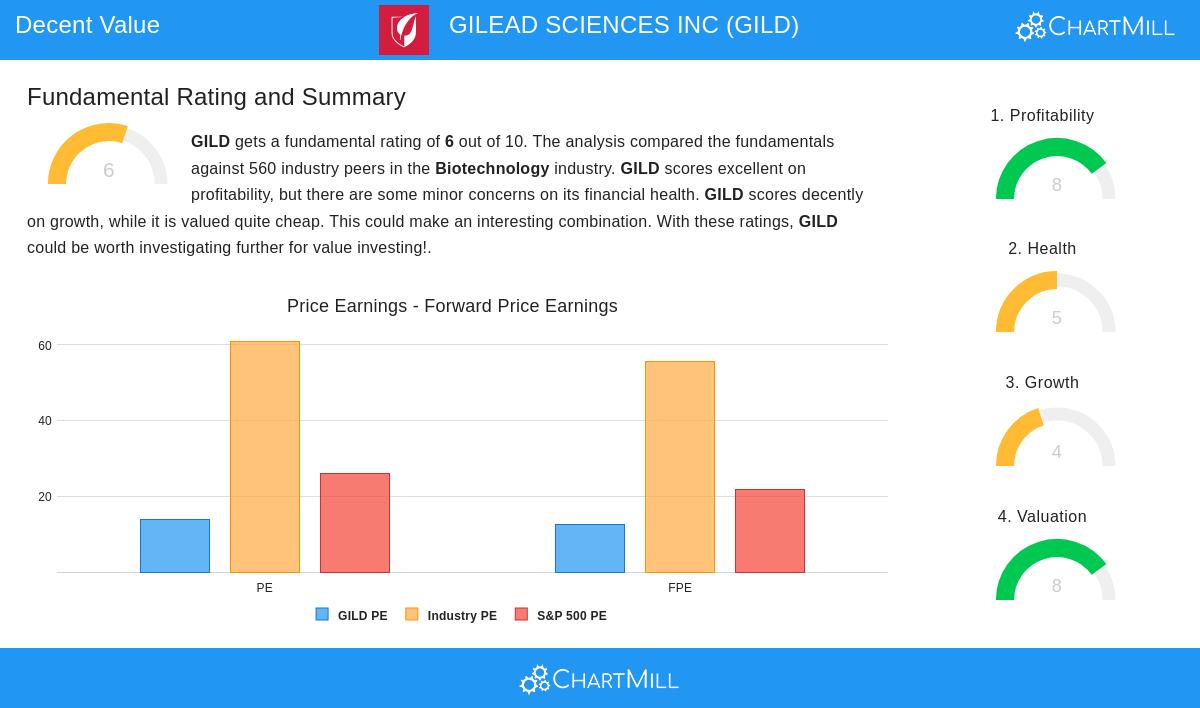

Valuation (Rating: 8/10)

GILD appears undervalued compared to both its industry peers and the broader market:

- P/E Ratio: At 13.87, it is cheaper than 95.89% of biotech industry peers (industry average: 60.91).

- Forward P/E: 12.47, well below the S&P 500 average of 21.77.

- Enterprise Value/EBITDA & Price/FCF: Both ratios rank better than 96% of industry competitors, reinforcing the stock’s discounted pricing.

- PEG Ratio: The low PEG suggests earnings growth is not fully reflected in the stock price.

Profitability (Rating: 8/10)

Gilead maintains strong profitability metrics:

- Return on Equity (ROE): 31.13%, outperforming 97.68% of industry peers.

- Operating Margin: 38.17%, among the best in the sector.

- Consistent Earnings: Positive earnings and cash flow over the past five years.

Financial Health (Rating: 5/10)

While generally stable, there are some areas to monitor:

- Debt Levels: A Debt/Equity ratio of 1.16 is higher than 79% of peers, indicating reliance on external financing.

- Liquidity: Current and Quick ratios are below industry averages but remain at manageable levels.

- Solvency: Strong free cash flow generation helps cover debt obligations.

Growth (Rating: 4/10)

Growth is moderate but shows signs of improvement:

- Recent EPS Growth: Up 77.93% year-over-year.

- Future EPS Growth: Expected to rise by 17.07% annually.

- Revenue Growth: Stable but modest at around 5% historically, with forecasts near 3.5% going forward.

Dividend (Rating: 6/10)

GILD offers a 2.93% dividend yield, higher than the S&P 500 average. However, the payout ratio of 66% is somewhat elevated, requiring monitoring for sustainability.

Our Decent Value screener lists more stocks with similar characteristics and is updated daily.

For a deeper dive, review the full fundamental report on GILD.

Disclaimer

This is not investment advice. The observations here are based on data available at the time of writing. Always conduct your own research before making investment decisions.