I’ve always admired FedEx (FDX | 222.00, -3.3%) for its operational grit and global reach. But when a company that moves the world’s goods becomes unsure about its own direction, I pay attention.

This week’s earnings release and market reaction told a clear story: FedEx beat expectations, but the lack of forward guidance and a murky macro backdrop left investors cold.

Q4 Delivers, But Confidence Doesn’t

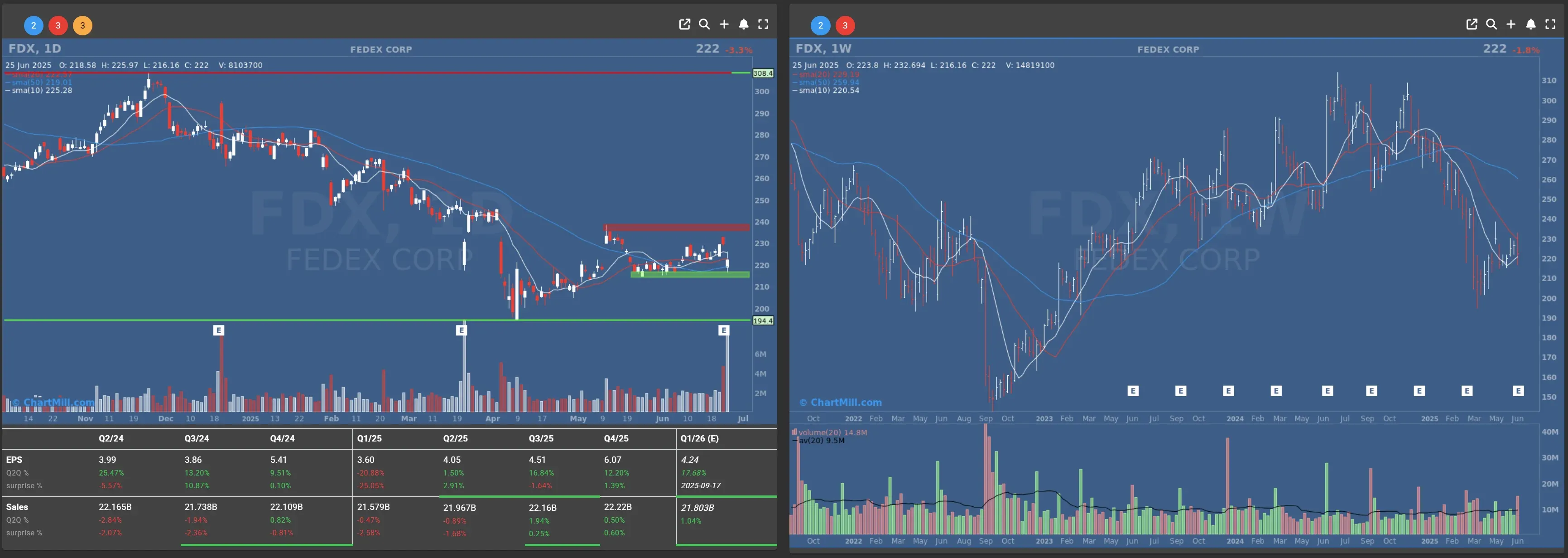

Let’s be fair, Q4 wasn’t bad. FedEx posted earnings per share of $6.07, beating the $5.87 consensus. Revenue came in at $22.2B, also above estimates. So far, so good. But the glow faded quickly.

Management dropped a wet blanket on the party by issuing a weaker-than-expected Q1 outlook.

They’re guiding for an EPS between $3.40 and $4.00, well below Wall Street’s $4.05 forecast. And they’ve pulled full-year guidance entirely, citing “volatile demand.” That’s corporate code for: “We have no idea what’s coming.”

When a logistics titan with global scale steps back from forward projections, it’s a signal. Economic uncertainty, political turbulence, and, let’s not forget, those revived Trump-era tariffs - especially on Chinese imports - are starting to leave a dent.

The Charts: Not as Flat as the Forecasts

The technical picture offers more nuance.

On the daily chart, FedEx broke out of a two-month range between ~$210 and ~$230 before tumbling right back inside it post-earnings.

The stock had climbed steadily since bottoming in April near $194, but Tuesday’s bearish reversal (high of $225.97, close at $222) shows clear rejection at the 10-day SMA (225.28) and just below the 50-day SMA (219.01), which now acts as short-term resistance.

On the weekly chart, the recovery looks less convincing. After a steep decline from the $308 peak last summer, the bounce from March’s $194 low lacks volume and conviction. The price now hovers near the 10- and 30-week SMAs, which are still downward sloping, a classic red flag in swing setups.

Unless the stock can convincingly retake $230–235 on strong volume, I don’t see a sustainable uptrend. The chart screams caution more than opportunity right now.

Sentiment: Shaky, and Then Some

It didn’t help that this quarter’s results were overshadowed by the passing of founder Fred Smith, the man who basically invented overnight delivery. His legacy is unmatched, but the timing of his death - coinciding with the company pulling guidance - is a somber metaphor. The company may be in transition, both structurally and sentimentally.

Investors don’t just want numbers, they want confidence. FedEx gave them neither in its outlook.

The fact that they're only guiding Q1, and that too conservatively, shows they’re bracing for a choppy macro road ahead.

"Investors don’t just want numbers, they want confidence. FedEx gave them neither in its outlook."

Conclusion: Mixed Cargo, Fragile Packaging

FedEx did what it needed to in Q4, but it wasn’t enough to ease long-term worries. For traders, the rejection at resistance is a clear short-term signal. For investors, the lack of full-year guidance and geopolitical risks signal turbulence ahead.

Until FedEx can show some directional clarity, on the chart or in its forecasts, I’ll stay on the sidelines. There’s no reward in catching a package mid-drop.

Walter Shares, ChartMill