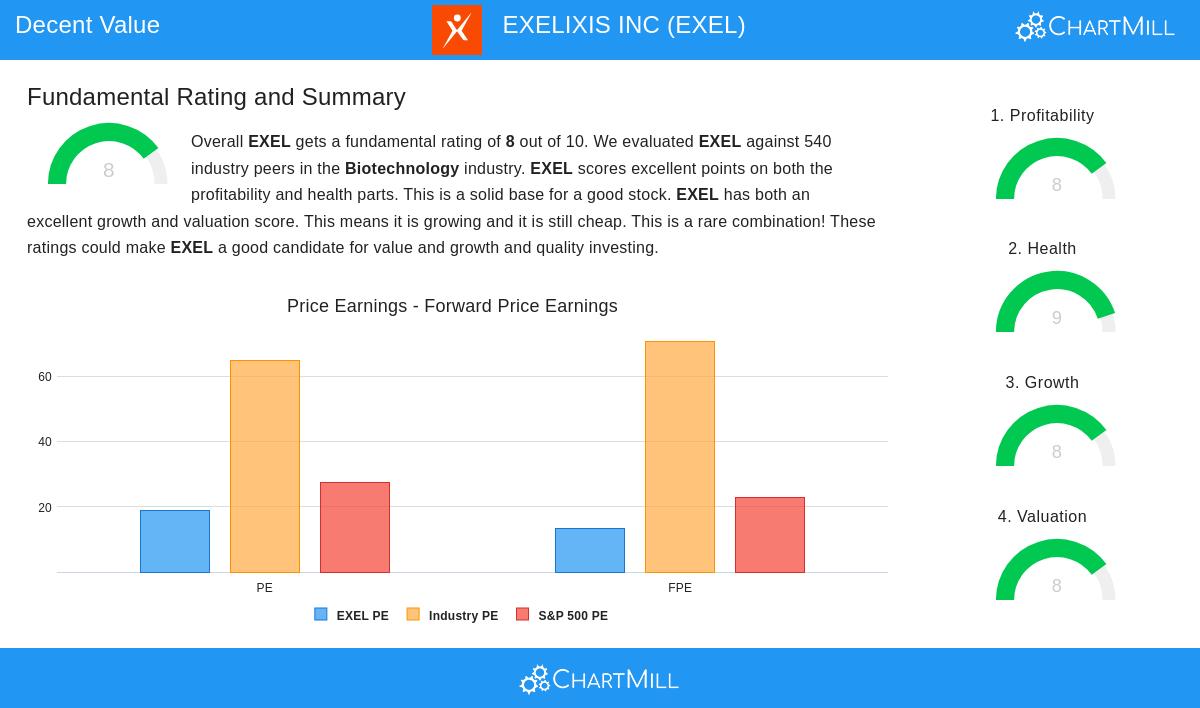

The search for undervalued stocks remains a cornerstone of value investing, a strategy pioneered by Benjamin Graham and David Dodd nearly a century ago. This approach centers on identifying companies trading below their intrinsic value, offering a margin of safety for investors. One method to find such opportunities involves screening for stocks with good fundamental ratings across valuation, health, profitability, and growth. EXELIXIS INC (NASDAQ:EXEL) recently surfaced through such a screen, suggesting it may warrant a closer look from value-oriented investors.

Valuation Metrics

EXELIXIS demonstrates good valuation characteristics that align with value investing principles. The company’s valuation rating of 8 out of 10 reflects several attractive metrics:

- A Price/Earnings ratio of 18.82, cheaper than 94.44% of its biotechnology industry peers

- A forward P/E of 13.48, below the S&P 500 average of 22.73

- Strong enterprise value to EBITDA and price/free cash flow ratios that place it in the top 5% of most undervalued companies in its sector

These valuation metrics are particularly important for value investors because they indicate the stock may be trading below its intrinsic value. The discounted valuation provides that crucial margin of safety that Benjamin Graham emphasized, buying at a price sufficiently below estimated worth to allow for errors in calculation or unexpected market conditions.

Financial Health

The company's very good financial health rating of 9 out of 10 highlights its strong balance sheet position:

- Zero outstanding debt, providing financial flexibility and reducing risk

- Current ratio of 3.51 and quick ratio of 3.44, indicating strong liquidity

- Altman-Z score of 11.83, well above bankruptcy risk thresholds

For value investors, financial health is paramount because it ensures the company can withstand economic downturns and continue operations without financial distress. A solid balance sheet means the company is less likely to face the value traps that often ensnare apparently cheap stocks with hidden financial weaknesses.

Profitability Strength

EXELIXIS shows impressive profitability with an 8 out of 10 rating, featuring:

- Return on equity of 29.62%, outperforming 97.22% of industry peers

- Profit margin of 27.01% and operating margin of 33.71%, both in the top tier of the biotechnology sector

- Consistent profitability over the past five years with positive cash flow from operations

Strong profitability is essential for value investors because it validates that the company's business model is fundamentally sound. High returns on capital suggest that management is effectively deploying resources, which supports the case that current market valuation may not fully reflect the company's earnings power.

Growth Trajectory

Despite being categorized as a value stock, EXELIXIS maintains solid growth characteristics with an 8 out of 10 growth rating:

- Revenue growth of 10.73% in the past year and 17.51% average annual growth over recent years

- EPS growth of 67.74% in the past year with 22.20% expected annual growth going forward

- Accelerating earnings growth compared to historical trends

The combination of value and growth is particularly attractive because it addresses one of the common criticisms of value investing, that cheap stocks may remain cheap due to stagnant business prospects. EXELIXIS appears to offer both valuation appeal and business momentum.

Investment Considerations

While the fundamental picture appears strong, investors should consider several factors. The company operates in the competitive biotechnology sector, where drug development risks and regulatory hurdles are always present. Additionally, the concentration in oncology treatments, while demonstrating expertise, also represents focused exposure to specific market dynamics.

The company's excellent fundamental analysis report reveals a rare combination of value, quality, and growth characteristics that typically don't appear together. This alignment suggests EXELIXIS might represent what value investors seek: a fundamentally sound business available at a reasonable price.

For investors interested in exploring similar opportunities, additional screening results can be found through this Decent Value Stocks screen, which identifies companies with strong valuation characteristics alongside solid fundamentals.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.