Technical breakout strategies focus on identifying stocks with strong trends while offering good entry points. These patterns often appear when a stock pauses after an upward move, giving investors a chance to enter before the next potential rise. The method uses two main measures: the ChartMill Technical Rating, which checks a stock's trend strength, and the Setup Quality Rating, which evaluates the consolidation pattern. Stocks with high scores in both areas often provide attractive risk-reward opportunities for trend-based strategies.

Technical Strength Supports Bullish Case

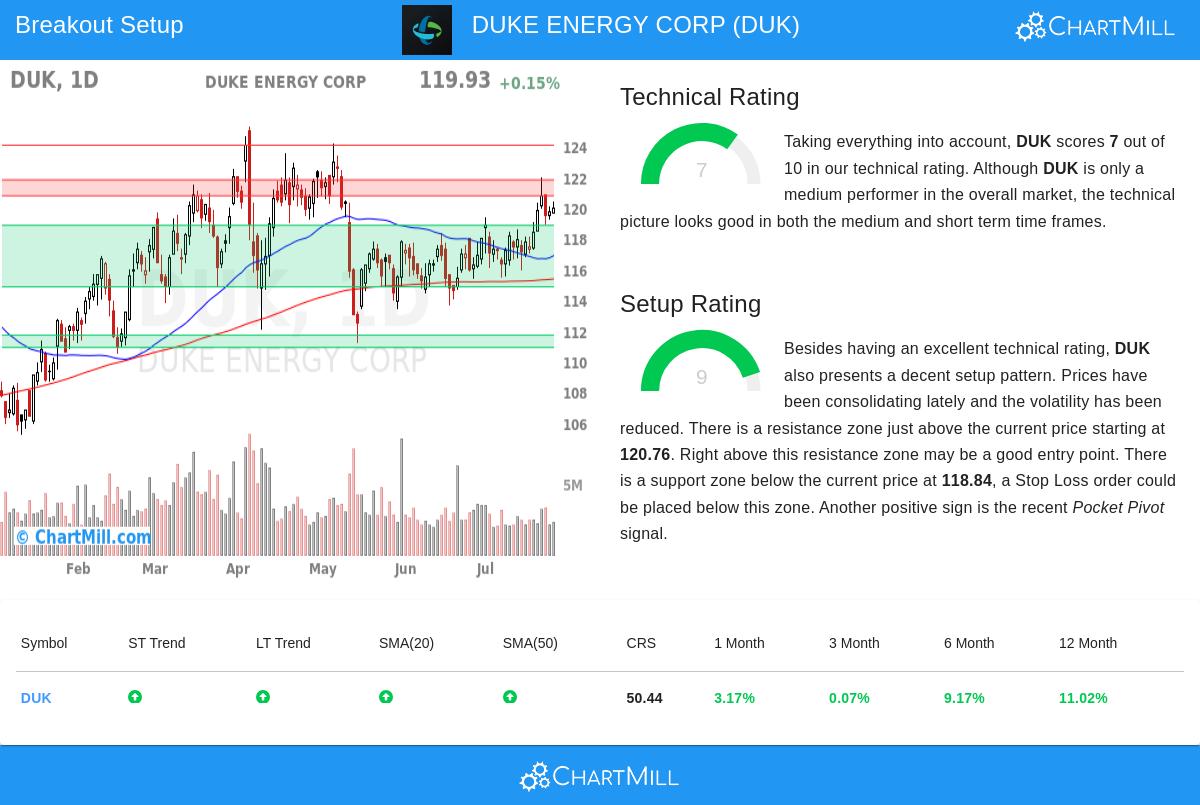

DUKE ENERGY CORP (NYSE:DUK) currently has a Technical Rating of 7, showing a steady uptrend across different timeframes. The detailed technical report points to several positive details:

- Both short-term and long-term trends stay positive, with the stock above key moving averages (20-day, 50-day, 100-day, and 200-day)

- The stock is near the top of its 52-week range (105.20 - 125.27), currently trading around 119.93

- Volume remains solid, with average daily volume over 2.9 million shares

While DUK's relative strength matches the broader market (performing better than 50% of stocks), its steady trend makes it appealing for technical traders. Rising moving averages across all timeframes suggest continued buying interest.

High-Quality Setup Emerges

With a Setup Rating of 9, DUK shows one of the better consolidation patterns in the market. Key features include:

- A clear trading range between 115.40 and 121.97 over the past month, showing price compression

- Multiple support levels between 114.84-118.84 and 110.89-111.69, offering clear stop-loss areas

- A recent pocket pivot signal indicating institutional buying

- Lower volatility during the consolidation phase

The setup suggests a potential breakout entry above 121.81 (just above the resistance zone of 120.76-121.80), with a stop loss below 115.93. This creates a risk of about 4.83% on the trade, which fits most breakout strategy guidelines.

Market Context and Execution Considerations

The current positive trends in the S&P 500's short-term and long-term outlook support breakout strategies. For DUK specifically, traders might consider:

- Waiting for confirmed breakout volume above 121.81 before entering

- Watching the Electric Utilities sector (where DUK performs better than 47% of peers) for confirmation

- Using a wider stop for longer-term positions, given DUK's role as a regulated utility

The combination of DUK's technical strength and strong setup makes it a candidate for breakout watchlists. As with all technical patterns, confirmation through price action is key before investing.

For investors looking for more breakout opportunities, the Technical Breakout Setups screen updates daily with stocks meeting similar criteria.

Disclaimer: This analysis is an objective review of technical patterns and should not be taken as investment advice or a recommendation to buy or sell any security. Always do your own research and assess your risk tolerance before making investment decisions.