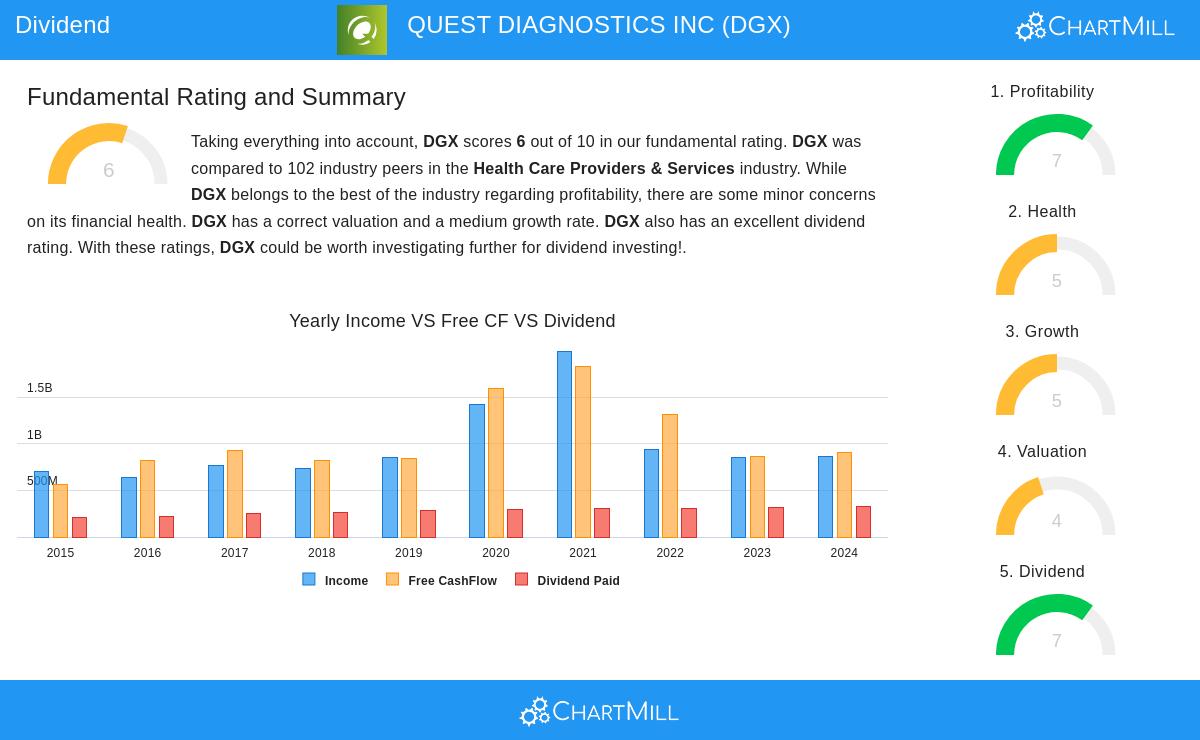

QUEST DIAGNOSTICS INC (NYSE:DGX) stands out as a strong candidate for dividend investors, according to our screening criteria. The company combines a solid dividend track record with decent profitability and financial health, making it an interesting option for income-focused portfolios.

Key Dividend Strengths

- Consistent Dividend Growth: DGX has increased its dividend at an annual rate of 6.92% over the past five years, demonstrating a commitment to rewarding shareholders.

- Reliable Payout History: The company has paid dividends for at least 10 years without any cuts, indicating stability in its distribution policy.

- Sustainable Payout Ratio: With only 37.67% of earnings allocated to dividends, DGX maintains a conservative payout ratio, reducing the risk of future cuts.

Profitability and Financial Health

- Strong Profit Margins: DGX’s 8.78% profit margin outperforms 92% of its industry peers, reflecting efficient operations.

- Solid Return Metrics: The company delivers a 12.87% return on equity, placing it among the top performers in its sector.

- Manageable Debt Levels: While DGX carries some debt (Debt/Equity of 0.85), its Altman-Z score of 3.12 suggests a low risk of financial distress.

Valuation Considerations

DGX trades at a Price/Earnings ratio of 18.46, slightly below the industry average, making it reasonably priced relative to peers. Analysts expect 8.82% annual EPS growth, which could support further dividend increases.

For a deeper dive into DGX’s fundamentals, review the full report here.

Our Best Dividend Stocks screener lists more high-quality dividend stocks updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.