CROCS INC (NASDAQ:CROX) has been identified through a systematic screening process designed to find stocks with good fundamental characteristics at appealing valuations. This approach, based on value investing principles, looks for companies with good profitability, solid financial health, and reasonable growth prospects that are trading below their intrinsic worth. By focusing on stocks with high valuation ratings alongside acceptable scores in other key areas, the strategy intends to find opportunities where market pricing may not completely reflect underlying business quality.

Valuation Metrics

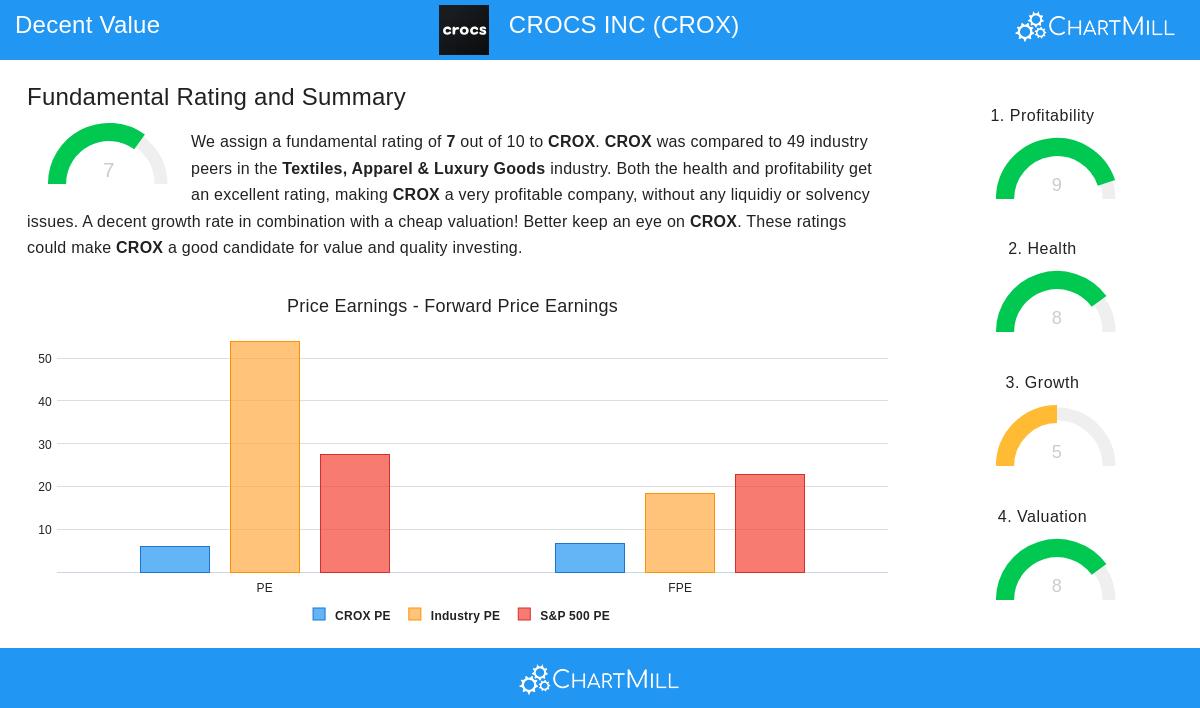

The company's valuation profile appears especially notable, scoring 8 out of 10 in ChartMill's assessment system. Several metrics stand out:

- Price/Earnings ratio of 6.06, much lower than the industry average of 53.98 and S&P 500 average of 27.43

- Price/Forward Earnings ratio of 6.68, less expensive than 97.96% of industry peers

- Enterprise Value/EBITDA and Price/Free Cash Flow ratios both ranking among the most appealing in the sector

These valuation multiples indicate the market may be undervaluing Crocs relative to both its industry competitors and the broader market, creating potential opportunity for value-oriented investors seeking a margin of safety in their investments.

Financial Health Assessment

Crocs shows good financial health with a rating of 8 out of 10, indicating a stable foundation for long-term investment. Key strengths include:

- Altman-Z score of 3.67, indicating low bankruptcy risk and doing better than 69.39% of industry peers

- Debt to FCF ratio of 1.79, suggesting good ability to service obligations quickly

- Consistent reduction in shares outstanding over both one-year and five-year periods

- Improving debt to assets ratio compared to previous year

While current and quick ratios show some relative weakness compared to industry standards, the company's excellent solvency metrics and profitability provide context that these liquidity measures may not indicate fundamental financial stress.

Profitability Analysis

The company does well in profitability with a notable 9 out of 10 rating, representing one of its strongest fundamental attributes:

- Return on Invested Capital of 24.29%, ranking among the industry's best and doing better than 93.88% of peers

- Operating Margin of 24.24%, exceeding 97.96% of competitors

- Consistent margin expansion across gross, operating, and profit margins in recent years

- Good Return on Assets (5.31%) and Return on Equity (16.64%) relative to industry averages

These profitability metrics are important for value investors, as sustained high returns on capital often indicate durable competitive advantages and efficient management, key factors in estimating intrinsic value.

Growth Prospects

Crocs receives a moderate growth rating of 5 out of 10, showing balanced historical performance with more conservative future expectations:

- Historical EPS growth averaging 51.64% annually over past years, though recent growth has moderated to 3.81%

- Revenue growth of 27.23% on average historically, with recent growth of 2.04%

- Expected future EPS growth of 2.84% and revenue growth of 2.29% annually

- Transition from exceptional historical growth rates to more sustainable, moderate expansion

While growth expectations have moderated from previous exceptional levels, the company maintains positive growth trajectory, which value investors typically prefer over stagnant or declining businesses when combined with appealing valuation.

Investment Considerations

For value investors employing a margin of safety approach, Crocs presents an interesting case study. The combination of exceptional profitability, good financial health, and appealing valuation multiples creates a notable profile. The company's brand strength in the footwear industry, global distribution network, and proprietary material technology represent intangible assets that may not be completely captured in quantitative metrics alone.

The moderate growth expectations, while less exciting than the company's historical performance, may actually provide protection against over-optimism that often leads to overvaluation. Value investors typically prefer companies with reasonable growth expectations trading at discounted multiples rather than high-growth stories commanding premium valuations.

View the complete fundamental analysis report for detailed metrics and comparative industry analysis.

For investors interested in discovering similar opportunities, additional stocks meeting these value investment criteria can be found through our Decent Value Stocks screening tool.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with qualified financial professionals before making investment decisions. Past performance does not guarantee future results, and all investments carry risk of loss.