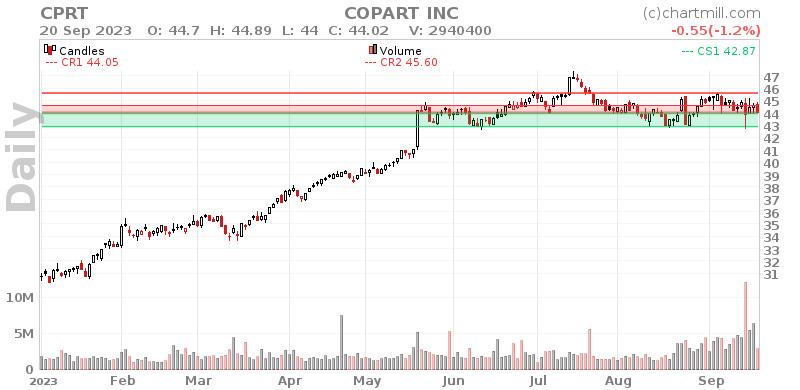

Our stock screener has detected a potential breakout setup on COPART INC (NASDAQ:CPRT). This breakout pattern is observed when a stock consolidates following a strong upward movement. It's important to note that this pattern is based on technical analysis, and the actual breakout outcome is uncertain. However, it might be worth keeping an eye on NASDAQ:CPRT.

What is the technical picture of NASDAQ:CPRT telling us.

ChartMill assigns a Technical Rating to every stock. This score ranges from 0 to 10 and is updated daily. The score is determined by evaluating multiple technical indicators and properties.

Taking everything into account, CPRT scores 7 out of 10 in our technical rating. In the last year, CPRT was one of the better performers, but we do observe some doubts in the very recent evolution.

- The long term trend is positive and the short term trend is neutral. The long term trend gets the benefit of the doubt for now.

- Looking at the yearly performance, CPRT did better than 92% of all other stocks. We also observe that the gains produced by CPRT over the past year are nicely spread over this period.

- CPRT is part of the Commercial Services & Supplies industry. There are 79 other stocks in this industry. CPRT outperforms 85% of them.

- CPRT is currently trading in the upper part of its 52 week range. The S&P500 Index is also trading in the upper part of its 52 week range, so CPRT is performing more or less in line with the market.

- In the last month CPRT has a been trading in the 42.69 - 45.64 range, which is quite wide. It is currently trading in the middle of this range where prices have been consolidating recently, this may present a good entry opportunity, but some resistance may be present above.

- Volume is considerably higher in the last couple of days.

Check the latest full technical report of CPRT for a complete technical analysis.

How do we evaluate the setup for NASDAQ:CPRT?

ChartMill incorporates a Setup Rating in its analysis, which measures the extent of consolidation in a stock over recent days and weeks. This rating, ranging from 0 to 10, is updated daily and takes into account multiple short-term technical indicators. The current setup rating for NASDAQ:CPRT is 8:

Besides having an excellent technical rating, CPRT also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is a support zone below the current price at 43.93, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

Trading setups like NASDAQ:CPRT

One strategy to consider is waiting for the actual breakout to occur, where the stock breaks out above the current consolidation zone. Traders can then enter a buy position, anticipating further upward momentum. As a risk management measure, it is advisable to set a stop loss order below the consolidation zone.

Disclaimer: This article is not intended to provide trading advice. It is crucial to conduct your own analysis and consider your own observations and trading style when making investment decisions. The article solely presents technical observations and should not be relied upon as a sole basis for trading.

Our Breakout screener lists more breakout setups and is updated daily.

Keep in mind

This article should in no way be interpreted as advice in any way. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.