CADENCE DESIGN SYS INC (NASDAQ:CDNS) meets the criteria of our Caviar Cruise screen, which identifies high-quality companies suitable for long-term investment. The company demonstrates strong revenue and profit growth, efficient capital allocation, and solid financial health. Below, we examine why CDNS stands out as a quality stock.

Key Strengths of CDNS

- Revenue and EBIT Growth: CDNS has delivered a 5-year revenue CAGR of 11.01%, while EBIT growth over the same period reached 22.65%. This indicates not only top-line expansion but also improving profitability.

- High Return on Invested Capital (ROIC): With an ROIC (excluding cash and goodwill) of 60.56%, the company efficiently generates profits from its capital investments, far exceeding the 15% threshold for quality stocks.

- Strong Profit Quality: The 5-year average profit quality stands at 128.61%, meaning the company converts net income into free cash flow at an exceptional rate.

- Low Debt Burden: CDNS has a Debt-to-Free Cash Flow ratio of 1.80, suggesting it could repay all debt in less than two years using current cash flows.

Fundamental Analysis Summary

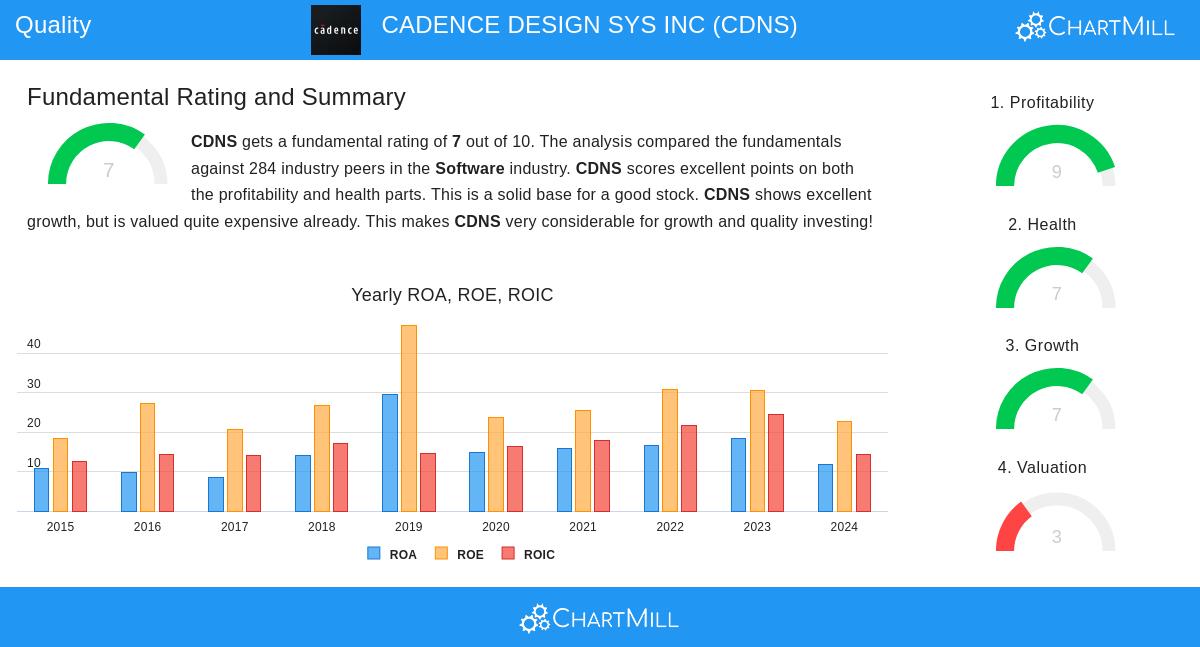

Our fundamental report rates CDNS 7 out of 10, highlighting strengths in profitability and financial health. Key takeaways:

- Profitability: High margins (Operating Margin of 30.60%, Gross Margin of 85.86%) and strong returns (ROE of 22.64%, ROA of 12.00%) place CDNS ahead of most industry peers.

- Financial Health: A solid Altman-Z score (14.83) and healthy liquidity ratios (Current Ratio of 3.07) reinforce stability.

- Valuation: The stock trades at a premium (P/E of 50.14), but this may be justified by its growth prospects and industry position.

Why Quality Investors Should Consider CDNS

The company benefits from long-term trends in semiconductor design, automation, and AI-driven system development. Its competitive advantages include high margins, pricing power, and global reach. While valuation is elevated, CDNS fits the profile of a business built for sustained performance.

For more quality stocks, explore our Caviar Cruise screener.

For a deeper dive, review the full fundamental analysis of CDNS.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.