Investors looking for companies that mix solid growth prospects with fair prices frequently use Growth At Reasonable Price (GARP) methods. This method tries to find businesses that are growing at a good pace but are not valued at very high levels, possibly providing a mix of opportunity and risk. One way to find these opportunities is by using a structured filter of basic financial measures, concentrating on good growth, acceptable profitability, sufficient financial stability, and a price that does not seem too high. CBRE Group Inc - A (NYSE:CBRE) recently appeared from this "Affordable Growth" filter, indicating it could deserve more attention from investors using this approach.

Growth Path

The main idea of a GARP method is finding companies with a good growth narrative, and CBRE's basic numbers show important momentum. A solid growth profile is necessary because it is the main source of future earnings and, as a result, stock price increases. CBRE's growth measures are clearly notable, receiving a ChartMill Growth Rating of 7 out of 10.

- Recent Growth: The company showed strong recent results, with Earnings Per Share (EPS) increasing by 50.95% in the last year and Revenue rising by 14.96%.

- Continued Momentum: Reviewing a five-year span, Revenue has increased at a steady average yearly rate of 8.40%.

- Future Projection: Analysts predict this good trend will persist, with estimates for EPS to grow 18.49% each year and Revenue to rise 8.64% per year in the next few years.

This mix of solid past growth and a positive future projection places CBRE as a company with real growth possibility, a main requirement for an affordable growth candidate.

Valuation Check

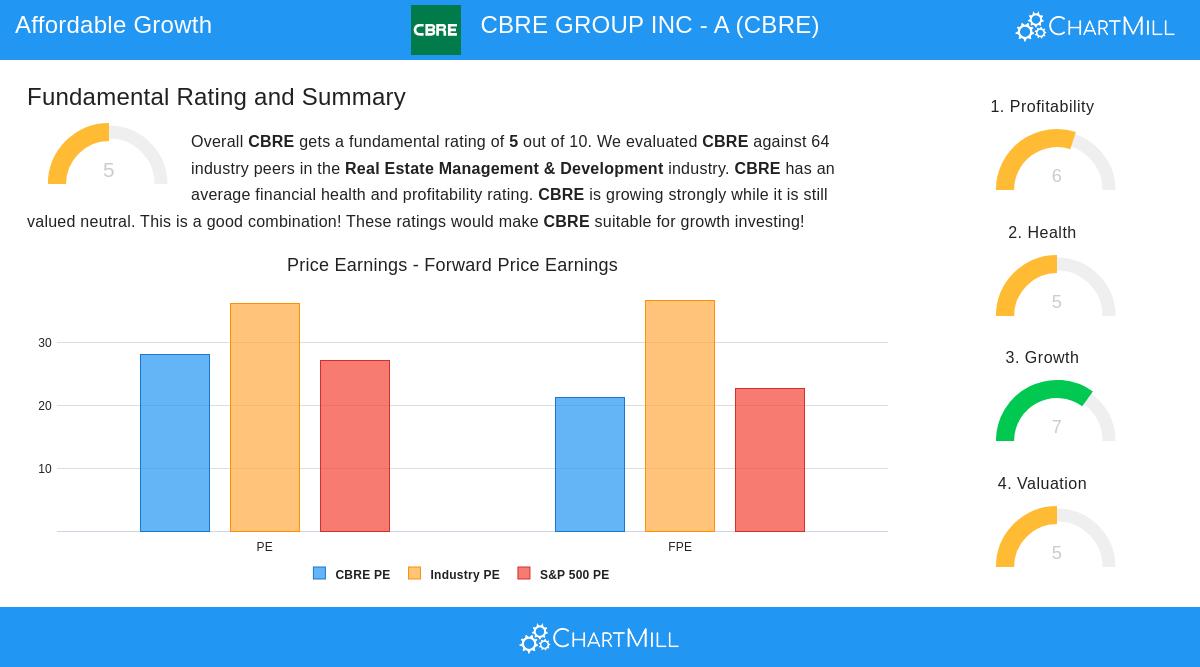

While growth is important, paying a fair price for that growth is what describes the GARP method. An overpriced stock can cancel out the advantages of even the most solid growth story. CBRE's valuation shows a varied but finally acceptable situation, shown in its ChartMill Valuation Rating of 5. When measured against its industry competitors, the stock seems priced well.

- Industry Measurement: CBRE's Price/Earnings (P/E) ratio of 28.06 is lower than 78% of companies in the Real Estate Management & Development industry, which has an average P/E of 36.19.

- Future Measures: The valuation situation gets better when thinking about future earnings. The Price/Forward Earnings ratio of 21.24 is lower than 83% of industry competitors.

- Other Ratios: The company also seems relatively low-cost based on its Enterprise Value to EBITDA and Price/Free Cash Flow ratios, doing better than about 69% of its industry on both measures.

Even though the absolute P/E ratio might look high to some value investors, its relative discount to the industry and the market, together with the company's growth rate, implies the valuation is not too high.

Profitability and Financial Stability

A lasting growth story needs a profitable business plan and a steady financial base. These elements reduce risk and make sure the company can pay for its growth. CBRE displays ability in these areas, with a Profitability Rating of 6 and a Financial Health Rating of 5.

The company's profitability is backed by returns that are competitive in its sector. Its Return on Equity (ROE) of 13.21% and Return on Invested Capital (ROIC) of 6.77% do better than a large portion of its industry competitors. However, investors should be aware that margins have experienced some recent squeeze, pointing to an area to watch carefully. From a stability viewpoint, CBRE's Altman-Z score of 3.54 suggests a low short-term chance of financial trouble, although its liquidity ratios are a bit lower than the industry average.

Conclusion

CBRE Group makes a good case for thought in a GARP-focused portfolio. The company's very good growth path, both in the past and expected, is its most appealing characteristic. This growth is available at a valuation that, while not cheap, is acceptable compared to its industry and is supported by sufficient profitability and financial stability. The mix of these factors—solid growth, a workable valuation, and acceptable basic fundamentals—fits well with the goal of finding affordable growth opportunities.

For investors curious about finding other companies that fit similar standards, this Affordable Growth filter can offer a beginning for more investigation. A more detailed basic analysis of CBRE is available in its full basic report.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy, sell, or hold any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.