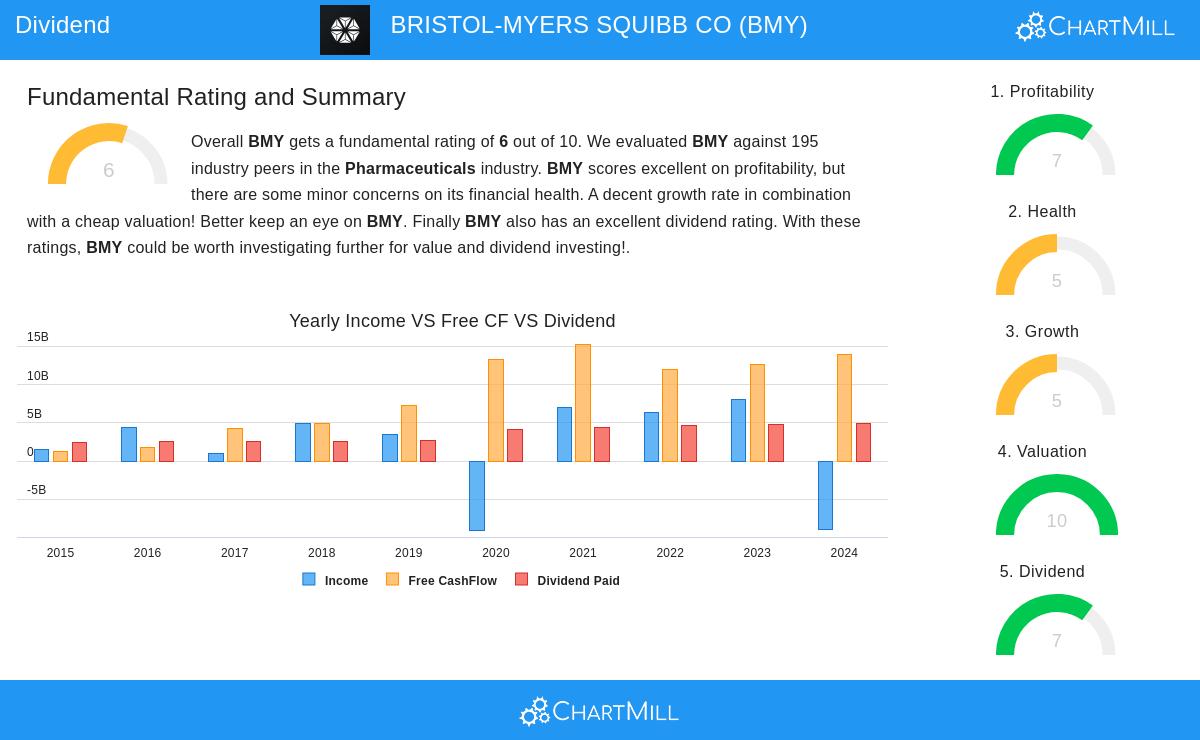

BRISTOL-MYERS SQUIBB CO (NYSE:BMY) was identified by our Best Dividend Stocks screener as a strong candidate for income-focused investors. The company combines an attractive dividend yield with solid profitability and reasonable financial health, making it a noteworthy option for dividend portfolios.

Dividend Strength

- High Yield: BMY currently offers a 5.18% dividend yield, well above both the industry average (4.15%) and the S&P 500 average (2.38%).

- Consistent Growth: The company has increased its dividend at an annualized rate of 11.67% over the past five years, demonstrating a commitment to rewarding shareholders.

- Long Track Record: BMY has paid dividends for at least 10 consecutive years, indicating reliability in its payouts.

Profitability & Valuation

- Strong Margins: BMY maintains an operating margin of 27.11%, outperforming 92.82% of its pharmaceutical peers.

- Attractive Valuation: With a P/E ratio of 6.52, BMY trades at a significant discount compared to both the industry (21.34) and the broader market (26.30).

- Earnings Growth: Analysts expect EPS growth of 38.96% annually over the next few years, which could support further dividend increases.

Financial Health Considerations

- Debt Levels: BMY carries a Debt/Equity ratio of 2.67, which is higher than ideal but manageable given its strong cash flow.

- Liquidity: The company has a Current Ratio of 1.28, indicating sufficient short-term liquidity, though it lags behind some industry peers.

While the payout ratio of 90.59% is high, BMY’s earnings growth prospects suggest the dividend remains sustainable. Investors should monitor future cash flow trends.

For a deeper dive, review the full fundamental report on BMY.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas, updated daily.

Disclaimer

This is not investing advice. The observations here are based on current data, but investors should conduct their own research before making decisions.