BAKER HUGHES CO (NASDAQ:BKR) emerged from our Peter Lynch-inspired screen as a potential fit for investors seeking growth at a reasonable price (GARP). The company, a provider of oilfield services and energy technology solutions, meets several key criteria for sustainable long-term growth while maintaining sound financial health.

Why BKR Fits the GARP Approach

- Strong Earnings Growth: BKR has delivered a 5-year average EPS growth of 23.35%, comfortably within Lynch’s preferred range of 15-30%. This indicates steady, sustainable expansion.

- Attractive Valuation: With a PEG ratio of 0.68 (below Lynch’s threshold of 1), the stock appears reasonably priced relative to its growth trajectory.

- Healthy Profitability: The company’s return on equity (ROE) stands at 17.17%, well above the 15% minimum Lynch favored, reflecting efficient use of shareholder capital.

- Conservative Debt Levels: A debt-to-equity ratio of 0.35 suggests a balanced capital structure, aligning with Lynch’s preference for companies with limited leverage.

- Solid Liquidity: A current ratio of 1.34 indicates sufficient short-term financial flexibility.

Fundamental Highlights

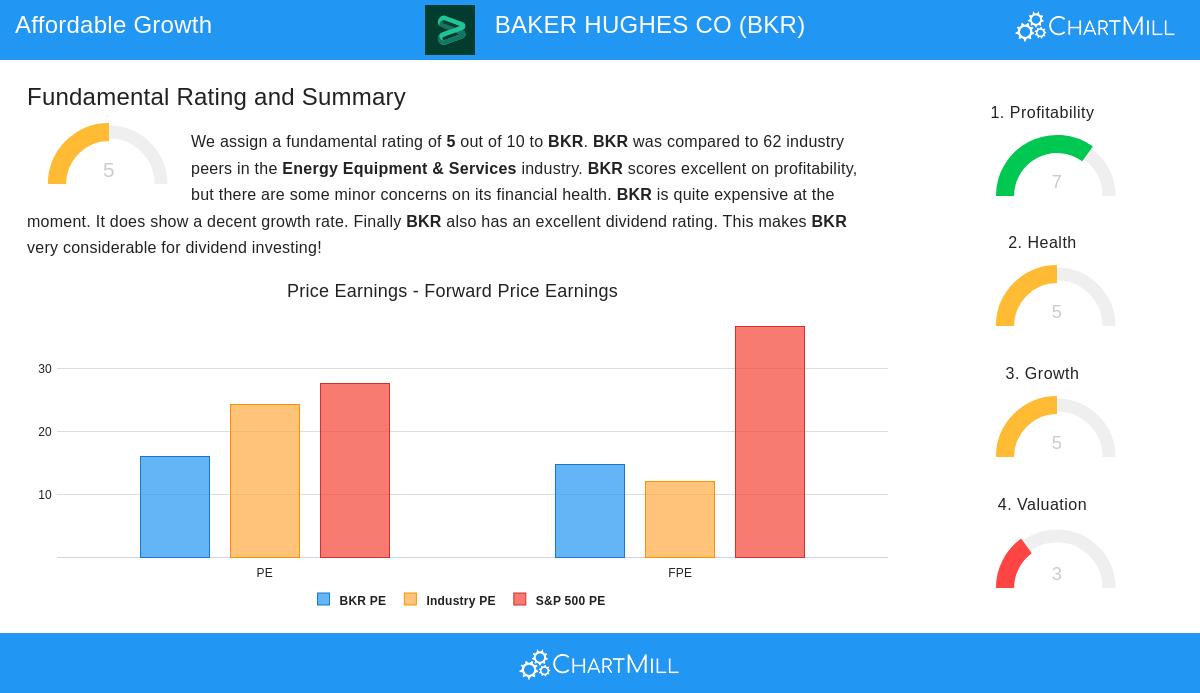

BKR’s fundamental report highlights additional strengths:

- Profitability: Above-industry margins, with a 10.51% net profit margin and improving operating efficiency.

- Dividend Stability: A 2.31% yield with a 10-year track record of consistent payouts and a sustainable payout ratio.

- Growth Outlook: While near-term revenue growth is modest (2.06% projected), earnings are expected to grow at 8.23% annually.

Our Peter Lynch Strategy screener lists more stocks that fit this disciplined approach.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.