ABERCROMBIE & FITCH CO-CL A (NYSE:ANF) stands out as a potential value opportunity based on its strong fundamentals and attractive valuation. The company, known for its apparel and accessories retail brands, has demonstrated solid profitability and financial health while trading at a discount compared to industry peers.

Key Strengths

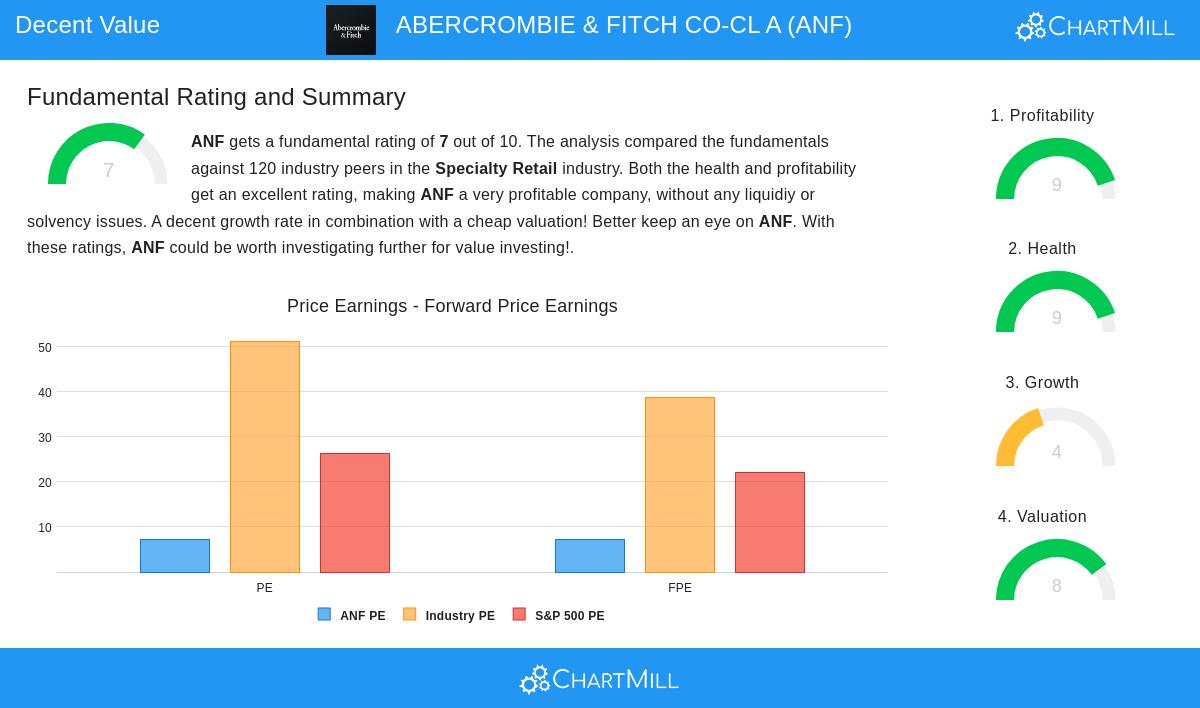

Valuation (Rating: 8/10)

- Price/Earnings (P/E) of 7.20 – Significantly lower than the industry average of 51.26 and the S&P 500’s 26.35.

- Price/Forward Earnings of 7.20 – Suggests the stock remains cheap even when accounting for future earnings expectations.

- Enterprise Value/EBITDA and Price/Free Cash Flow – Both metrics indicate ANF is priced more attractively than nearly 90% of its peers.

Profitability (Rating: 9/10)

- High Margins – Gross margin of 64.15% and operating margin of 15.20% outperform 92.5% of competitors.

- Strong Returns – Return on Assets (17.16%) and Return on Equity (42.39%) rank in the top 5-10% of the industry.

- Consistent Cash Flow – Positive operating cash flow in four of the past five years.

Financial Health (Rating: 9/10)

- No Debt – A rare advantage, eliminating solvency concerns.

- Solid Liquidity – While the quick ratio (0.97) is slightly below ideal levels, the company’s strong profitability mitigates liquidity risks.

- Share Buybacks – Reduced outstanding shares over the past five years, signaling confidence in the business.

Growth (Rating: 4/10)

- Past Growth Strong – Revenue grew 15.6% YoY, while EPS surged 70.27%.

- Future Expectations Modest – Revenue is projected to grow 2.45% annually, though earnings may dip slightly (-4.61%).

Why ANF Could Be Undervalued

Despite strong profitability and a debt-free balance sheet, ANF trades at a steep discount to peers. The market may be underestimating its ability to sustain margins and cash flow, particularly given its brand strength and operational efficiency.

For a deeper look, review the full fundamental analysis of ANF.

Our Decent Value Stock Screener highlights more stocks with strong valuations and fundamentals.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.