ABBOTT LABORATORIES (NYSE:ABT) stands out as a strong candidate for quality investors, meeting key criteria for long-term growth, profitability, and financial health. The company’s fundamentals align well with the Caviar Cruise screening strategy, which focuses on identifying high-quality businesses with sustainable competitive advantages.

Key Strengths of ABT

- Revenue and EBIT Growth: Over the past five years, ABT has delivered solid revenue growth of 6.77% annually, while EBIT growth has been even stronger at 8.41%, indicating improving profitability.

- High Return on Invested Capital (ROIC): With an ROIC (excluding cash and goodwill) of 19.85%, ABT efficiently generates returns from its capital investments, placing it among the top performers in its industry.

- Strong Profit Quality: The company converts nearly 100% of its net income into free cash flow, demonstrating high earnings quality and financial efficiency.

- Manageable Debt: ABT’s debt-to-free cash flow ratio of 1.99 suggests it can repay its debt in under two years using current cash flows, reflecting a conservative financial structure.

Fundamental Analysis Highlights

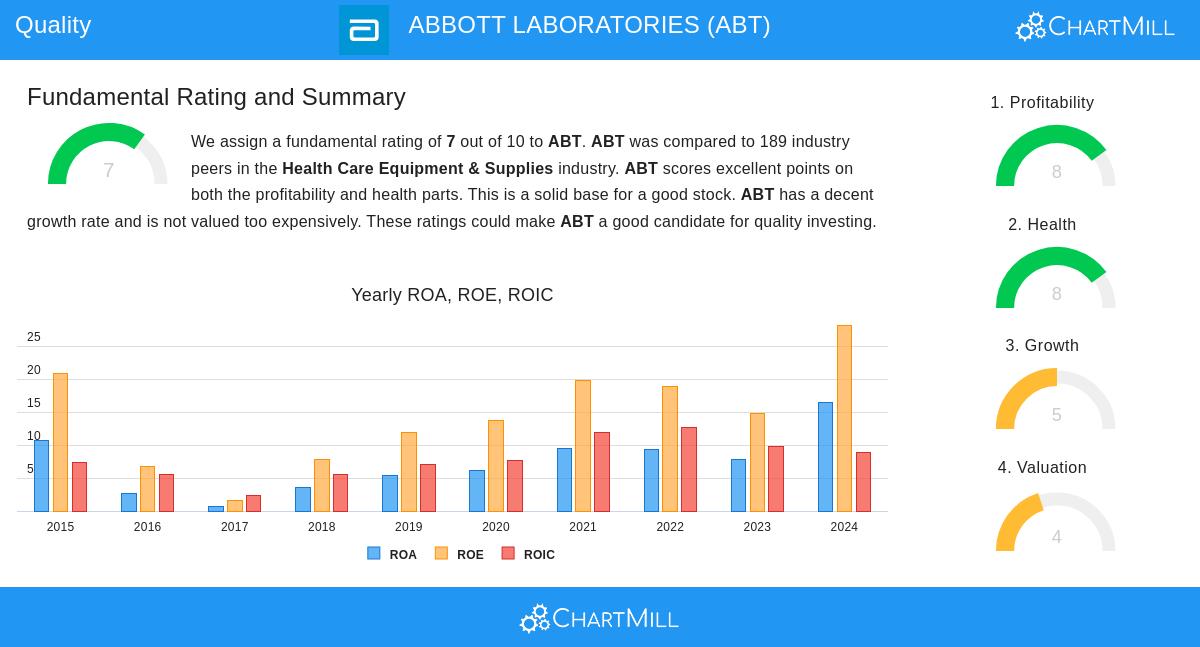

Our fundamental report assigns ABT a rating of 7 out of 10, with particularly strong scores in profitability and financial health. Key takeaways include:

- Profitability: ABT outperforms most peers in operating margin (17.45%) and profit margin (31.89%).

- Dividend Growth: The company has raised its dividend for at least 10 consecutive years, with an annual growth rate of 11.40%.

- Valuation: While not cheap, ABT trades in line with industry peers, supported by its strong fundamentals.

For investors seeking high-quality businesses with stable growth and financial discipline, ABT presents a compelling case.

Our Caviar Cruise screener lists more quality stocks and is updated regularly.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.