After market: 685.88 -0.41 (-0.06%)

After market: 605.41 -0.38 (-0.06%)

After market: 263.87 -0.12 (-0.05%)

Market Today

Advancing

Above SMA(20)

Above SMA(50)

Above SMA(100)

Above SMA(200)

New High Vs Low

Market Monitor

Market News

Software Rout Wipes $7.2 Billion Off Atlassian Founders’ Wealth

Google, Shopee-owner Sea to develop AI tools for e-commerce, gaming

Foreign Investors Resume Selling Indian IT Stocks on AI Scare

Packaging firm Mondi slashes dividend by 60% as annual profit falls

Debenhams raises nearly $54 million in oversubscribed fundraise

Discover: ChartMill Trading and Investment Ideas

ChartMill provides a huge library of pre-configured screens to get you started. You can easily fine tune these screens to your own needs.

Combining Technical and Fundamental Analysis for Position Trading in High Growth systems, Swing Trading based on Technical Analysis or pure Fundamental Analysis for long term Growth, Value or Quality investments ... it's all there!

O'Neill CANSLIM High Growth screen

Mark Minervini - Trend Template + FA Screen 6

High Growth Momentum + Trend Template

High Growth Momentum Breakout Setups

Martin Zweig: Growth at Reasonable Price

Strong Growth Stocks with good Technical Setup Ratings

James O’Shaughnessy: Tiny Titans

Discover ChartMill

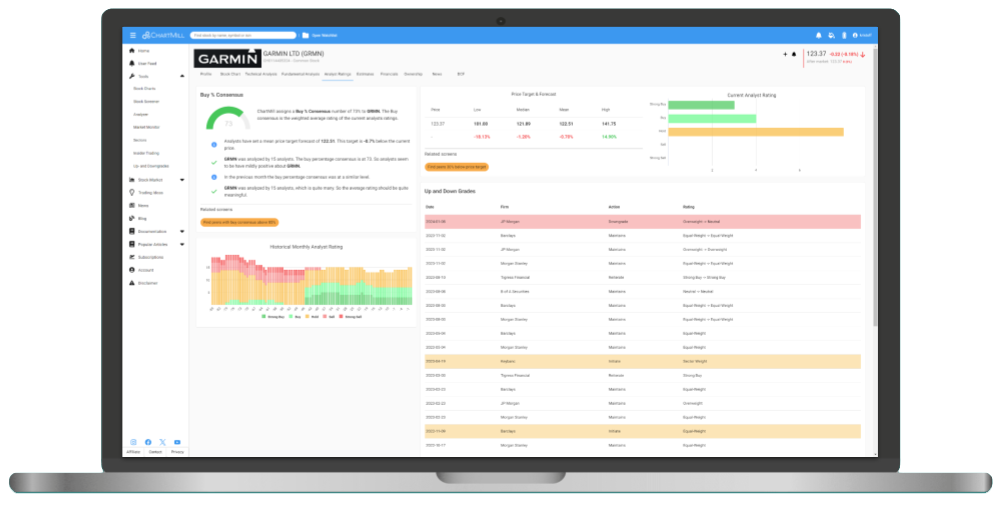

Smart Tools for Smart Traders and Investors

ChartMill provides tools for individual investors who take control of their investing. Find your next trade or investment with our Technnical and Fundamental Stock Screener, do your analysis and stay organized with Watchlists and Alerts.

Technical and Fundamental Stock Screener

The ChartMill stock screener is one of the most advanced screeners on the market and is suited for a wide range of strategies. Whether you use Technical Analysis for short term day- or swing trading, Fundamental Analysis for long term Growth, Value, Quality or Dividend investing or combine both for Growth Position Trading, we've got you covered.