04 Bet The Farm

What We Know

Making money in the stock market, or any place else for that matter, is about knowing where the money is and taking control over how to get it. No matter how much control you think you might have over what tomorrow’s winners will be (by doing analysis), far more control is to be seized in how much we risk (and invest) as well as in keeping our losses small and adding to our winners. My own story illustrates the power of such a simple thing. But there’s more …

What Not All of Us Know

Be careful with diversification! I’ve brought my story to hundreds of people in my country. If not thousands by now. On one occasion early on, someone came up to me after my talk and told me that what I was explaining was the advice to diversify, plain and simple. Although I couldn’t exactly pinpoint why at that precise moment, I felt that this was not the message I was trying to bring. Luckily, up until today, only one person told me that this was what he was taking from my speech. As I was travelling home, I was reflecting on this misunderstanding of his, when it occurred to me that what I was telling was in fact the exact opposite of diversifying. Here’s why.

As winners get bigger in our portfolio, they represent an ever increasing percentage of it. When we cut our losses early, before they can do real damage, this frees up money. At the same time, adding to our winners, locks in money. So what’s actually happening is our winners taking a bigger and bigger chunk of the cash. So basically doing the right thing is about concentrating our allocation of money in fewer positions, instead of diversifying it over different positions. Back then, realizing it, shook my world and made my profits really take off. I got extremely confident in piling up money in one or a few positions. Until then, I merely was trying to stick to my winners (trying not to sell them). That’s when I took the average size of my winners to a whole other level. By not just keeping them but adding to them (buying more of them). Today, it’s crystal clear to me that this is exactly what really makes successful investors. Even a super-investor like Warren Buffet.

So however that person was, if you recognize this, thank you so very much!

Fool’s Risk

To diversify seems the sensible path. Not betting the farm or not putting one’s eggs into one basket, are but linguistic examples of this common sense dictum. And it does make sense when looking at it from a perspective of risk. Buying 10 stocks instead of one will ease the blow when one of the companies - let’s take the worst case here - goes bankrupt. Then again it won’t protect you when the whole of the market goes down. You’ll just end up losing money in 10 stocks instead of one. But this is where the downside of spreading rears its ugly head.

The price we pay for diversification might well hold dire consequences. Because spreading your money will average down your overall return! If you have one stock showing you a 100% profit among 9 others showing you on average 5% profit (some losers you didn’t sell yet, some mediocre winners not taking off, …), averages out your overall return to a mere 12%. And always remember that every 300% winner, once started out as a 3% winner. So don’t sell winners, buy more of them!

Diversification originates from spreading one’s resources over several asset classes. Today we have all kinds of tools (such as options, ETF’s, …) to fine-tune risk. Tools that don’t come with the downside on return, as diversification does. Instead of not putting all your eggs in one basket, you should do so and watch the basket and its associated risk carefully.

Monte Carlo Ahead

Now, all that’s very nice, you think. But I can’t go throwing all my money at one horse. Besides where would I get the money to keep adding to my winners. This is indeed a real concern. Not the fact that you should worry about buying one stock with all your money. But the fact that you will run out of money to buy even more, eventually.

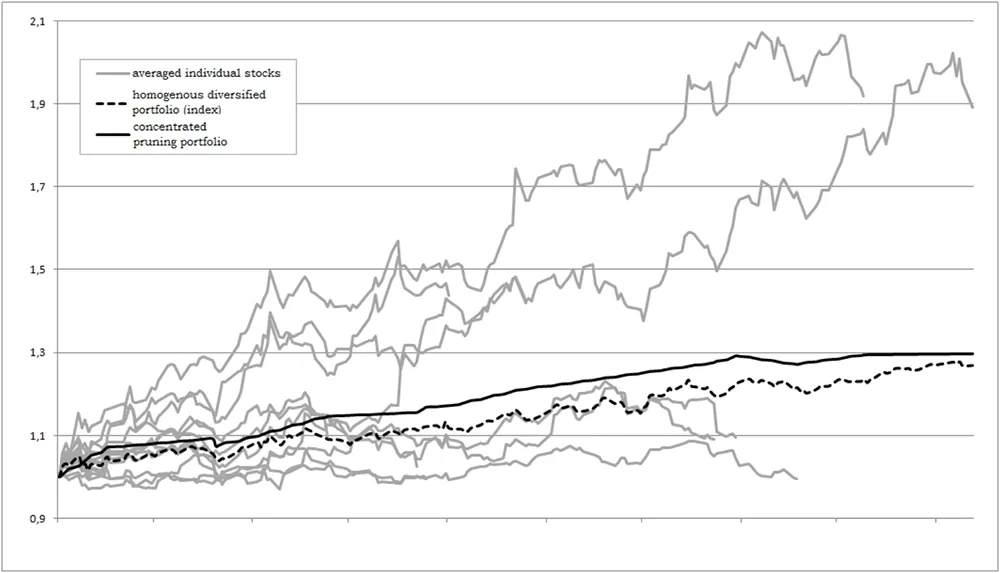

Let’s first tackle the risk worries once more. First of all I never mentioned putting all your money into one stock at once. I’m talking about buying more as the earlier shares you bought already show you profit. Don’t ever buy more of your losers, remember. Besides what we invest is not what we have to risk. Keep an eye on your risk so you don’t have to worry about what you have invested. Having that out of the way, where do we find the money to buy more of our winners? Well, what about the money we get back in from the losers we sell early. Imagine that we start out with a bunch of stocks, let’s say 13 (that’s a prime number and I’m an engineer). All 13 of them getting an equal share. Let’s call that the reference portfolio, which we won’t touch anymore from here on. Furthermore, imagine making a an exact copy of that portfolio. In this copy, I’ll call it the ‘pruning portfolio’, whatever money gets stopped out, for instance if we lose more than 5% from the last top a stock showed, gets equally distributed over the survivors in that portfolio. That way, eventually, one position will remain carrying the entire capital of the portfolio. What if, at that moment, we stop the clock and compare it to the ‘equal share’ reference portfolio that has been left untouched until then.

Well, I did this experiment a million times over with a computer program called a Monte Carlo machine. Each time thirteen stocks were picked at random from a universe of liquid $20+ stocks with companies behind them showing positive earnings. Not to say, a simple but decent junk free universe. Below you can see the averaged out returns in gray for each of those 13 stocks (so stock 1 might be another stock in each of those 1 million random portfolios). The black striped line shows the average return of the reference portfolios while the solid black line shows the average return of the pruning portfolios. At any point, on average, the pruning portfolio (piling up money in its winners while throwing out the ‘laggards ‘n losers’) beats the counterpart reference ‘buy and hold’ portfolio. In each of the 1 million cases both portfolios started out with the same positions in the same stocks of course. Well, what’d you know. Seems as if this do-not-diversify-cut-losers-buy-more-of-the-winners mumbo-jumbo works after all. My field test with real money, running for over 13 years now, strengthens this proof.

We can take this to yet another level by trying to invest even more than we have by borrowing (using margin), using leverage (through ETF’s, options and other derivatives), cash extraction, volume extraction, etc. This would take me just too far here. But let me show you next time some of these techniques (and all the while how to take care of risk) through an actual trade of mine.

Bullet points

- What we invest doesn’t have to be what we risk. In fact what we invest should follow from what we want to risk. I explained that in more detail here.

- Be careful with diversification. It’s unnecessary with the risk management tools we have at our disposal nowadays (more later). And besides, it drives a wrecking ball through our overall profitability.

- Don’t take common wisdom for granted. You can handle risk without having to take the downside of old school diversification. If you do what everybody does, you’ll end up with what everybody has. As Buffett has put it: diversification is protection against ignorance. It makes little sense if you know what you are doing.

- Do not confuse my message of better not diversifying, with the wrong idea of having to take unreasonable risk. Again, with today’s tools, both have almost nothing to do with each other anymore. More on that in later articles.

- By merely focusing on trying not to lose money, instead of trying to win, most people in the stock market impair themselves, rendering it impossible to consistently make money over time. When your right and as long as you are proven right, keep going.

The next article in this series is A Take On Tesla