SPX TECHNOLOGIES INC (SPXC) Stock Price, Forecast & Analysis

NYSE:SPXC • US78473E1038

SPXC Key Statistics, Chart & Performance

The current stock price of SPXC is 239 USD. In the past month the price increased by 11.89%. In the past year, price increased by 60.41%.

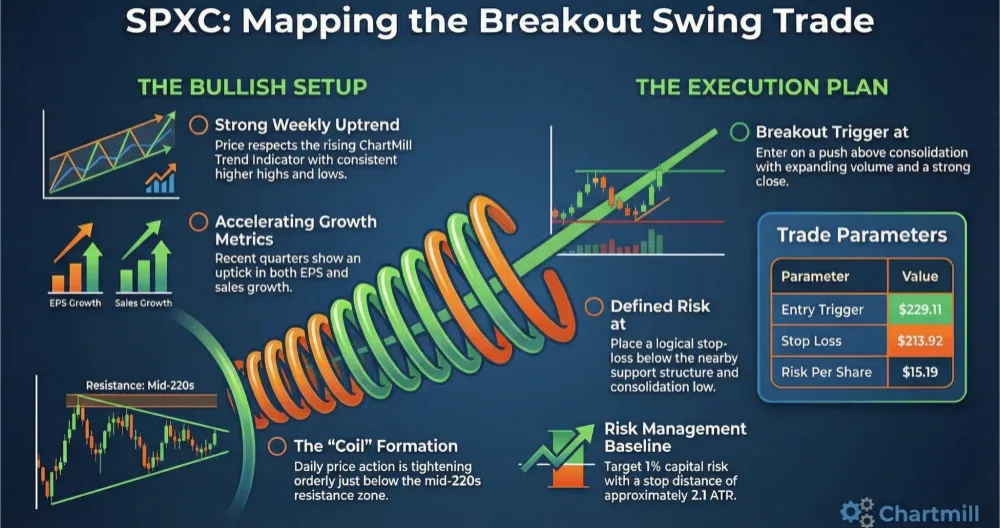

SPXC Technical Analysis

ChartMill assigns a technical rating of 10 / 10 to SPXC. When comparing the yearly performance of all stocks, SPXC is one of the better performing stocks in the market, outperforming 89.21% of all stocks.

SPXC Fundamental Analysis

ChartMill assigns a fundamental rating of 6 / 10 to SPXC. Both the health and profitability get an excellent rating, making SPXC a very profitable company, without any liquidiy or solvency issues.

SPXC Financial Highlights

Over the last trailing twelve months SPXC reported a non-GAAP Earnings per Share(EPS) of 6.38. The EPS increased by 20.15% compared to the year before.

| Industry Rank | Sector Rank | ||

|---|---|---|---|

| PM (TTM) | 10.33% | ||

| ROA | 6.48% | ||

| ROE | 10.39% | ||

| Debt/Equity | 0.23 |

SPXC Forecast & Estimates

17 analysts have analysed SPXC and the average price target is 235.56 USD. This implies a price decrease of -1.44% is expected in the next year compared to the current price of 239.

For the next year, analysts expect an EPS growth of 23.5% and a revenue growth 13.7% for SPXC

SPXC Ownership

SPXC Latest News, Press Relases and Analysis

SPXC Competitors/Peers

| Symbol | Company Name | Technical Rating | Fundamental Rating | FPE | Market Cap |

|---|---|---|---|---|---|

| PH | PARKER HANNIFIN CORP | 28.62 | 123.945B | ||

| ITW | ILLINOIS TOOL WORKS | 26.34 | 86.598B | ||

| IR | INGERSOLL-RAND INC | 26.86 | 37.223B | ||

| OTIS | OTIS WORLDWIDE CORP | 20.18 | 35.757B | ||

| SYM | SYMBOTIC INC | 57.16 | 32.945B | ||

| DOV | DOVER CORP | 21.77 | 31.623B | ||

| XYL | XYLEM INC | 22.81 | 31.186B | ||

| SNA | SNAP-ON INC | 18.76 | 19.688B | ||

| FTV | FORTIVE CORP | 19.82 | 17.55B | ||

| RBC | RBC BEARINGS INC | 40.51 | 17.404B |

Related stock screener links

View all stocks in the Industrial Machinery & Supplies & Components Industry | View all stocks in the Industrials Sector | View all stocks on the New York Stock Exchange Exchange | Find stocks with similar TA and Setup ratings on the USA exchanges | Find stocks with similar Fundamental rating on the USA exchanges | Find the competitors with the best technical ratings on the USA exchanges | Find the competitors with the best fundamentals on the USA exchanges | Find the competitors with the best valuation on the USA exchanges | Find the competitors with the best dividend on the USA exchanges | Find the competitors with the best analyst ratings on the USA exchanges

About SPXC

Company Profile

Company Info

SPX TECHNOLOGIES INC

6325 Ardrey Kell Road, Suite 400

Charlotte NORTH CAROLINA 28277 US

CEO: Eugene J. Lowe

Employees: 4300

Phone: 19804743700

SPX TECHNOLOGIES INC / SPXC FAQ

What does SPXC do?

SPX Technologies, Inc. engages in the supply of infrastructure equipment. The company is headquartered in Charlotte, North Carolina and currently employs 4,300 full-time employees. Its segments include HVAC and Detection and Measurement. The HVAC segment engineers, designs, manufactures, installs and services cooling products and engineered air movement and handling solutions for the HVAC industrial, commercial, data center, and power generation markets, as well as heating and ventilation products for the residential, industrial, and commercial markets. The distribution channels for the segment’s products are direct to customers, independent manufacturing representatives, third-party distributors, and retailers. The Detection and Measurement segment engineers, designs, manufactures, services, and installs underground pipe and cable locators, inspection and rehabilitation equipment, robotic systems, transportation systems, communication technologies, and aids to navigation.

What is the current price of SPXC stock?

The current stock price of SPXC is 239 USD. The price increased by 3.5% in the last trading session.

Does SPX TECHNOLOGIES INC pay dividends?

SPXC does not pay a dividend.

What is the ChartMill technical and fundamental rating of SPXC stock?

SPXC has a ChartMill Technical rating of 10 out of 10 and a ChartMill Fundamental rating of 6 out of 10.

Is SPX TECHNOLOGIES INC (SPXC) stock a good buy?

This depends on your investment goals. Check the Technical and Fundamental Analysis tabs for insights on SPXC.

What is the employee count for SPXC stock?

SPX TECHNOLOGIES INC (SPXC) currently has 4300 employees.

What is SPX TECHNOLOGIES INC worth?

SPX TECHNOLOGIES INC (SPXC) has a market capitalization of 11.91B USD. This makes SPXC a Large Cap stock.