Dell (DELL) Reports Q1: Everything You Need To Know Ahead Of Earnings

Provided By StockStory

Last update: May 28, 2025

Computer hardware and IT solutions company Dell (NYSE:DELL) will be announcing earnings results tomorrow after market close. Here’s what investors should know.

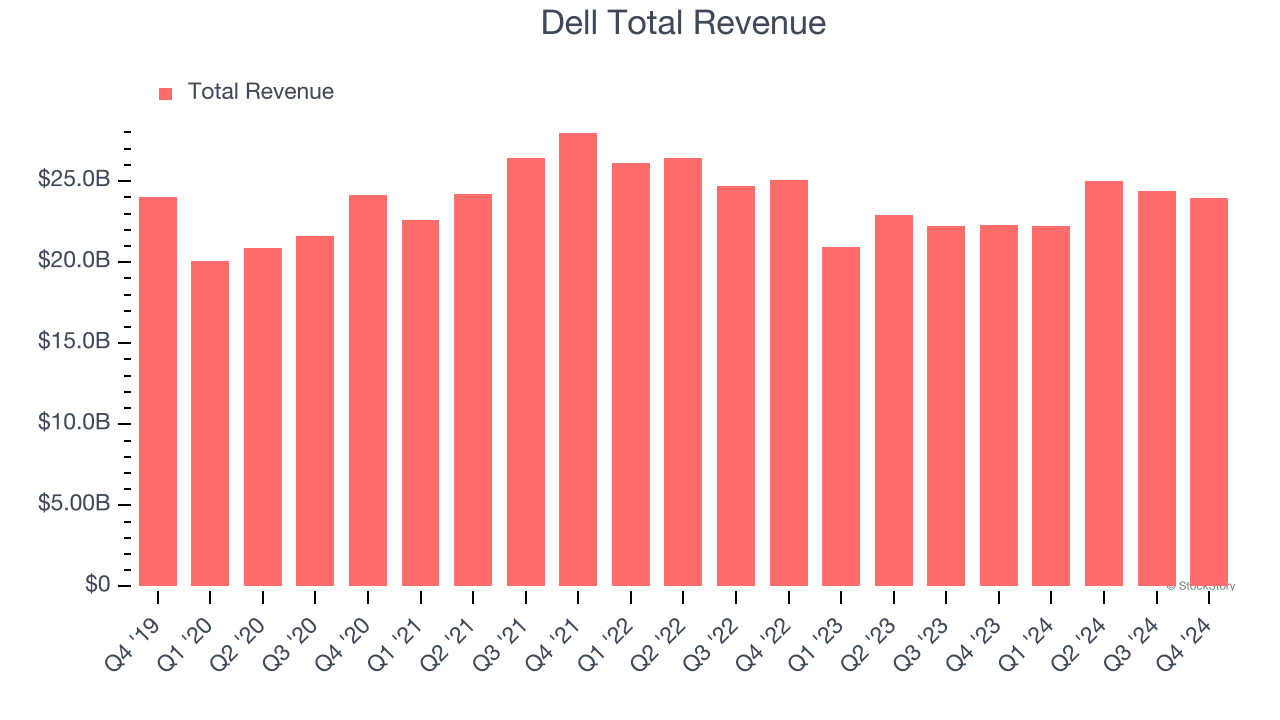

Dell missed analysts’ revenue expectations by 2.5% last quarter, reporting revenues of $23.93 billion, up 7.2% year on year. It was a mixed quarter for the company, with an impressive beat of analysts’ operating income estimates.

Is Dell a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Dell’s revenue to grow 4% year on year to $23.13 billion, slowing from the 6.3% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.69 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Dell has missed Wall Street’s revenue estimates five times over the last two years.

Looking at Dell’s peers in the hardware & infrastructure segment, some have already reported their Q1 results, giving us a hint as to what we can expect. IonQ posted flat year-on-year revenue, beating analysts’ expectations by 0.9%, and Super Micro reported revenues up 19.5%, falling short of estimates by 2.7%. IonQ traded up 9.3% following the results while Super Micro was down 1.2%.

Read our full analysis of IonQ’s results here and Super Micro’s results here.

There has been positive sentiment among investors in the hardware & infrastructure segment, with share prices up 8.5% on average over the last month. Dell is up 21.7% during the same time and is heading into earnings with an average analyst price target of $128.11 (compared to the current share price of $114.10).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

135.13

-4.06 (-2.92%)

111.27

-2.36 (-2.08%)

110.73

-2.3 (-2.03%)

Find more stocks in the Stock Screener

NVDA Latest News and Analysis

2 days ago - ChartmillTop S&P500 movers in Friday's session

2 days ago - ChartmillTop S&P500 movers in Friday's sessionLet's have a look at what is happening on the US markets one hour before the close of the markets on Friday. Below you can find the top S&P500 gainers and losers in today's session.

2 days ago - ChartmillWhich S&P500 stocks are the most active on Friday?

2 days ago - ChartmillWhich S&P500 stocks are the most active on Friday?Curious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

2 days ago - ChartmillMost active stocks in Friday's session

2 days ago - ChartmillMost active stocks in Friday's sessionThese stocks are making the most noise in today's session. Stay tuned for the latest updates!

2 days ago - ChartmillDiscover which S&P500 stocks are making waves on Friday.

2 days ago - ChartmillDiscover which S&P500 stocks are making waves on Friday.Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Friday.

2 days ago - ChartmillNVIDIA CORP (NASDAQ:NVDA) – A Strong Contender for CANSLIM Investors

2 days ago - ChartmillNVIDIA CORP (NASDAQ:NVDA) – A Strong Contender for CANSLIM InvestorsNVIDIA (NVDA) meets CANSLIM criteria with strong earnings growth, leadership in AI, and solid technicals. A top pick for growth investors.

2 days ago - ChartmillMarket Monitor News May 30 (Nvidia UP - HP, Best Buy DOWN)

2 days ago - ChartmillMarket Monitor News May 30 (Nvidia UP - HP, Best Buy DOWN)While AI titans like Nvidia propelled optimism, tariff-related headwinds pulled down stalwarts like HP and Best Buy.

3 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

3 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Thursday.

3 days ago - ChartmillThursday's session: most active stock in the S&P500 index

3 days ago - ChartmillThursday's session: most active stock in the S&P500 indexLooking for the most active S&P500 stocks in today's session? Join us as we dive into the US markets on Thursday and discover the stocks that are dominating the trading activity and setting the pace for the market.

3 days ago - ChartmillWhich stocks are most active on Thursday?

3 days ago - ChartmillWhich stocks are most active on Thursday?Curious about the most active stocks in today's session? Get a glimpse into the stocks that are generating the highest trading volume and capturing market attention.

3 days ago - ChartmillStay informed with the top movers within the S&P500 index on Thursday.

3 days ago - ChartmillStay informed with the top movers within the S&P500 index on Thursday.Curious about the top performers within the S&P500 index in the middle of the day on Thursday? Dive into the list of today's session's top gainers and losers for a comprehensive overview.

3 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?

3 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?The US market is yet to commence its session on Thursday, but let's get a preview of the pre-market session and explore the top S&P500 gainers and losers driving the early market movements.

3 days ago - ChartmillMarket Monitor News May 29 (Abercrombie & Fitch, Box UP - Okta, Trump Media DOWN)

3 days ago - ChartmillMarket Monitor News May 29 (Abercrombie & Fitch, Box UP - Okta, Trump Media DOWN)Wall Street Slips as Investors Brace for Nvidia Earnings and Economic Uncertainty