Once again we have some new and very useful features and updates to announce that will make your favorite stock screener even more user-friendly and efficient.

Additional and expanded estimate data

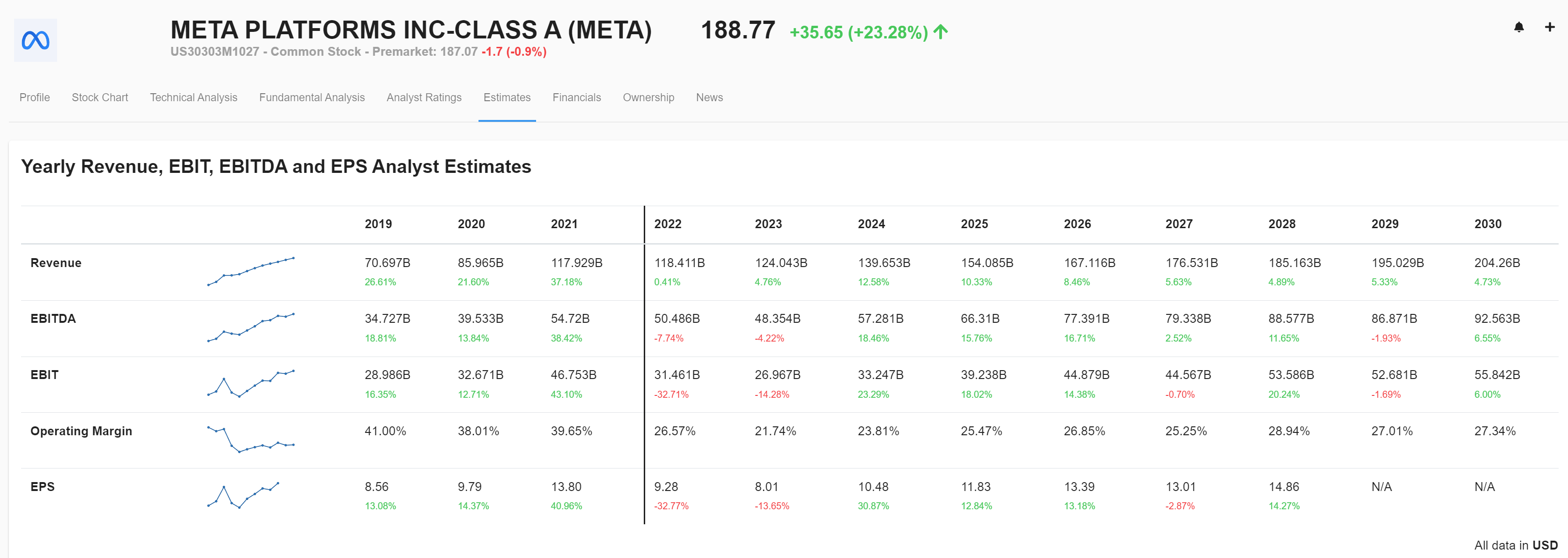

Next to the EPS and Revenue estimates, our new data also covers EBIT and EBITDA estimates. On top of that the new data also looks further ahead in time. The availability of long term estimates depends on the stock and whether the analysts following it provide these long term estimates. For well known names analyst do provide estimates for up to 8 years in the future!

Unfortunately, such comprehensive data comes at a significant cost. Therefore, these valuable long-term estimates will only be visible to our paying subscribers. Free users, however, will still have access to the upcoming periods, including the new EBIT and EBITDA estimates.

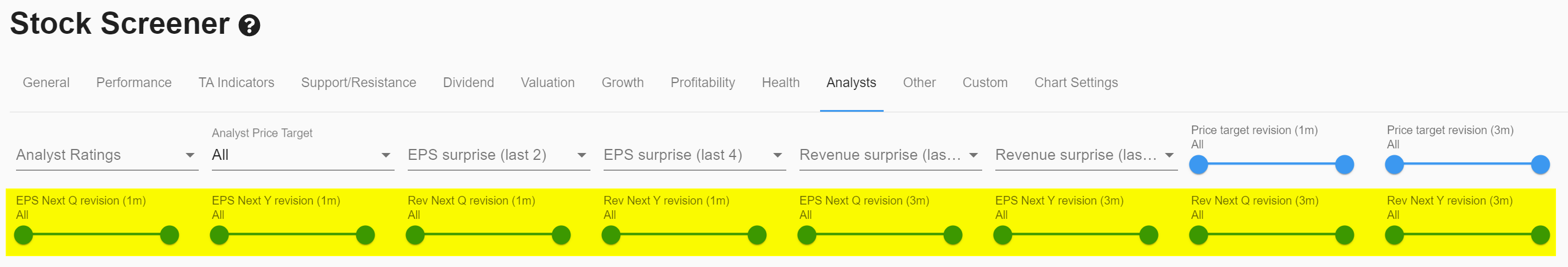

Analyst Revisions

ChartMill now also keep tracks of revisions of analyst price targets, eps and revenue estimates. These revisions are powerful signals and very popular among growth investors. The screener allows you to filter on up or downward revisions during the past 1 or 3 months.

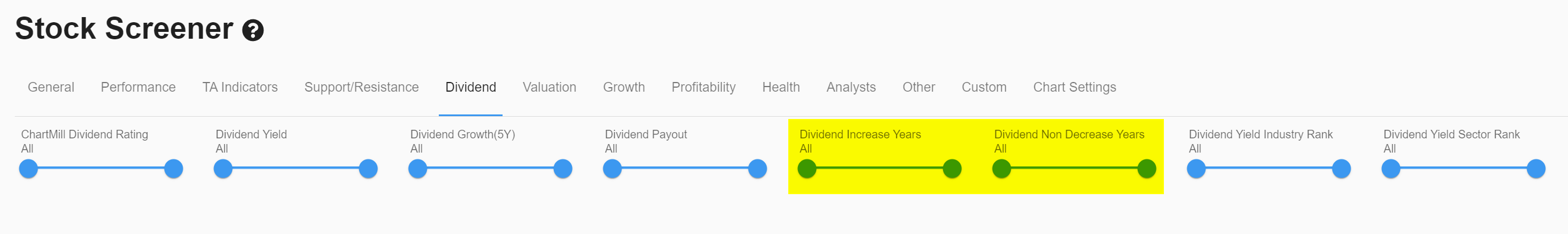

Extra dividend filters

The dividend screening capabilities in Chartmill already made it possible to obtain a nice list of high-quality dividend stocks but since perfection simply does not exist we are always looking for things that can be improved. So, based on feedback, we extended the dividend screen with two specific filters:

-

Dividend Increase Years: This filter allows you to set how many consecutive years the company has increased its dividend. Keep in mind that this is a very strict filter. For example, if you set this filter to 10 it means that in the past 10 years there has not been a single year that the dividend was lower or stayed at the same level as the previous year.

-

Dividend Non Decreas Years: As explained, the previous filter is quite strict and filters out all stocks whose dividends are not explicitly increased year after year. However, if you also want to see the stocks whose dividend stays the same (OR grows) year after year then you are better off using this filter. The number of stocks will be considerably higher with this filter because in this case also a constant dividend is accepted by screener.

Soon, another video will be available, explaining more about the new filters in the dividend screening section.

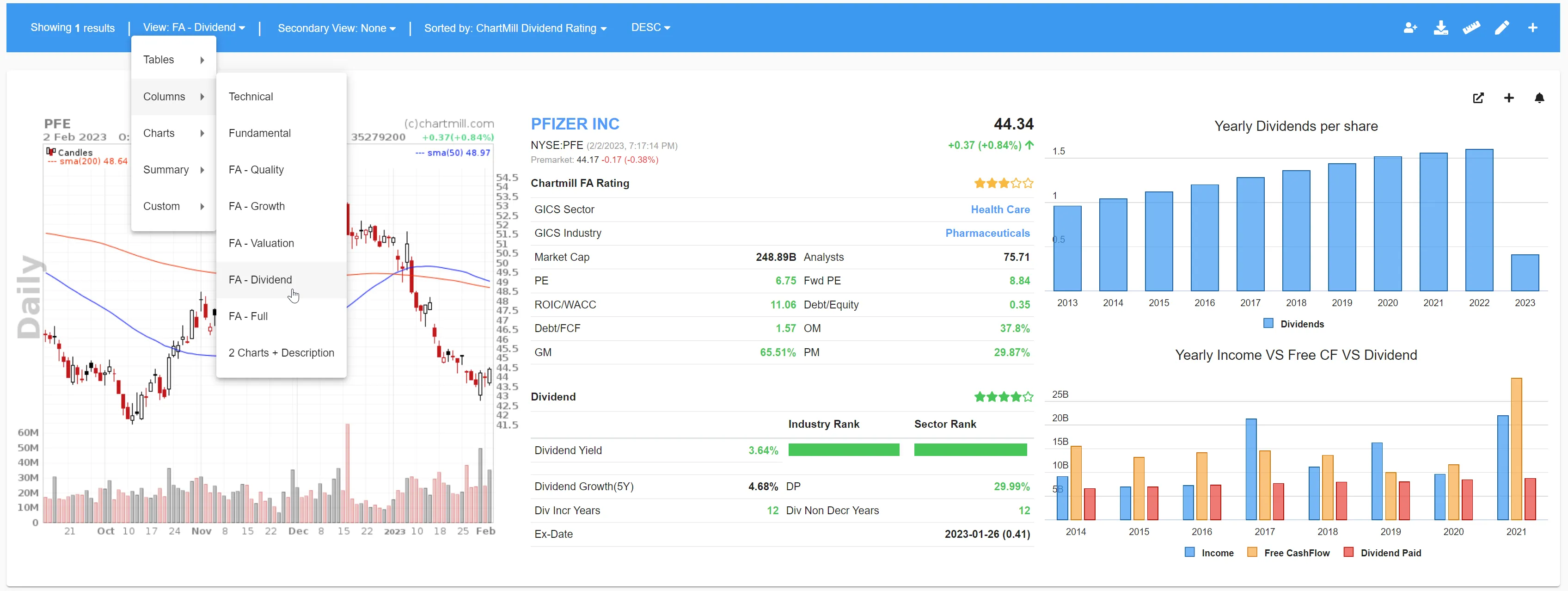

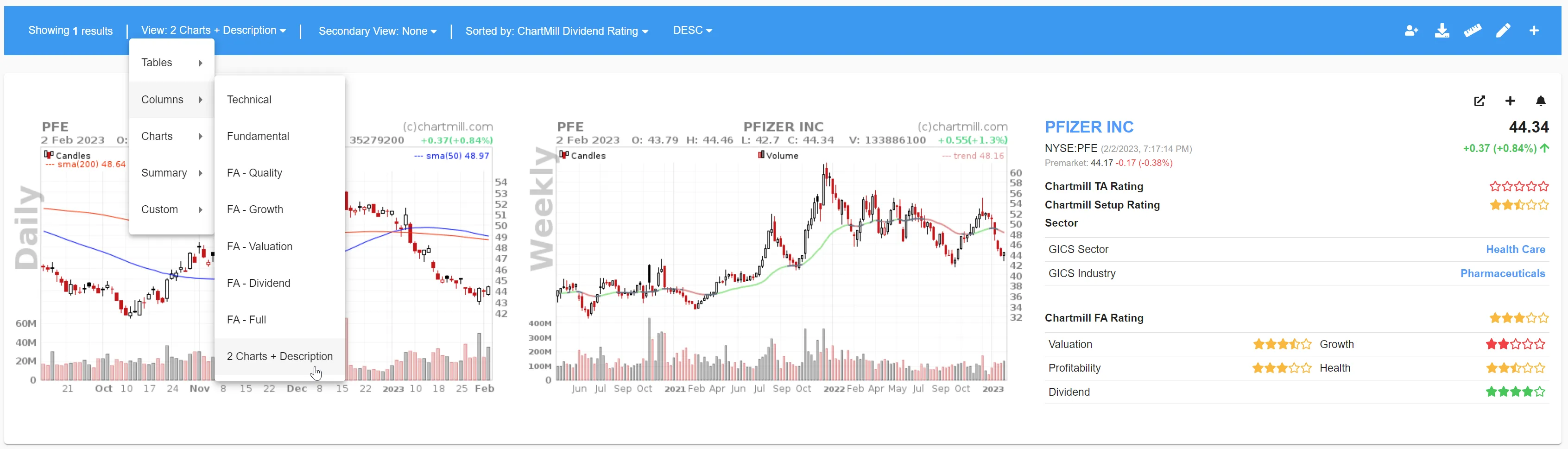

More view options

Once you have used the screener to obtain a list of stocks you wish to further analyze, it is important that this can be done as correctly and adequately as possible. In this respect, the way the screener allows you to view the results plays a major role. That is exactly why ChartMill has added many additional predefined view options. But even for those who would prefer to use their own custom view that best suits the applied strategy, the options are very extensive.

Below are just two examples.

Screen I: dividend view

Screen II: 2 charts + description view

It would take too much writing to explain it all in this blog post, so we made a video about it!