Travel + Leisure Co (NYSE:TNL) stands out as a potential opportunity for value investors, according to our fundamental screening criteria. The company’s valuation appears attractive, while its financial health, profitability, and growth prospects remain solid. Below, we break down why TNL could be an interesting pick.

Valuation

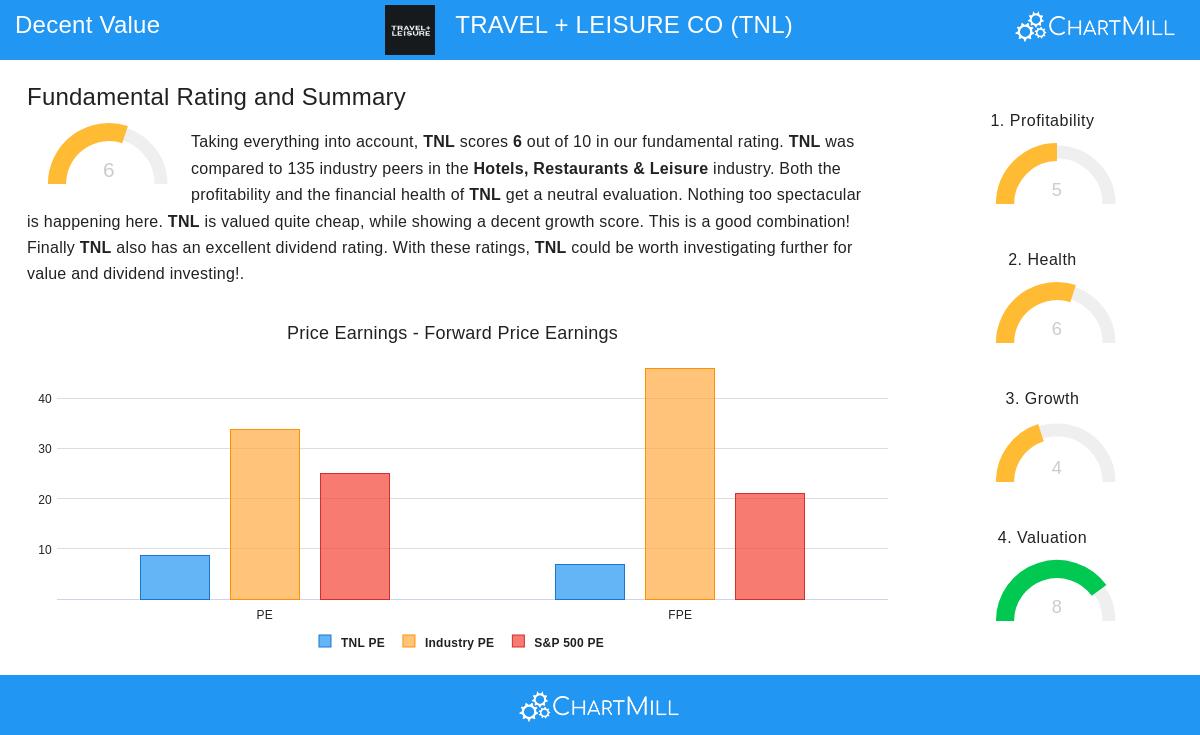

TNL’s valuation metrics suggest the stock is priced reasonably compared to its earnings and cash flow:

- P/E Ratio: At 8.57, TNL trades below both the industry average (33.77) and the S&P500 (25.05).

- Forward P/E: The forward P/E of 6.78 indicates further earnings growth is expected.

- Price/Free Cash Flow: The stock is cheaper than 95.6% of its industry peers based on this metric.

These figures suggest the market may be undervaluing TNL relative to its earnings potential.

Financial Health

The company maintains a stable financial position:

- Liquidity: A current ratio of 3.88 and a quick ratio of 2.85 indicate strong short-term solvency.

- Debt Management: While the debt-to-FCF ratio is high at 12.63, it remains in line with industry standards.

- Share Reduction: TNL has reduced its share count over the past year and five years, which can improve per-share metrics.

Profitability

TNL’s profitability is solid, though not exceptional:

- Return on Invested Capital (ROIC): At 10.49%, it outperforms 75.6% of industry peers.

- Operating Margin: A healthy 19.55% margin places it above 77% of competitors.

- Profit Margin: At 10.76%, it remains competitive within the sector.

Growth Outlook

While past growth has been modest, future expectations are more promising:

- Earnings Growth: Analysts project a 15.8% annual EPS growth rate in the coming years.

- Revenue Growth: Revenue is expected to increase by 3.6% annually.

Dividend Appeal

TNL offers an attractive dividend yield of 4.67%, well above the industry average (3.60%) and the S&P500 (2.40%). The payout ratio of 34.7% suggests sustainability, and the company has maintained dividend payments for over a decade.

Our Decent Value Stocks screener lists more stocks with similar characteristics. For a deeper dive, review the full fundamental report on TNL.

Disclaimer

This is not investment advice. The observations here are based on data available at the time of writing. Always conduct your own research before making investment decisions.