Growth investors are on the lookout for stocks displaying robust revenue and EPS growth. In this analysis, we'll assess whether PALANTIR TECHNOLOGIES INC-A (NYSE:PLTR) aligns with growth investing criteria, especially as it consolidates and signals a possible breakout. As always, investors should conduct their own research, but PALANTIR TECHNOLOGIES INC-A has surfaced on our radar for growth with base formation, warranting further examination.

Assessing Growth Metrics for NYSE:PLTR

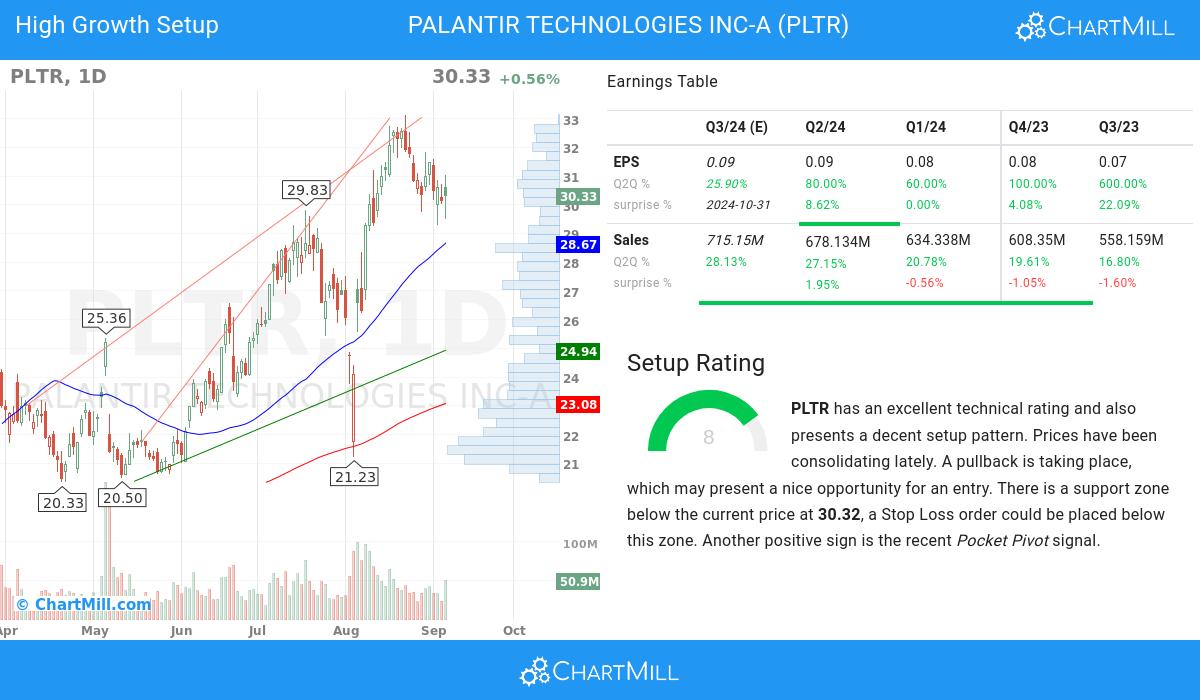

ChartMill assigns a Growth Rating to every stock. This score ranges from 0 to 10 and evaluates the different growth aspects like EPS and Revenue, both in the past as in the future. NYSE:PLTR scores a 8 out of 10:

- The Earnings Per Share has grown by an impressive 113.33% over the past year.

- Looking at the last year, PLTR shows a very strong growth in Revenue. The Revenue has grown by 21.22%.

- The Revenue has been growing by 30.17% on average over the past years. This is a very strong growth!

- The Earnings Per Share is expected to grow by 23.35% on average over the next years. This is a very strong growth

- The Revenue is expected to grow by 21.47% on average over the next years. This is a very strong growth

How We Gauge Health for NYSE:PLTR

ChartMill assigns a Health Rating to every stock. This score ranges from 0 to 10 and evaluates the different health aspects like liquidity and solvency, both absolutely, but also relative to the industry peers. NYSE:PLTR scores a 8 out of 10:

- PLTR has an Altman-Z score of 35.82. This indicates that PLTR is financially healthy and has little risk of bankruptcy at the moment.

- PLTR's Altman-Z score of 35.82 is amongst the best of the industry. PLTR outperforms 98.23% of its industry peers.

- There is no outstanding debt for PLTR. This means it has a Debt/Equity and Debt/FCF ratio of 0 and it is amongst the best of the sector and industry.

- A Current Ratio of 5.92 indicates that PLTR has no problem at all paying its short term obligations.

- Looking at the Current ratio, with a value of 5.92, PLTR belongs to the top of the industry, outperforming 87.63% of the companies in the same industry.

- PLTR has a Quick Ratio of 5.92. This indicates that PLTR is financially healthy and has no problem in meeting its short term obligations.

- With an excellent Quick ratio value of 5.92, PLTR belongs to the best of the industry, outperforming 87.63% of the companies in the same industry.

Profitability Examination for NYSE:PLTR

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of NYSE:PLTR, the assigned 6 is noteworthy for profitability:

- PLTR has a better Return On Assets (7.79%) than 84.10% of its industry peers.

- The Return On Equity of PLTR (9.99%) is better than 81.27% of its industry peers.

- PLTR has a Return On Invested Capital of 5.26%. This is in the better half of the industry: PLTR outperforms 77.74% of its industry peers.

- The Profit Margin of PLTR (16.32%) is better than 84.10% of its industry peers.

- Looking at the Operating Margin, with a value of 11.78%, PLTR belongs to the top of the industry, outperforming 82.33% of the companies in the same industry.

- PLTR's Gross Margin of 81.39% is amongst the best of the industry. PLTR outperforms 84.45% of its industry peers.

- PLTR's Gross Margin has improved in the last couple of years.

Why is NYSE:PLTR a setup?

Besides the Technical Rating, ChartMill assigns a Setup Rating to every stock to determine the degree of consolidation. This rating, ranging from 0 to 10, is updated daily and evaluates various short-term technical indicators. NYSE:PLTR currently holds a 8 as its setup rating, suggesting a particular level of consolidation in the stock.

Besides having an excellent technical rating, PLTR also presents a decent setup pattern. Prices have been consolidating lately. A pullback is taking place, which may present a nice opportunity for an entry. There is a support zone below the current price at 30.32, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

Every day, new Strong Growth stocks can be found on ChartMill in our Strong Growth screener.

Check the latest full fundamental report of PLTR for a complete fundamental analysis.

For an up to date full technical analysis you can check the technical report of PLTR

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.