What To Expect From Arcos Dorados’s (ARCO) Q1 Earnings

Provided By StockStory

Last update: May 13, 2025

Fast-food chain Arcos Dorados (NYSE:ARCO) will be reporting results tomorrow morning. Here’s what to expect.

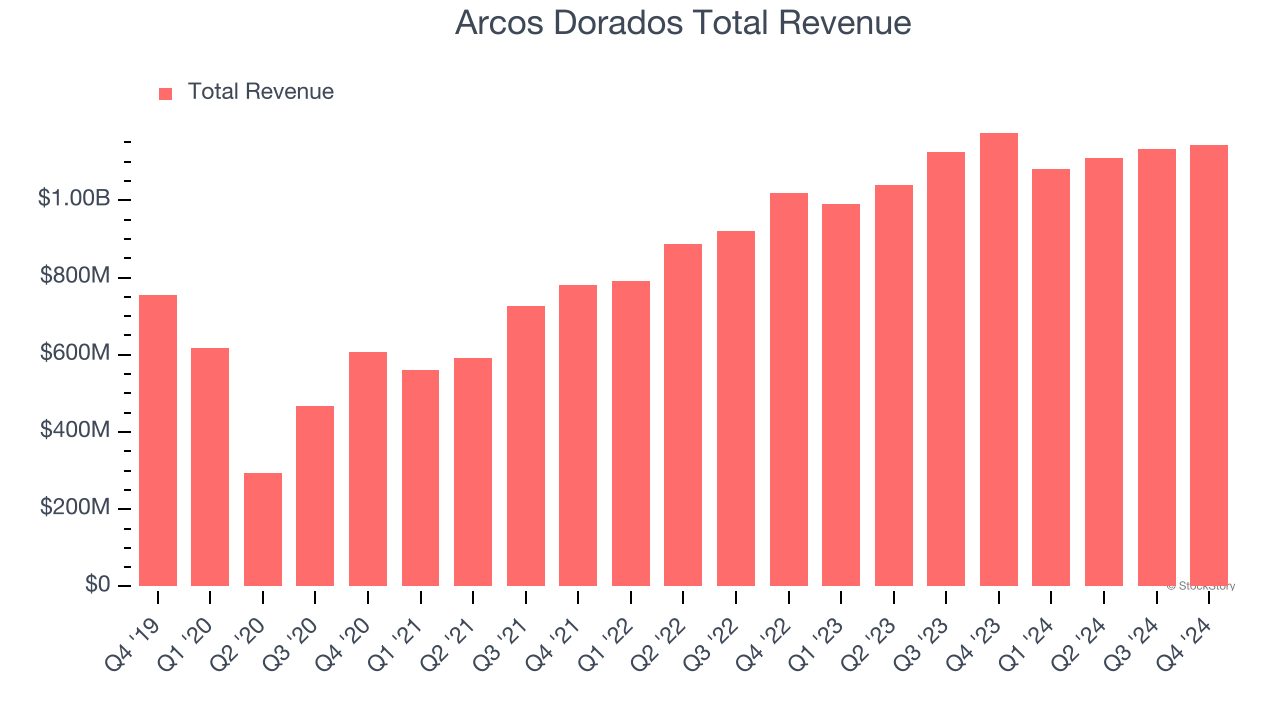

Arcos Dorados missed analysts’ revenue expectations by 2.7% last quarter, reporting revenues of $1.14 billion, down 2.7% year on year. It was a strong quarter for the company, with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ same-store sales estimates.

Is Arcos Dorados a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Arcos Dorados’s revenue to grow 3.3% year on year to $1.12 billion, slowing from the 9.1% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.13 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Arcos Dorados has missed Wall Street’s revenue estimates twice over the last two years.

Looking at Arcos Dorados’s peers in the traditional fast food segment, some have already reported their Q1 results, giving us a hint as to what we can expect. Papa John's posted flat year-on-year revenue, beating analysts’ expectations by 0.6%, and Dutch Bros reported revenues up 29.1%, topping estimates by 3%. Papa John's traded up 14.8% following the results while Dutch Bros was also up 9%.

Read our full analysis of Papa John’s results here and Dutch Bros’s results here.

There has been positive sentiment among investors in the traditional fast food segment, with share prices up 11% on average over the last month. Arcos Dorados is up 8.8% during the same time and is heading into earnings with an average analyst price target of $10.93 (compared to the current share price of $7.93).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

116.19

+0.5 (+0.43%)

141.72

+1.73 (+1.24%)

7.53

+0.01 (+0.13%)

Find more stocks in the Stock Screener

AMD Latest News and Analysis

3 days ago - ChartmillMarket Monitor News June 04 (Dollar General, ON Semiconductor UP - Kenvue DOWN)

3 days ago - ChartmillMarket Monitor News June 04 (Dollar General, ON Semiconductor UP - Kenvue DOWN)US Markets Rebound on Strong Job Data; Tech Stocks Shine as Dollar General Soars

3 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?

3 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?Let's have a look at what is happening on the US markets on Tuesday. Below you can find the most active S&P500 stocks in today's session.

4 days ago - ChartmillThese S&P500 stocks are moving in today's session

4 days ago - ChartmillThese S&P500 stocks are moving in today's sessionLet's delve into the developments on the US markets one hour before the close of the markets on Monday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.

4 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Monday?

4 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Monday?Explore the S&P500 index on Monday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest and driving market movements.

7 days ago - ChartmillADVANCED MICRO DEVICES (NASDAQ:AMD) – A Strong Growth Stock with Technical Breakout Potential

7 days ago - ChartmillADVANCED MICRO DEVICES (NASDAQ:AMD) – A Strong Growth Stock with Technical Breakout PotentialAMD (NASDAQ:AMD) shows strong growth fundamentals and a bullish technical setup, making it a stock to watch for investors seeking high-growth semiconductor opportunities.

8 days ago - ChartmillMarket Monitor News May 30 (Nvidia UP - HP, Best Buy DOWN)

8 days ago - ChartmillMarket Monitor News May 30 (Nvidia UP - HP, Best Buy DOWN)While AI titans like Nvidia propelled optimism, tariff-related headwinds pulled down stalwarts like HP and Best Buy.

8 days ago - ChartmillThursday's session: most active stock in the S&P500 index

8 days ago - ChartmillThursday's session: most active stock in the S&P500 indexLooking for the most active S&P500 stocks in today's session? Join us as we dive into the US markets on Thursday and discover the stocks that are dominating the trading activity and setting the pace for the market.

9 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?

9 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?The US market is yet to commence its session on Thursday, but let's get a preview of the pre-market session and explore the top S&P500 gainers and losers driving the early market movements.

10 days ago - ChartmillStay informed about the most active stocks in the S&P500 index on Tuesday's session.

10 days ago - ChartmillStay informed about the most active stocks in the S&P500 index on Tuesday's session.Curious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

11 days ago - ChartmillThese S&P500 stocks are moving in today's pre-market session

11 days ago - ChartmillThese S&P500 stocks are moving in today's pre-market sessionAs we await the opening of the US market on Tuesday, let's delve into the pre-market session and discover the S&P500 top gainers and losers shaping the early market sentiment.

18 days ago - ChartmillMonday's session: most active stock in the S&P500 index

18 days ago - ChartmillMonday's session: most active stock in the S&P500 indexCurious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

18 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

18 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Join us in exploring the top gainers and losers within the S&P500 index in the middle of the day on Monday as we examine the latest happenings in today's session.