Why Tesla (TSLA) Stock Is Trading Up Today

Provided By StockStory

Last update: Apr 25, 2025

What Happened?

Shares of electric vehicle pioneer Tesla (NASDAQ:TSLA) jumped 10.4% in the afternoon session after the National Highway Traffic Safety Administration (NHTSA), rolled out new rules to speed up the launch of home-built self-driving cars. As part of this push, the group planned to cut red tape in crash reports, making it easier for firms like Tesla to test their autonomous vehicles. NHTSA also wants to stretch an old rule that lets some cars skip standard checks, so more US-made driverless cars can join. These moves were designed to offer a clear plan to put the US ahead in the autonomous vehicle market, especially as China steps up its game.

For companies like Tesla, this regulatory easing could significantly accelerate the commercialization of autonomous mobility solutions across the US.

Is now the time to buy Tesla? Access our full analysis report here, it’s free.

What The Market Is Telling Us

Tesla’s shares are extremely volatile and have had 128 moves greater than 2.5% over the last year. But moves this big are rare even for Tesla and indicate this news significantly impacted the market’s perception of the business.

The previous big move we wrote about was 2 days ago when the stock gained 8.9% on the news that CEO Elon Musk announced plans to limit his involvement at the Department of Government Efficiency, suggesting a shift in focus toward his business ventures, especially Tesla. Musk added during the Q1 2025 earnings, "I think starting probably in next month, May, my time allocation to DOGE will drop significantly."

The quarter itself was underwhelming as Tesla delivered fewer vehicles than forecasted, its revenue in all three segments (Services, Automotive, and Energy) missed, and its EPS fell short of Wall Street's estimates.

Still, investors cheered Musk's renewed focus on the business, especially as the company continued to make significant operational adjustments towards delivering more vehicles and keeping to its promise to introduce more affordable EVs while also fending off rising competition.

Tesla is down 25.1% since the beginning of the year, and at $284.05 per share, it is trading 40.8% below its 52-week high of $479.86 from December 2024. Investors who bought $1,000 worth of Tesla’s shares 5 years ago would now be looking at an investment worth $5,334.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

NASDAQ:NVDA (7/14/2025, 2:15:10 PM)

165.04

+0.12 (+0.07%)

NASDAQ:AMD (7/14/2025, 2:15:10 PM)

146.564

+0.14 (+0.1%)

NASDAQ:TSLA (7/14/2025, 2:15:10 PM)

314.425

+0.92 (+0.29%)

Find more stocks in the Stock Screener

NVDA Latest News and Analysis

26 minutes ago - ChartmillThese S&P500 stocks are the most active in today's session

26 minutes ago - ChartmillThese S&P500 stocks are the most active in today's sessionExplore the S&P500 index on Monday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest.

31 minutes ago - ChartmillMost active stocks in Monday's session

31 minutes ago - ChartmillMost active stocks in Monday's sessionCurious about the most active stocks on Monday? Find out which stocks are dominating the market action!

10 hours ago - ChartmillNVIDIA CORP (NASDAQ:NVDA) – A Strong Candidate for CANSLIM Investors

10 hours ago - ChartmillNVIDIA CORP (NASDAQ:NVDA) – A Strong Candidate for CANSLIM InvestorsNVIDIA (NVDA) meets CANSLIM criteria with strong earnings growth, leadership in AI, and bullish technicals. A top pick for growth investors.

14 hours ago - ChartmillMarket Monitor News July 14 BMO (Levi Strauss & Red Cat Holdings UP - Dave DOWN)

14 hours ago - ChartmillMarket Monitor News July 14 BMO (Levi Strauss & Red Cat Holdings UP - Dave DOWN)Tariff Tantrums and Tech Triumphs: Wall Street’s Risk Appetite Takes a Hit

3 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Friday?

3 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Friday?Curious about the most active S&P500 stocks in today's session? Join us as we explore the US markets on Friday and uncover the stocks that are leading the way in terms of trading volume and market attention.

3 days ago - ChartmillThese stocks are the most active in today's session

3 days ago - ChartmillThese stocks are the most active in today's sessionLet's dive into the action on the US markets on Friday. Here are the most active stocks that are driving the market today.

4 days ago - ChartmillMarket Monitor News July 11 BMO (Airline stocks UP - Ultragenyx Pharmaceuticals DOWN)

4 days ago - ChartmillMarket Monitor News July 11 BMO (Airline stocks UP - Ultragenyx Pharmaceuticals DOWN)Investors shrug off tariff drama as earnings, chip euphoria, and airline optimism steal the show.

4 days ago - ChartmillThese S&P500 stocks are the most active in today's session

4 days ago - ChartmillThese S&P500 stocks are the most active in today's sessionLooking for the most active S&P500 stocks in today's session? Join us as we dive into the US markets on Thursday and discover the stocks that are dominating the trading activity and setting the pace for the market.

4 days ago - ChartmillCurious about the most active stocks on Thursday?

4 days ago - ChartmillCurious about the most active stocks on Thursday?Let's dive into the action on the US markets on Thursday. Here are the most active stocks that are driving the market today.

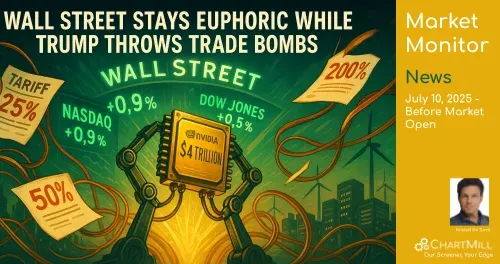

5 days ago - ChartmillMarket Monitor News July 10 BMO (AES Corporation, Penguin Solutions UP - AEHR Test Systems DOWN)

5 days ago - ChartmillMarket Monitor News July 10 BMO (AES Corporation, Penguin Solutions UP - AEHR Test Systems DOWN)Wall Street Stays Euphoric While Trump Throws Trade Bombs: Why Investors Shrugged It Off

5 days ago - ChartmillThese S&P500 stocks are the most active in today's session

5 days ago - ChartmillThese S&P500 stocks are the most active in today's sessionLooking for the most active S&P500 stocks in today's session? Join us as we dive into the US markets on Wednesday and discover the stocks that are dominating the trading activity and setting the pace for the market.

5 days ago - ChartmillWhich stocks are most active on Wednesday?

5 days ago - ChartmillWhich stocks are most active on Wednesday?Get a pulse on the US markets on Wednesday by checking out the most active stocks in today's session. Discover the stocks that are leading the way in terms of trading volume and market activity.