LENNAR CORP-A (NYSE:LEN) stands out as a compelling pick for investors seeking growth at a reasonable price (GARP). The company, a leading homebuilder in the U.S., meets key criteria from Peter Lynch’s investment strategy, balancing solid growth with sound financial health and an attractive valuation.

Why LEN Fits the GARP Approach

- Sustainable Growth: LEN has delivered a 5-year average EPS growth of 20.01%, aligning with Lynch’s preference for companies growing at a steady but not excessive pace (15-30%).

- Reasonable Valuation: With a PEG ratio of 0.42 (well below Lynch’s threshold of 1), the stock is priced attractively relative to its growth.

- Strong Profitability: The company’s return on equity (ROE) of 16.26% exceeds Lynch’s 15% benchmark, reflecting efficient use of shareholder capital.

- Healthy Balance Sheet: A debt-to-equity ratio of 0.16 and a current ratio of 8.37 indicate low financial risk and ample liquidity.

Fundamental Highlights

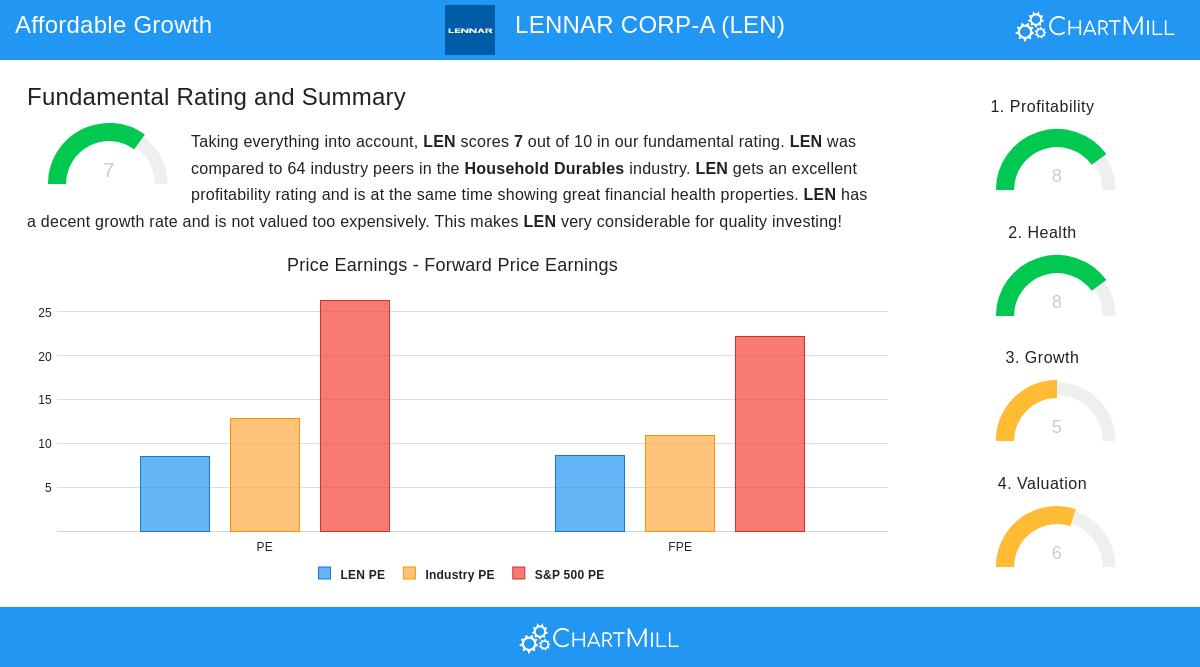

LEN scores 7/10 in our fundamental analysis, with standout ratings in profitability (8/10) and financial health (8/10). Key strengths include:

- High operating margin (13.74%) and profit margin (10.34%), outperforming most peers.

- Consistent revenue growth (9.75% annualized over 5 years).

- A reliable dividend history, with payouts growing at 65.54% annually over the past decade.

For a deeper dive, review the full fundamental analysis of LEN.

Our Peter Lynch Strategy screener lists more stocks that fit this strategy and is updated regularly.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should always conduct your own analysis before making investment decisions.