EXLSERVICE HOLDINGS INC (NASDAQ:EXLS) was identified as a quality stock through our Caviar Cruise screener, which focuses on companies with strong financial health, profitability, and growth potential. EXLS stands out due to its high return on invested capital, manageable debt levels, and consistent cash flow generation. Below, we examine why this stock fits the criteria for quality investors.

Key Strengths of EXLS

- High Return on Invested Capital (ROIC): EXLS has an impressive ROIC of 33.9%, well above the 15% threshold required by the Caviar Cruise screen. This indicates efficient use of capital to generate profits.

- Low Debt Relative to Free Cash Flow: The company’s debt-to-free cash flow ratio is 1.25, meaning it could repay all its debt in just over a year using current cash flows. This reflects a strong balance sheet.

- Strong Profit Quality: Over the past five years, EXLS has converted 118% of its net income into free cash flow, exceeding the 75% benchmark. This suggests earnings are backed by real cash generation rather than accounting adjustments.

- EBIT Growth Outpacing Revenue Growth: With a five-year EBIT growth rate of 25.3%, EXLS demonstrates improving operational efficiency, a key trait for quality businesses.

Fundamental Analysis Summary

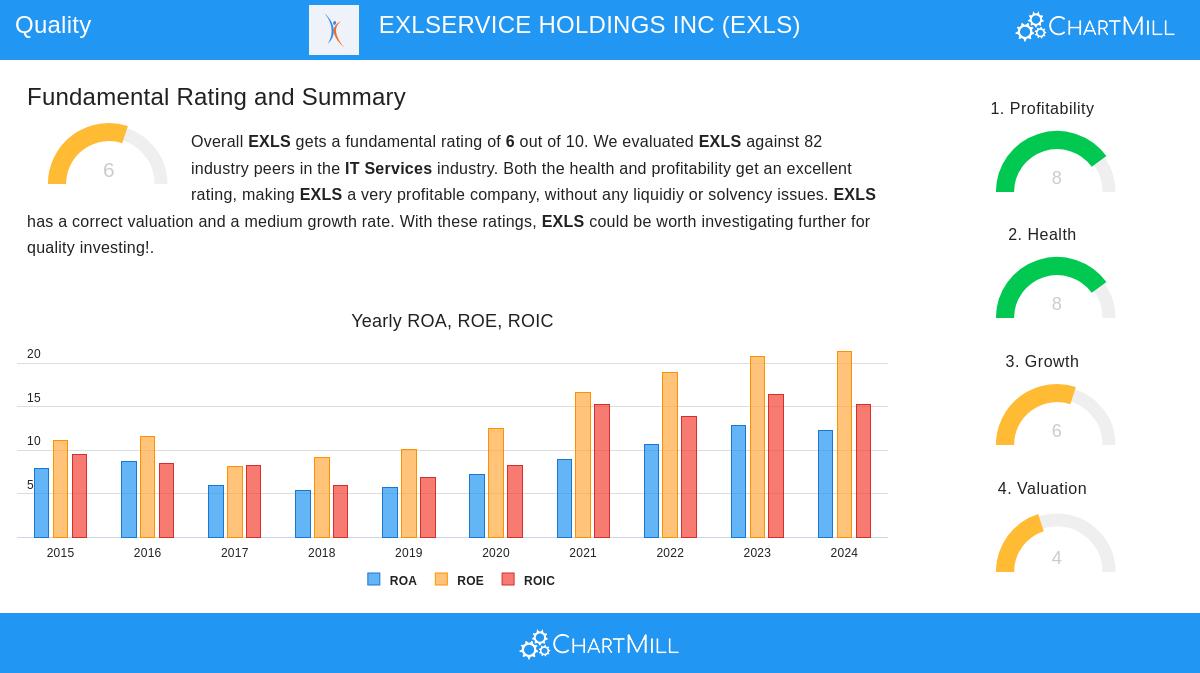

Our fundamental report gives EXLS an overall score of 6 out of 10, with high marks for profitability (8/10) and financial health (8/10). Key highlights include:

- Profitability: The company outperforms most peers in return on equity (21.4%) and operating margin (14.7%).

- Liquidity & Solvency: A current ratio of 3.41 and Altman-Z score of 10.28 indicate minimal bankruptcy risk.

- Valuation: While the P/E ratio of 27.3 appears expensive, it aligns with industry averages and may be justified by growth prospects.

Why Quality Investors Should Consider EXLS

EXLS operates in business process management and analytics, sectors with long-term growth potential. Its ability to maintain high margins, generate cash, and reinvest efficiently makes it a candidate for buy-and-hold strategies.

For more quality stocks, explore our Caviar Cruise screener.

Review the full fundamental analysis of EXLS for deeper insights.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own research before making investment decisions.