When cannabis stocks outperform AI and chip giants, you know it's not your average Monday on Wall Street.

Markets Drift, But There’s Fire Beneath the Surface

It was a sluggish start to the week with the major indices only modestly higher. The Dow Jones closed up 0.2%, the S&P 500 added 0.3%, and the Nasdaq led the way with a 0.5% gain.

Traders are clearly biding their time ahead of Friday’s all-important U.S. jobs report. But even that’s not a done deal, a potential government shutdown starting October 1st could delay the release altogether.

If that happens, the Fed might be left flying blind, especially since Chair Powell has repeatedly stressed the central bank’s “data-dependent” approach.

And when you take away the data? You add uncertainty and volatility.

Cannabis Stocks Blaze Ahead After Trump Endorsement

The real fireworks came from an unexpected source: weed stocks.

Over the weekend, President Donald Trump shared a video on his Truth Social platform touting the potential health benefits of CBD (cannabidiol), calling it a possible “revolution” for elderly healthcare. That was all it took for the cannabis sector to catch fire.

Here’s how it played out:

-

Tilray Brands (TLRY | +60.87%) exploded higher.

-

Canopy Growth (CGC | +17.16%) followed suit.

North of the border, Charlotte's Web (CWEB.CA | +92.57%), Aurora Cannabis (ACB.CA | +27.92%), and Curaleaf (CURA.CA | +34.85%) also joined the party.

Despite the rally, it’s worth remembering cannabis remains a Schedule 1 substance at the federal level in the U.S., grouped with heroin and ecstasy. Trump has hinted at plans to reclassify it, but so far, action has been lacking.

Until then, any optimism remains more smoke than fire.

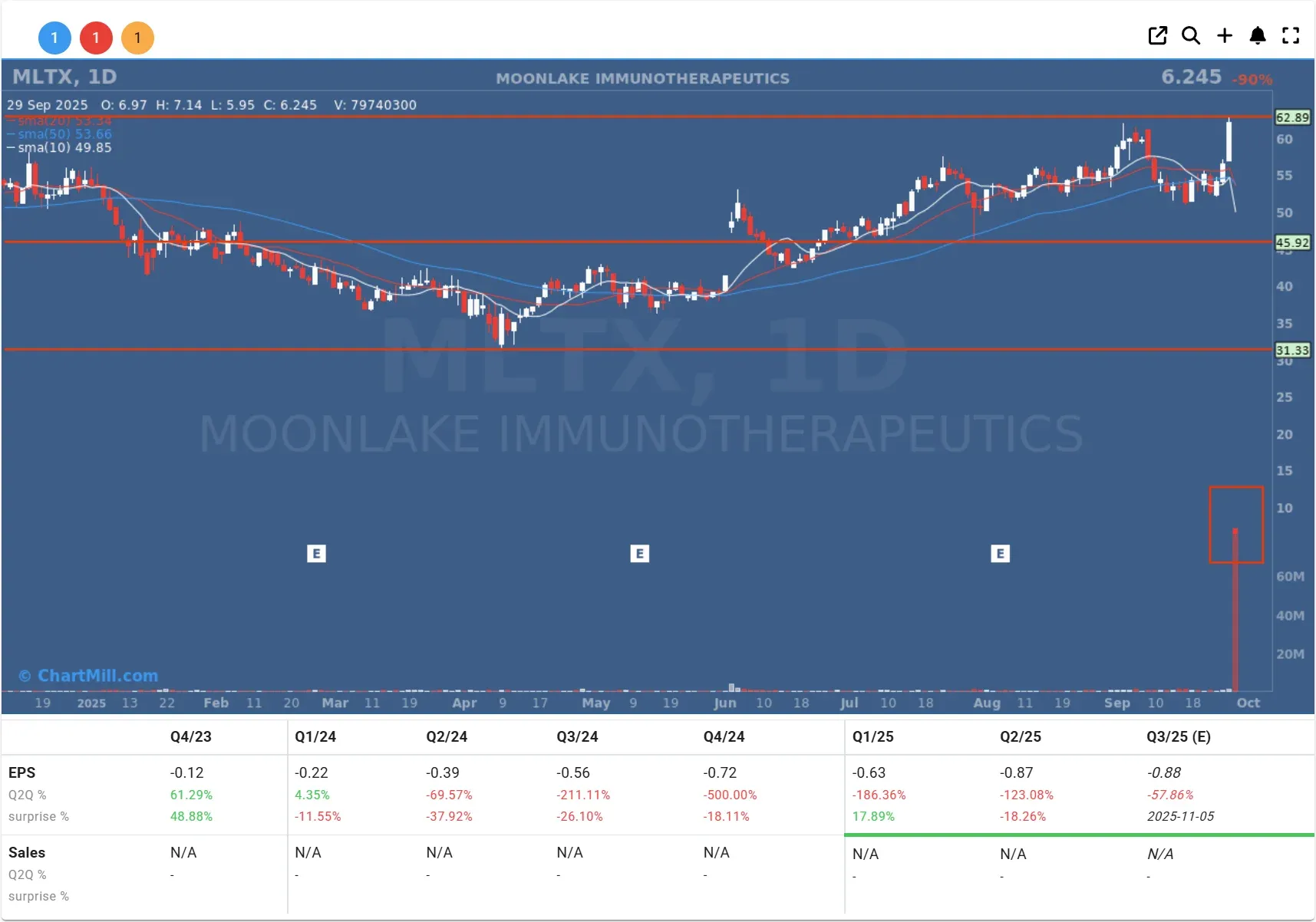

Biotech Nightmare: MoonLake Wiped Out

If cannabis stocks were flying, MoonLake Immunotherapeutics (MLTX | -89.93%) crashed straight into the ground.

The biotech firm lost nearly its entire market cap in a single session after disappointing trial results for its flagship drug sonelokimab, aimed at treating hidradenitis suppurativa (HS).

The problem? A surprisingly strong placebo effect in one of the two studies rendered the results statistically insignificant.

Before this, MoonLake had been riding high on its $4 billion valuation. After Monday, it's limping away with a market cap under $400 million. A brutal reminder that in biotech, hope can be erased in a single headline.

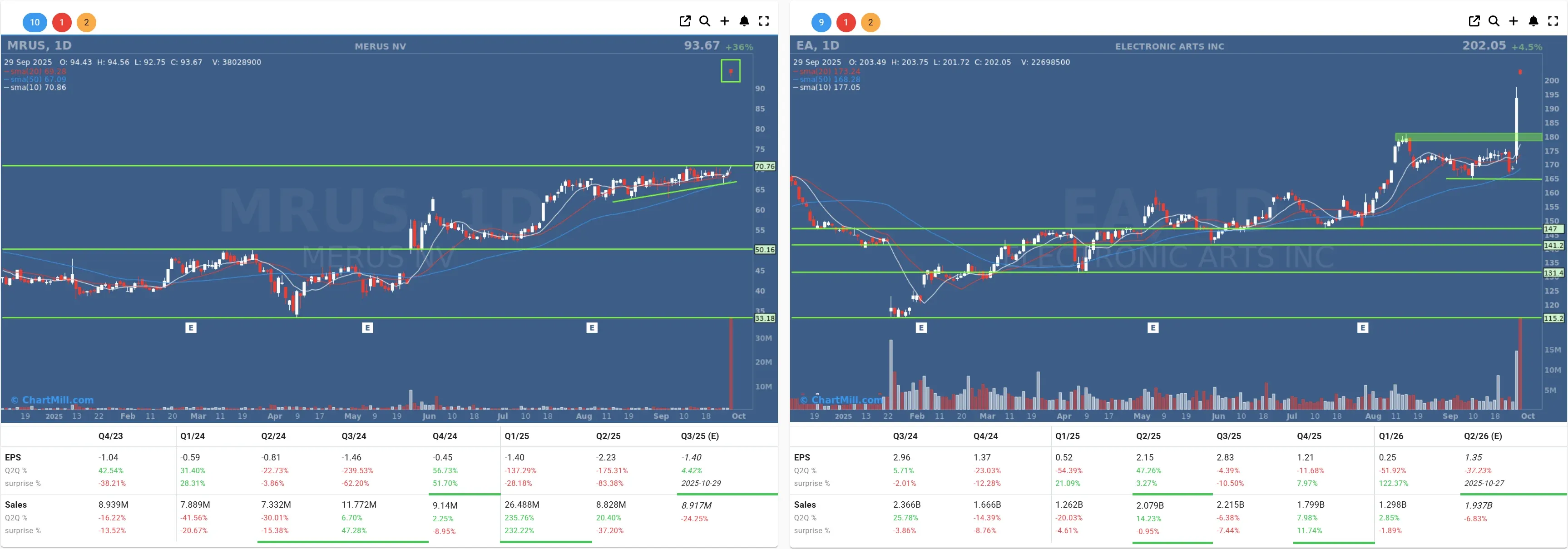

Deal-Making Heats Up: EA and Merus in the Spotlight

On the M&A front, there were two big movers:

-

Electronic Arts (EA | +4.50%) jumped after news broke that it’s being acquired by a private investment consortium at a $55 billion valuation. If the deal goes through, EA will exit the public market entirely.

-

Merus (MRUS | +35.97%) soared after Danish biotech Genmab announced plans to acquire the Dutch firm for $8 billion. Merus brings a promising cancer drug pipeline to the table, including treatments for head and neck cancers. The deal is expected to close in Q1 2026.

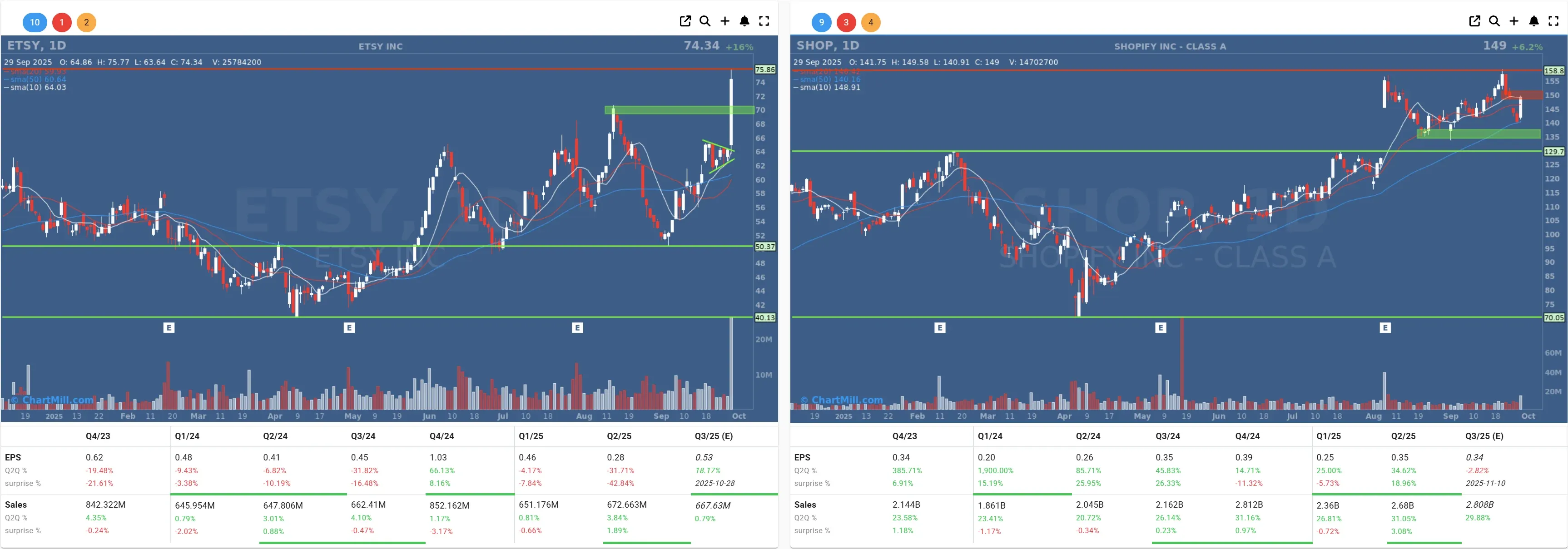

OpenAI’s Checkout Surprise Boosts Etsy and Shopify

Tech also made some noise thanks to OpenAI.

The company launched Instant Checkout, a feature that lets users buy products directly via ChatGPT. Initially linked with Etsy sellers, the service will soon expand to Shopify vendors like Skims and Glossier.

The ripple effect:

Who said chatbots can’t sell?

Housing Rebounds, Oil Dips, Gold Shines

In macro news, pending U.S. home sales rebounded strongly in August, up 4.0% after several months of decline. Lower mortgage rates appear to be bringing buyers back, particularly in the Midwest.

On the flip side, oil prices fell around 3.5% as OPEC+ hinted at increasing output in November. That could relieve pressure on global reserves and maybe even at the pump.

Meanwhile, gold and silver continued their upward march, while bond yields edged lower across the board. With all eyes on Friday’s payrolls data (shutdown permitting), precious metals might continue to shine as a hedge.

Bottom Line

Yes, the indices were sleepy, but don’t let that fool you, underneath the surface, Monday’s market was full of action.

From Trump’s CBD hype rallying cannabis stocks, to biotech implosions and new AI-driven shopping integrations, there’s no shortage of storylines heading into what could be a chaotic week.

Friday’s jobs data may be the big macro test… if we even get it.

Until then, I’m watching volatility, political headlines, and - oddly enough - pot stocks.

Let’s see what lights up next.

Kristoff - ChartMill

Next to read: Steady Start to the Week as Breadth Consolidates