The search for undervalued companies with solid basic financials remains a key part of value investing, a strategy created by Benjamin Graham and famously used by Warren Buffett. This method focuses on finding stocks trading for less than their calculated worth while having good financial condition and earnings. By focusing on companies that are inexpensive compared to their profits and assets but still show high operational quality, investors try to build holdings with contained risk of loss and notable potential for gain.

Valuation Measurements

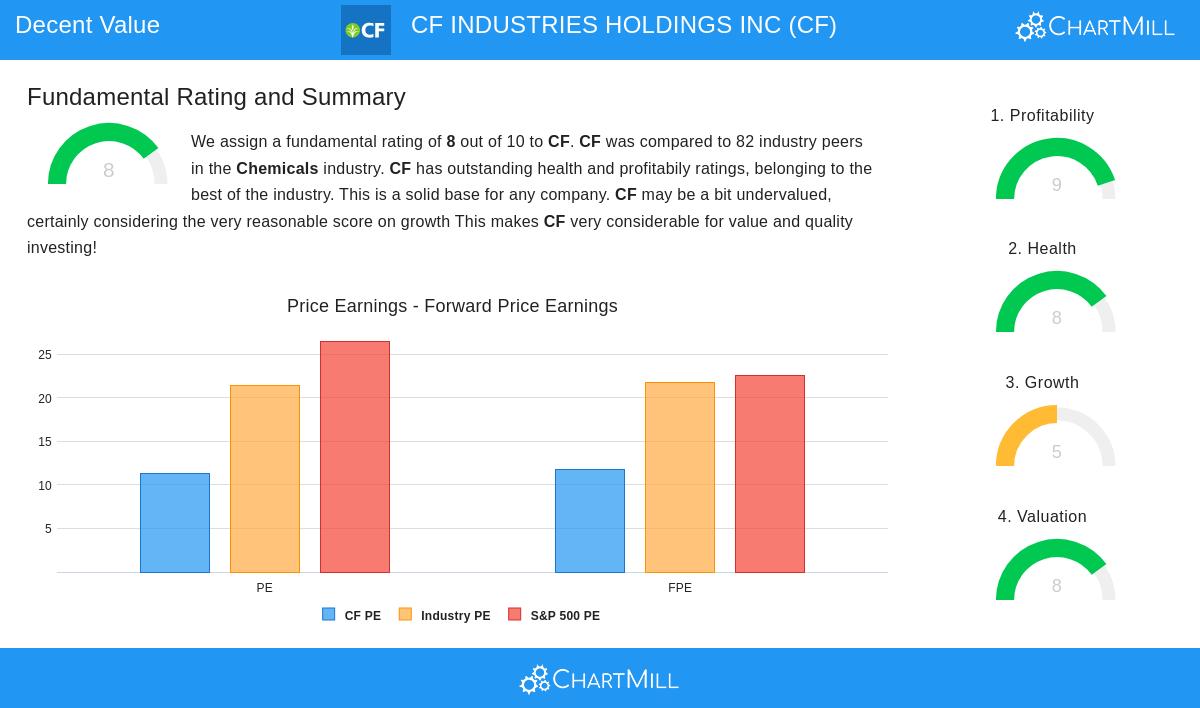

CF Industries Holdings Inc (NYSE:CF) presents an interesting valuation situation according to its fundamental analysis report. The company's current earnings multiple is at 11.32, much lower than both the S&P 500 average of 26.51 and the chemicals industry average of 21.46. This lower pricing is seen in several valuation measurements:

- Enterprise Value to EBITDA ratio places CF as less expensive than 92.68% of industry peers

- Price to Free Cash Flow ratio is better than 90.24% of competitors

- Forward P/E ratio of 11.82 stays well under market averages

For value investors, these measurements suggest the market may be pricing CF's earnings ability too low. The company's profitability score of 9/10 further supports the view that current prices may not completely show the firm's ability to generate money.

Financial Condition Evaluation

The company shows good financial condition with a score of 8/10, an important factor for value investors looking for stability and lower risk of financial failure. CF's balance sheet strength is clear in several main areas:

- Current ratio of 3.22 indicates strong short-term cash position, performing better than 85.37% of industry peers

- Quick ratio of 2.84 shows very good immediate payment ability, superior to 90.24% of competitors

- Debt to free cash flow ratio of 1.66 suggests the company could pay off all debt in less than two years from operational cash flows

This financial steadiness provides the safety buffer that value investors look for, making sure the company can handle economic slowdowns while continuing business and giving capital back to shareholders.

Earnings Performance Review

CF's high profitability score of 9/10 highlights the company's operational effectiveness and market strengths. The nitrogen fertilizer producer creates returns that are much higher than industry averages:

- Return on equity of 26.23% is better than 93.90% of chemical industry peers

- Return on invested capital of 12.07% is higher than 91.46% of competitors

- Profit margin of 20.20% places in the top group of the industry at 98.78%

- Operating margin of 29.21% beats 95.12% of similar companies

These measurements show that CF works from a strong position in its market, creating large returns on investor money while keeping control over pricing and costs.

Growth Path and Dividend Information

While CF's growth score of 5/10 seems average, the company shows important expansion in main areas. Recent performance includes a 26.01% rise in earnings per share over the last year, with revenue increasing 9.53% in the same time. The five-year average annual EPS growth rate of 24.81% points to continued earnings improvement.

The dividend part adds another aspect of value, with CF maintaining a 2.42% yield while showing:

- 10.99% average yearly dividend growth over recent years

- 10+ year history of consistent dividend payments without cuts

- Manageable payout ratio of 26.34% of income

This mix of acceptable growth, returns to shareholders, and careful payout ratios matches value investing ideas that favor sensible capital distribution over fast but possibly unreliable expansion.

Investment Points

CF Industries represents the kind of opportunity value investors have historically looked for: a business with sound basics trading at low multiples. The company's solid market position in nitrogen fertilizers, together with its financial control and policies that benefit shareholders, creates an interesting case for more study. While the chemicals sector deals with cyclical challenges, CF's valuation seems to include these issues while possibly not fully valuing the company's lasting strengths.

For investors curious about similar opportunities, more screening results can be found using the Decent Value Stocks screener, which finds companies with good valuation features along with acceptable basics across several measurements.

This article presents information for educational purposes only and should not be seen as investment advice, recommendation, or support of any security or investment method. Investors should do their own research and talk with financial advisors before making investment choices. Past performance does not ensure future results.