Peter Lynch’s investment philosophy combines fundamental analysis with a deep understanding of business models. Let’s analyze if CF INDUSTRIES HOLDINGS INC (NYSE:CF) meets his criteria for a solid investment.

Is CF INDUSTRIES HOLDINGS INC (NYSE:CF) the type of stock Peter Lynch would love?

- In terms of Return on Equity(ROE), CF is performing well, achieving a 24.43% ratio. This highlights the company's effective allocation of shareholder investments and signifies its commitment to maximizing returns.

- CF has a Debt/Equity ratio of 0.6, indicating a balanced approach to financing growth.

- CF has achieved 24.81 growth in EPS over the past 5 years, reflecting a sustained improvement in earnings performance.

- A PEG ratio of 0.51 suggests that CF offers an attractive balance between growth and valuation.

- CF maintains a healthy liquidity position with a Current Ratio of 3.08.

What else is there to say on the fundamentals of CF?

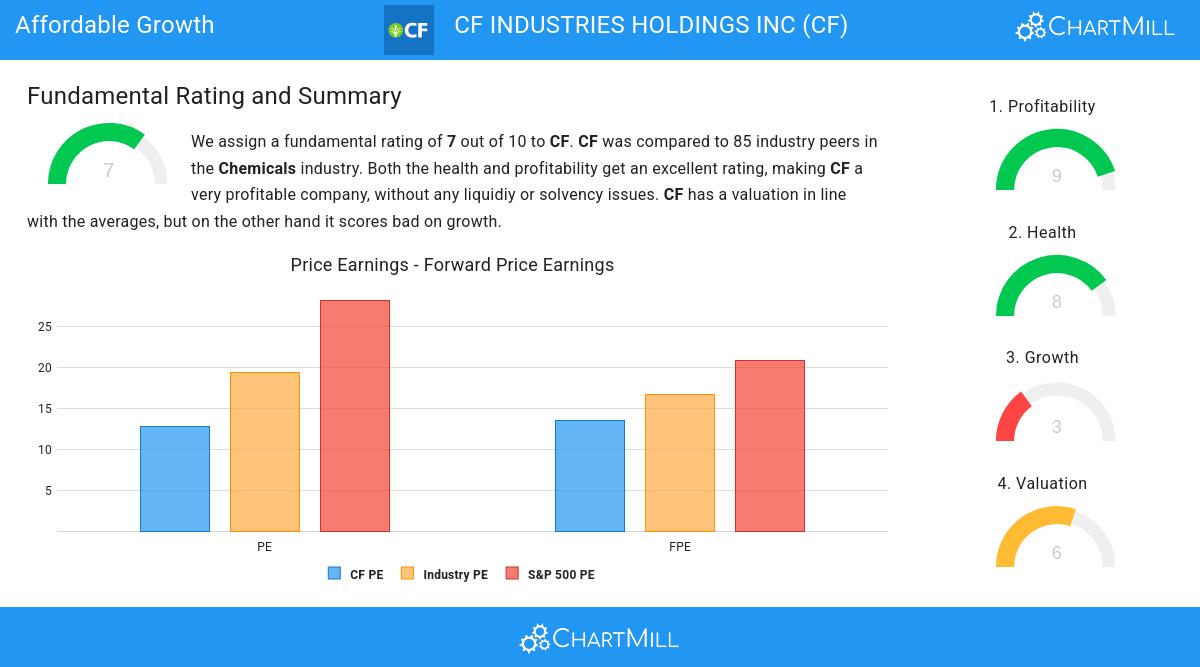

Every day ChartMill assigns a Fundamental Rating to every stock. The score ranges from 0 to 10 and is determined by evaluating multiple fundamental indicators and properties.

Overall CF gets a fundamental rating of 7 out of 10. We evaluated CF against 85 industry peers in the Chemicals industry. CF has outstanding health and profitabily ratings, belonging to the best of the industry. This is a solid base for any company. CF has a valuation in line with the averages, but on the other hand it scores bad on growth.

Our latest full fundamental report of CF contains the most current fundamental analsysis.

More Affordable Growth stocks can be found in our Peter Lynch screener.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.