Technical Signals Point to a Possible Breakout for BOEING CO/THE.

By Mill Chart

Last update: Feb 10, 2025

Our stock screener has detected a potential breakout setup on BOEING CO/THE (NYSE:BA). This breakout pattern is observed when a stock consolidates following a strong upward movement. It's important to note that this pattern is based on technical analysis, and the actual breakout outcome is uncertain. However, it might be worth keeping an eye on NYSE:BA.

Analyzing the Technical Aspects

ChartMill assigns a Technical Rating to every stock. This score, ranging from 0 to 10, is updated daily and is determined by evaluating multiple technical indicators and properties.

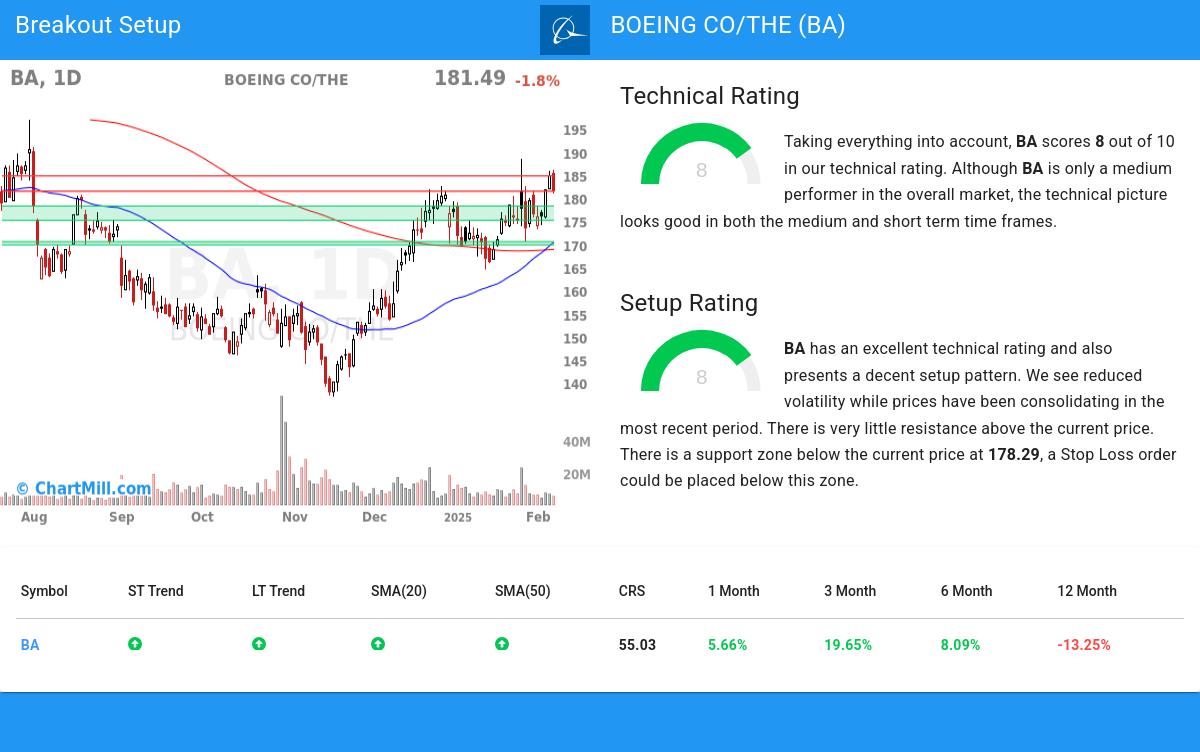

We assign a technical rating of 8 out of 10 to BA. Although BA is only a medium performer in the overall market, the technical picture looks good in both the medium and short term time frames.

- The long and short term trends are both positive. This is looking good!

- In the last month BA has a been trading in the 164.62 - 188.48 range, which is quite wide. It is currently trading near the high of this range.

- When compared to the yearly performance of all other stocks, BA outperforms 55% of them, which is more or less in line with the market.

- BA is currently trading in the middle of its 52 week range. The S&P500 Index however is currently trading near new highs, so BA is lagging the market.

For an up to date full technical analysis you can check the technical report of BA

Why is NYSE:BA a setup?

In addition to the Technical Rating, ChartMill provides a Setup Rating for each stock. This rating, ranging from 0 to 10, assesses the level of consolidation in the stock based on multiple short-term technical indicators. Currently, NYSE:BA has a 8 as its setup rating, indicating its current consolidation status.

BA has an excellent technical rating and also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. There is very little resistance above the current price. There is a support zone below the current price at 178.29, a Stop Loss order could be placed below this zone.

How can NYSE:BA be traded?

One way to play this would be to wait for the actual breakout to happen and buy when the stock breaks out above the current consolidation zone. A possible place for a stop loss would be below this zone.

Of course, there are many ways to trade or not trade NYSE:BA and this article should in no way be interpreted as trading advice. The article is purely based on an automated technical analysis and just points out the technical observations. Always make your own analysis and trade at your own responsibility.

More breakout setups can be found in our Breakout screener.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

NYSE:BA (6/25/2025, 2:13:09 PM)

198.75

-2.19 (-1.09%)

Find more stocks in the Stock Screener

BA Latest News and Analysis

2 days ago - ChartmillMarket Monitor News June 24 BMO (Tesla, Northern Trust UP - Hims&Hers, Super Micro Computer DOWN)

2 days ago - ChartmillMarket Monitor News June 24 BMO (Tesla, Northern Trust UP - Hims&Hers, Super Micro Computer DOWN)Markets Brush Off Missiles and Missteps — Sentiment Stays Surprisingly Resilient

13 days ago - ChartmillMarket Monitor News June 13 (Oracle UP - Gamestop DOWN)

13 days ago - ChartmillMarket Monitor News June 13 (Oracle UP - Gamestop DOWN)U.S. stocks edge higher as inflation cools, Oracle soars on AI growth, and markets brace for Israel-Iran conflict escalation.

13 days ago - ChartmillTop S&P500 movers in Thursday's session

13 days ago - ChartmillTop S&P500 movers in Thursday's sessionLet's have a look at what is happening on the US markets one hour before the close of the markets on Thursday. Below you can find the top S&P500 gainers and losers in today's session.

13 days ago - ChartmillExplore the S&P500 index on Thursday and find out which stocks are the most active in today's session.

13 days ago - ChartmillExplore the S&P500 index on Thursday and find out which stocks are the most active in today's session.Curious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

13 days ago - ChartmillCurious about which S&P500 stocks are generating unusual volume on Thursday? Find out below.

13 days ago - ChartmillCurious about which S&P500 stocks are generating unusual volume on Thursday? Find out below.Discover the S&P500 stocks that are experiencing unusual trading volume in today's session. Find out more about these stocks below.

13 days ago - ChartmillExploring the top movers within the S&P500 index during today's session.

13 days ago - ChartmillExploring the top movers within the S&P500 index during today's session.Stay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Thursday.

13 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocks

13 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocksSeeking insights into today's market movers? Discover the S&P500 gap up and gap down stocks in today's session on Thursday. Stay informed about the latest market trends.

13 days ago - ChartmillThese S&P500 stocks that are showing activity before the opening bell on Thursday.

13 days ago - ChartmillThese S&P500 stocks that are showing activity before the opening bell on Thursday.As we await the opening of the US market on Thursday, let's delve into the pre-market session and discover the S&P500 top gainers and losers shaping the early market sentiment.