When AI Mega-Deals Stop Inspiring Confidence

Sometimes a story hits the tape and you can almost hear investors collectively raising an eyebrow. Yesterday was one of those days.

Wall Street spent the session trading lower yet again, weighed down by the same cocktail of concerns that has dominated November: AI exuberance turning into AI exhaustion, crypto whiplash, and an uncomfortable amount of doubt about whether the Fed will actually cut rates in December.

The latest spark?

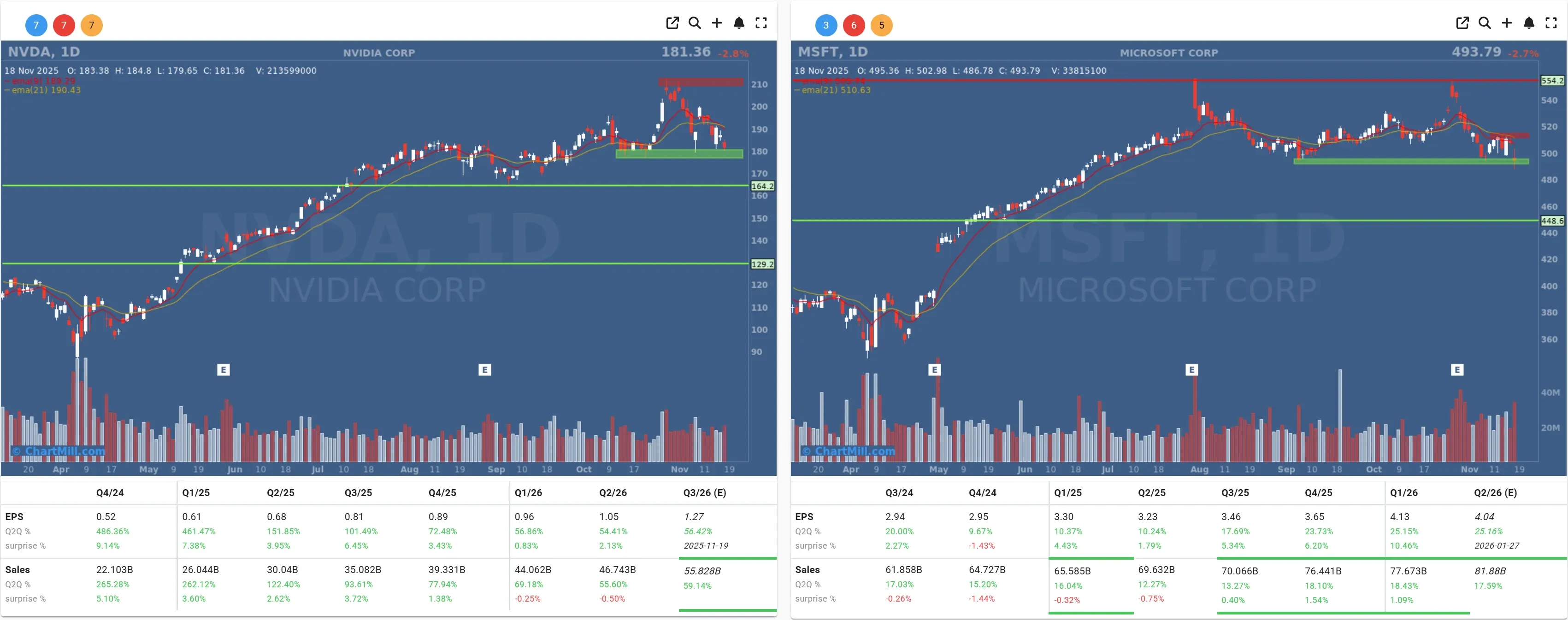

A new circular financing-and-spending loop involving Microsoft (MSFT | -2.7%) and Nvidia (NVDA | -2.81%), with AI startup Anthropic right in the middle. Anthropic reportedly ordered $30 billion worth of Azure compute - powered by Nvidia chips - while Microsoft and Nvidia simultaneously committed $15 billion in fresh investment into Anthropic.

Even for an industry that reinvented the word “hyperscale,” these deals are starting to look like everyone selling shovels to each other during the gold rush.

JPMorgan vice-chair Daniel Pinto echoed what many are thinking: a correction of at least 10% in AI names wouldn’t surprise him, and yes, such a pullback would inevitably drag the broader tech sector (and perhaps the entire market) with it.

That message was not lost on investors.

Markets Fall for a Fourth Straight Session

The Dow Jones slipped again, the Nasdaq followed, and the S&P 500 wasn’t spared either. With cash allocations at a multi-year low and equity exposure stretched to February-like highs, Bank of America warned the market is vulnerable if the Fed doesn’t deliver a rate cut next month.

And right now, the odds of a December cut are below 50%.

Thanks, government shutdown: the October jobs report will only be released Thursday, injecting more uncertainty into an already jittery market.

Crypto added its own fireworks - Bitcoin fell below $90,000 before clawing back to around $93,000 - while oil quietly climbed to the $60 region.

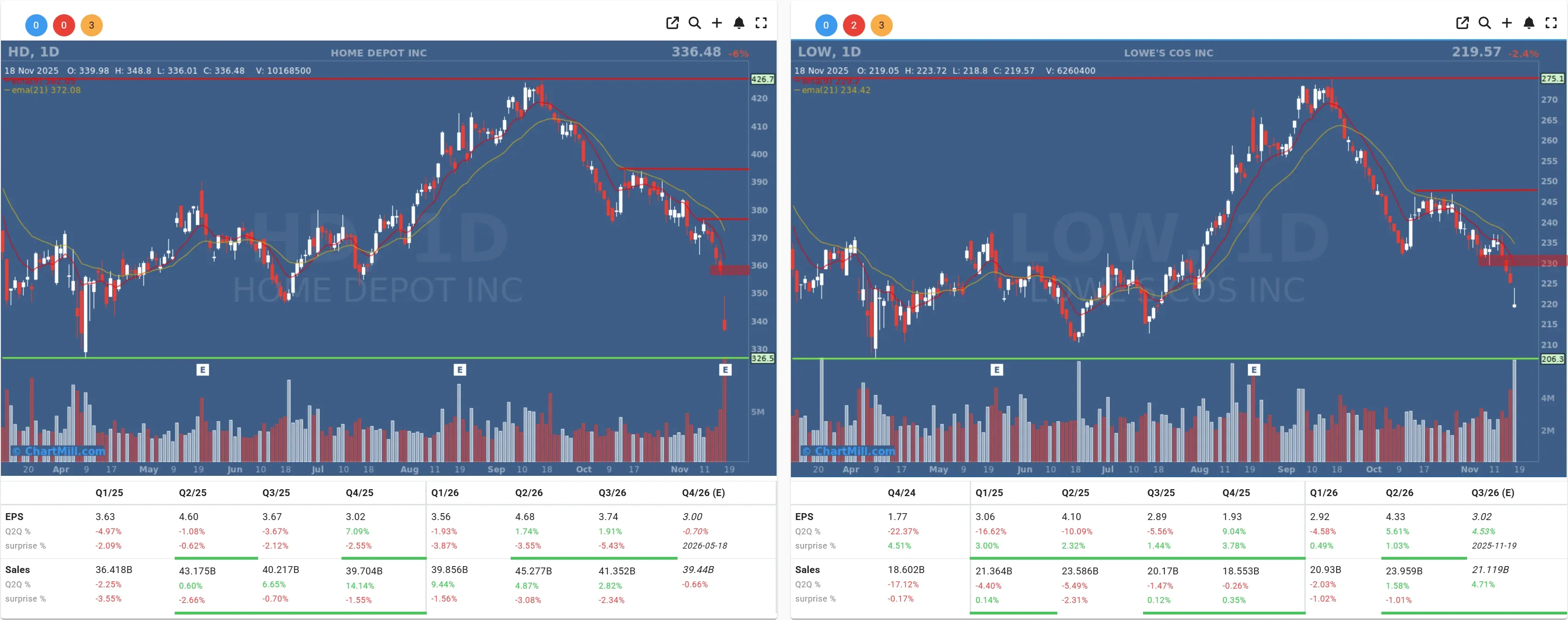

Home Depot Misses… and Blames the Weather

One of the more eyebrow-raising corporate explanations came from Home Depot (HD | -6.02%), which tumbled 6% after posting disappointing EPS:

-

Reported: $3.74

-

Expected: $3.84

But the real story was the guidance cut. Full-year EPS is now projected to fall 5%, compared to the previously expected 2% decline.

CEO Ted Decker pointed to a surprising culprit: “There were fewer storms than expected.”

As odd as that sounds, it’s true that hurricanes and storms historically boost demand for repair materials and equipment. But the company also admitted another issue, consumers are holding back on big-ticket purchases.

With Lowe’s (LOW | -2.41%) reporting today, we’re about to find out whether this is a Home Depot problem or a sector-wide one.

Nvidia Earnings: The Elephant in the Room

Tech dragged hard ahead of Wednesday’s highly anticipated earnings from Nvidia.

Not helping sentiment: news that billionaire investor Peter Thiel had sold his Nvidia shares. That alone knocked the stock earlier this week.

Meanwhile, other semiconductor names also struggled:

AMD (AMD | -4.25%), Marvell (MRVL | -5.72%), and Micron (MU | -5.56%) all posted declines between 4–6%.

Investors want answers. Specifically:

-

Are hyperscalers still buying GPUs at the same breakneck pace?

-

Is the rumored slowdown in China export-adjusted shipments real?

-

And most importantly: is peak AI enthusiasm behind us?

Tonight’s earnings will set the tone for the rest of the week, perhaps even the rest of the quarter.

Amazon and Microsoft Face EU Scrutiny

As if mega-cap tech needed more pressure, the EU announced an investigation into whether Amazon (AMZN | -4.43%) and Microsoft (MSFT | +0.00%) act as “gatekeepers” in cloud computing. Given their dominance with AWS and Azure, this storyline could linger.

Meta Platforms (META | -0.72%) caught a rare break: a U.S. court ruled the company did not violate antitrust laws with its acquisitions of WhatsApp and Instagram back in the early 2010s. Investors rewarded the stock with a comparatively modest decline.

Earnings to watch

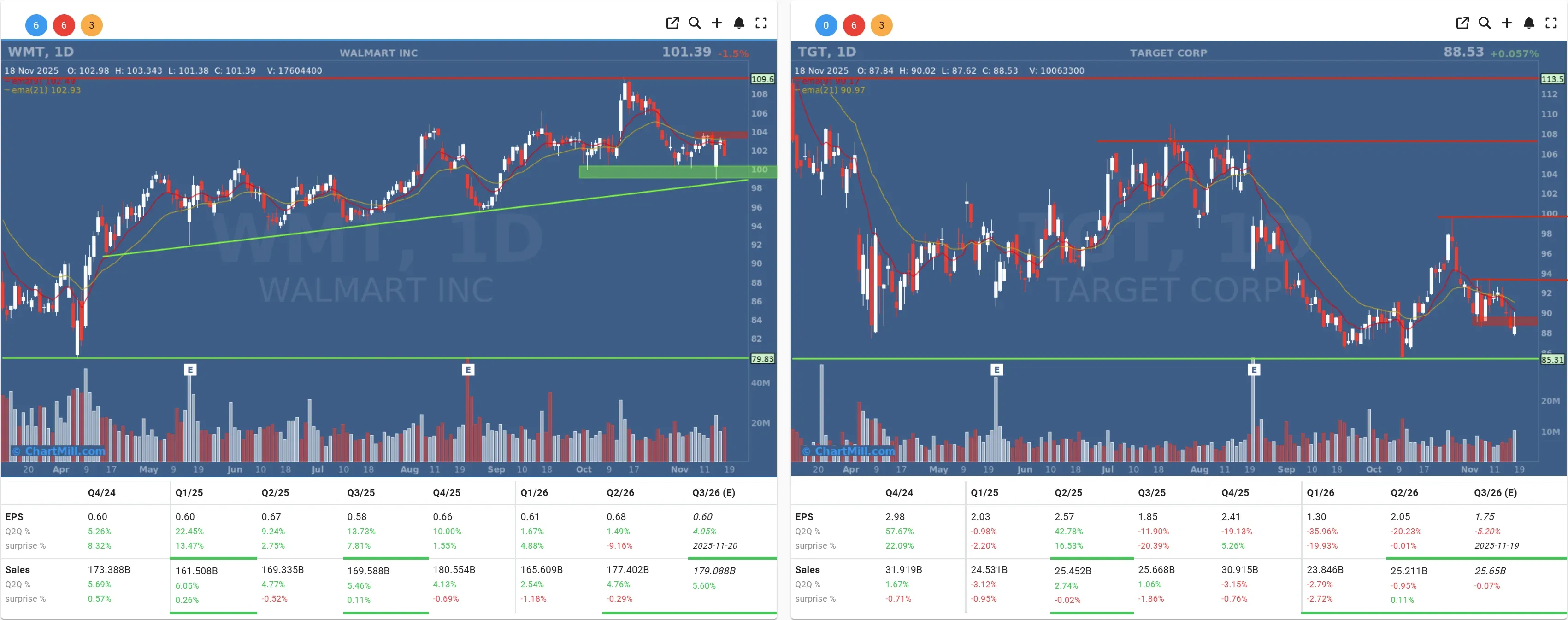

Retail heavyweights Walmart (WMT | -1.52%) and Target (TGT | +0.06%) report later this week, offering further clues about holiday-season consumer strength.

Macro Notes: Calm Data, Nervous Traders

A few macro data points trickled in yesterday:

-

Factory orders rose in August, exactly as expected.

-

Homebuilder sentiment showed only slight improvement - hardly enough to move the needle.

-

The EUR/USD pair dropped back below 1.16, closing near 1.1580.

-

The big catalysts remain Nvidia’s earnings tonight and Thursday’s delayed jobs report. Until then, markets seem content drifting lower.

Final Take

The market feels like it’s waiting for permission to pick a direction. Nvidia’s earnings will either calm the nerves or confirm the fear that AI has run too hot for too long.

As always, I’ll break down the numbers once they arrive, but for now, the theme is simple: AI euphoria is finally running into investor reality. And the next 48 hours will tell us how deep that reality check goes.

Kristoff - ChartMill

Next to read: Market Breadth Stabilizes, But Trend Remains Negative