DUOLINGO (DUOL) Stock Price, Forecast & Analysis

NASDAQ:DUOL • US26603R1068

DUOL Key Statistics, Chart & Performance

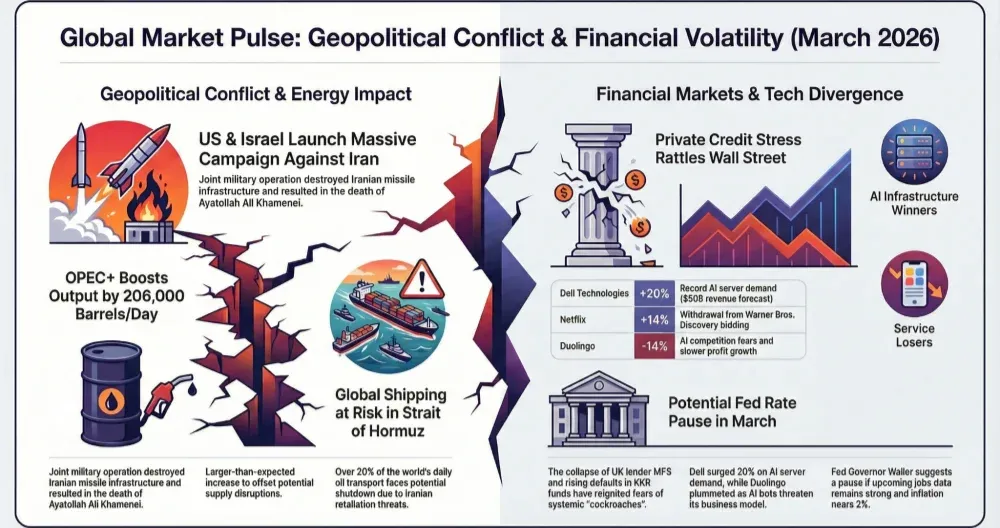

The current stock price of DUOL is 101 USD. In the past month the price decreased by -27.58%. In the past year, price decreased by -67.64%.

DUOL Technical Analysis

DUOL Fundamental Analysis

ChartMill assigns a fundamental rating of 6 / 10 to DUOL. While DUOL has a great health rating, its profitability is only average at the moment.

DUOL Financial Highlights

Over the last trailing twelve months DUOL reported a non-GAAP Earnings per Share(EPS) of 8.52. The EPS increased by 355.61% compared to the year before.

| Industry Rank | Sector Rank | ||

|---|---|---|---|

| PM (TTM) | 40.03% | ||

| ROA | 20.47% | ||

| ROE | 29.52% | ||

| Debt/Equity | 0 |

DUOL Forecast & Estimates

31 analysts have analysed DUOL and the average price target is 289.98 USD. This implies a price increase of 187.11% is expected in the next year compared to the current price of 101.

For the next year, analysts expect an EPS growth of -48.04% and a revenue growth 22.43% for DUOL

DUOL Ownership

DUOL Latest News, Press Relases and Analysis

DUOL Competitors/Peers

| Symbol | Company Name | Technical Rating | Fundamental Rating | FPE | Market Cap |

|---|---|---|---|---|---|

| LAUR | LAUREATE EDUCATION INC | 14.82 | 4.766B | ||

| GHC | GRAHAM HOLDINGS CO-CLASS B | 14.98 | 4.592B | ||

| LOPE | GRAND CANYON EDUCATION INC | 15.7 | 4.449B | ||

| BFAM | BRIGHT HORIZONS FAMILY SOLUT | 14.32 | 4.214B | ||

| LRN | STRIDE INC | 10.85 | 3.593B | ||

| ATGE | ADTALEM GLOBAL EDUCATION INC | 10.74 | 3.401B | ||

| CVSA | COVISTA INC | 10.68 | 3.382B | ||

| MH | MCGRAW HILL INC | 8.24 | 2.674B | ||

| PRDO | PERDOCEO EDUCATION CORP | 11.76 | 2.145B |

Related stock screener links

View all stocks in the Education Services Industry | View all stocks in the Consumer Discretionary Sector | View all stocks on the Nasdaq Exchange | Find stocks with similar TA and Setup ratings on the USA exchanges | Find stocks with similar Fundamental rating on the USA exchanges | Find the competitors with the best technical ratings on the USA exchanges | Find the competitors with the best fundamentals on the USA exchanges | Find the competitors with the best valuation on the USA exchanges | Find the competitors with the best dividend on the USA exchanges | Find the competitors with the best analyst ratings on the USA exchanges

About DUOL

Company Profile

Company Info

DUOLINGO

5900 Penn Ave, Second Floor

Pittsburgh PENNSYLVANIA US

CEO: Luis von Ahn

Employees: 830

Phone: 14123476116

DUOLINGO / DUOL FAQ

What does DUOL do?

Duolingo, Inc. is a language-learning website and mobile application, which engages in the development of a free language learning website and crowd sourced text translation platform. The company is headquartered in Pittsburgh, Pennsylvania and currently employs 830 full-time employees. The company went IPO on 2021-07-28. The firm is engaged in offering a mobile learning platform, as well as a digital English language proficiency assessment exam. The company operates a freemium business model, namely, the app and the Website are accessible free of charge, although Duolingo also offers premium services for a subscription fee. Its solutions consist of the Duolingo App, Super Duolingo, Duolingo Max, Duolingo English Test: AI-Driven Language Assessment, Duolingo for Schools, and Duolingo ABC. The Duolingo App offers courses in over 40 different languages, including Spanish, English, French, German, Italian, Portuguese, Japanese and Chinese. Duolingo can also be accessed on desktop computers via a Web browser. Its subscription offering, Super Duolingo, offers learners additional features to enhance their learning experience. The Duolingo English Test is an online, on-demand, high-stakes English proficiency assessment. The company also operates an animation and motion design studio.

Can you provide the latest stock price for DUOLINGO?

The current stock price of DUOL is 101 USD. The price decreased by -14.01% in the last trading session.

What is the dividend status of DUOLINGO?

DUOL does not pay a dividend.

How is the ChartMill rating for DUOLINGO?

DUOL has a ChartMill Technical rating of 0 out of 10 and a ChartMill Fundamental rating of 6 out of 10.

Is DUOLINGO (DUOL) expected to grow?

The Revenue of DUOLINGO (DUOL) is expected to grow by 22.43% in the next year. Check the estimates tab for more information on the EPS, Sales, EBIT and EBITDA future analyst estimates.

Can you provide the market cap for DUOLINGO?

DUOLINGO (DUOL) has a market capitalization of 4.67B USD. This makes DUOL a Mid Cap stock.

Can you provide the upcoming earnings date for DUOLINGO?

DUOLINGO (DUOL) will report earnings on 2026-04-29, after the market close.