The investment philosophy of Peter Lynch, the famous manager of the Fidelity Magellan Fund, focuses on locating well-run, expanding companies available at fair prices, a strategy often called Growth at a Reasonable Price (GARP). Lynch supported a long-term, buy-and-hold method, concentrating on companies with durable earnings expansion, sound financial condition, and appealing prices compared to their expansion potential. His process, outlined in his book One Up on Wall Street, employs particular quantitative filters to find possible choices, highlighting items like a steady earnings expansion rate, a small debt amount, high earnings, and an attractive valuation measure called the PEG ratio.

One company that presently emerges from a filter using Lynch's main standards is WILLIAMS-SONOMA INC (NYSE:WSM). The home furnishings seller, recognized for names like Williams Sonoma, Pottery Barn, and West Elm, seems to match several important parts of the Lynch investment philosophy. We will look at how WSM compares to the particular filters and what that could mean for long-term investors looking for growth at a fair price.

Reviewing the Lynch Standards

A typical Peter Lynch filter searches for companies that show durable expansion, financial soundness, and attractive price. Here is how Williams-Sonoma compares to these important measures:

- Durable Earnings Expansion: Lynch looked for companies with a confirmed history of expansion, but he was cautious of extreme expansion that could not continue. The filter needs a 5-year earnings per share (EPS) expansion rate between 15% and 30%. WSM's EPS has expanded at a notable average yearly rate of 29.28% over the last five years, putting it at the higher end of Lynch's chosen range. This shows a solid and steady historical expansion path.

- Price Accounted for by Expansion (PEG Ratio): Maybe the central part of Lynch's price method is the PEG ratio, which matches a stock's Price-to-Earnings (P/E) ratio to its earnings expansion rate. A PEG ratio of 1 or less implies the market may be pricing the stock's expansion potential too low. WSM's PEG ratio, using its past five-year expansion, is 0.71. This sits well below Lynch's limit, meaning that even with its high historical expansion rate, the stock's present price may not completely show its earnings ability.

- Sound Financial Condition (Debt/Equity): Lynch preferred companies with very little debt, thinking it gave a safety buffer in economic declines. His firm choice was for a Debt-to-Equity ratio below 0.25. WSM does very well here, stating a Debt/Equity ratio of 0.0, meaning it functions with no interest-bearing debt on its balance sheet. This outstanding financial situation gives notable stability.

- Sufficient Liquidity (Current Ratio): To make sure a company can meet its near-term duties, Lynch wanted a Current Ratio of at least 1. WSM's Current Ratio of 1.43 means it has enough current assets to pay for its current liabilities, meeting this basic check of liquidity.

- High Earnings (Return on Equity): Lynch needed a high Return on Equity (ROE) to find management teams that are good at creating profits from shareholder money. The filter sets a lowest ROE of 15%. WSM's ROE of 53.45% is exceptional, greatly passing the need and implying very efficient use of equity capital.

Basic Condition and Expansion Picture

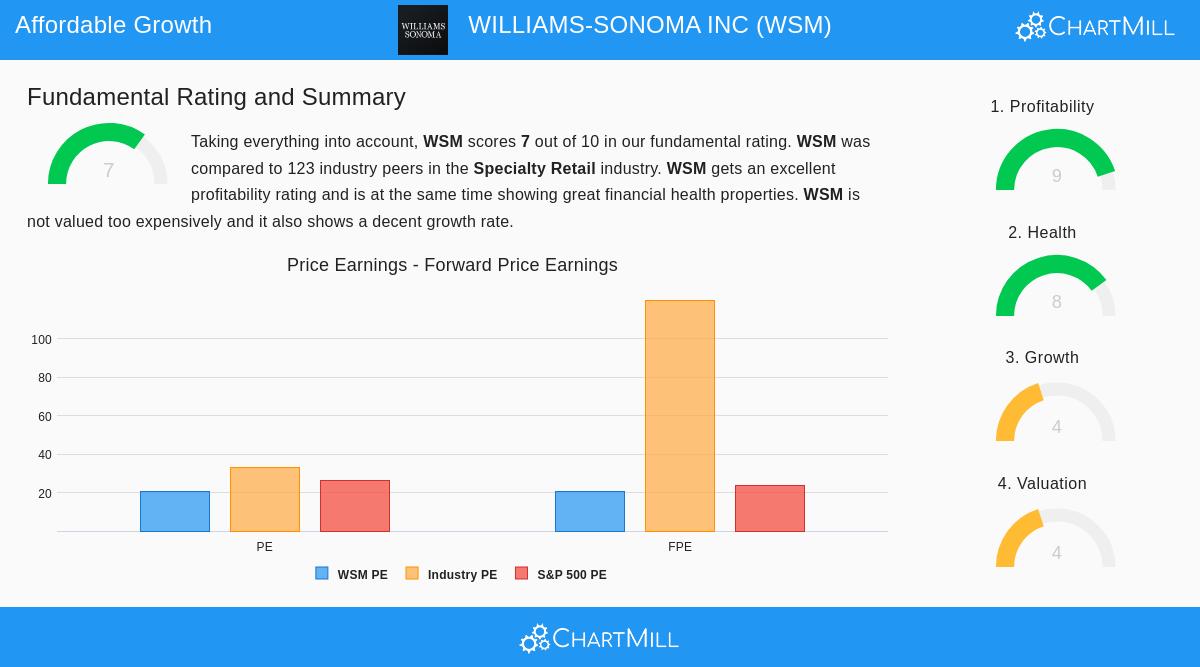

Beyond the specific filter settings, a wider view of Williams-Sonoma's basic report shows a company in good condition. The company gets a high total basic rating of 7 out of 10. Its earnings are rated as outstanding (9/10), led by sector-topping margins and returns on assets and invested capital. Financial condition is also solid (8/10), helped by the debt-free balance sheet and a firm Altman-Z score meaning low bankruptcy risk.

The expansion view is mixed. While past expansion has been excellent, analyst forecasts for future EPS and sales expansion are more limited, in the mid-single-digit percentages. This fits with Lynch's focus on durable, not extreme, long-term expansion. The price rating is neutral (4/10), with a P/E ratio that seems high alone but becomes more appealing when considered with the company's expansion and exceptional earnings, as shown by the low PEG ratio.

You can see the full, detailed basic examination for WILLIAMS-SONOMA INC (NYSE:WSM) here.

Match with the GARP Philosophy

For investors looking for growth at a fair price, Williams-Sonoma offers a strong example. It represents the Lynch idea of investing in clear businesses, a multi-brand seller in the home area. Its numbers meet the important points: a shown history of solid earnings expansion, a price that seems fair when expansion is considered (PEG < 1), and a very strong balance sheet with no debt. The high ROE means a profitable business model, and the company's direct-to-customer focus has shown strength. While future expansion is predicted to become normal, the company's financial soundness and earnings give a buffer and the chance for continued shareholder gains through dividends and share repurchases.

Locating More Possible Choices

Williams-Sonoma is one instance of a company that passes a filter created on Peter Lynch's structured standards. Investors curious about finding other companies that fit this GARP-focused profile can run the filter themselves.

You can find the whole Peter Lynch strategy filter and its present outcomes here.

Disclaimer: This article is for information only and does not form financial guidance, a support, or a suggestion to buy, sell, or hold any security. The examination uses publicly available information and a particular investment strategy model. Investors should do their own complete study and think about their personal financial situation and risk comfort before making any investment choices.