WILLIAMS-SONOMA INC (NYSE:WSM) stands out as a potential fit for investors seeking long-term growth at a reasonable price. The company meets key criteria from Peter Lynch’s investment strategy, combining solid earnings growth, strong profitability, and a healthy financial position. Below, we examine why WSM could be worth considering for a diversified portfolio.

Key Strengths of WSM

- Earnings Growth: Over the past five years, WSM has delivered an impressive average EPS growth of 29.28%, well above the minimum 15% threshold in Lynch’s strategy. This indicates sustained profitability.

- Strong Return on Equity (ROE): With an ROE of 52.52%, the company ranks among the top performers in its industry, reflecting efficient use of shareholder capital.

- Healthy Balance Sheet: WSM carries no debt, a rare and positive trait that reduces financial risk. Its current ratio of 1.44 also suggests sufficient liquidity to cover short-term obligations.

- Reasonable Valuation: While the P/E ratio of 19.26 is slightly above the market average, it remains reasonable relative to the company’s growth and profitability.

Fundamental Analysis Summary

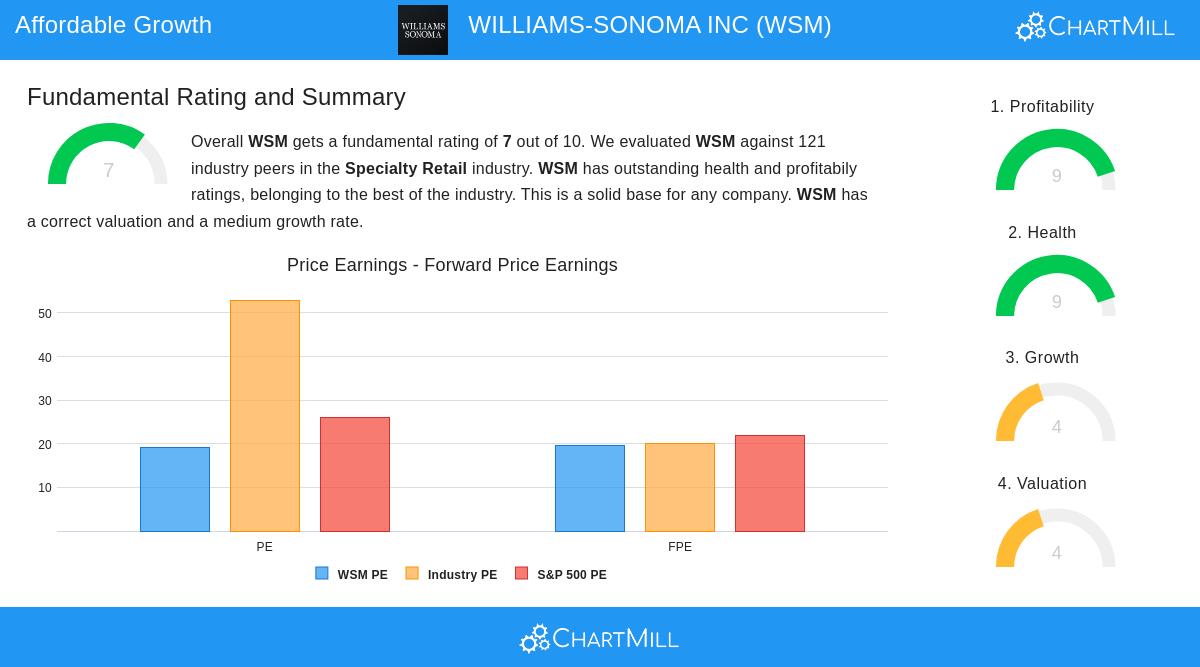

WSM earns a fundamental rating of 7 out of 10, with standout scores in profitability (9/10) and financial health (9/10). The company excels in margins, with operating and profit margins well above industry peers. However, revenue growth has slowed recently, and future EPS growth is projected at a more modest 7.32%.

For a deeper look, review the full fundamental analysis report here.

Why WSM Fits the GARP Approach

Growth at a reasonable price (GARP) investors prioritize companies with consistent earnings expansion, strong financials, and valuations that don’t overpay for growth. WSM’s combination of high ROE, debt-free balance sheet, and historical earnings growth aligns well with this strategy. While future growth may moderate, the company’s fundamentals suggest resilience.

Our Peter Lynch Strategy screener lists more stocks that meet these criteria and is updated regularly.

Disclaimer

This is not investing advice. The observations here are based on data available at the time of writing. Always conduct your own research before making investment decisions.