The investment philosophy created by Peter Lynch focuses on finding companies with good growth potential that are available at fair prices, a method often called Growth at a Reasonable Price (GARP). Lynch's system, described in his book One Up on Wall Street, uses fundamental analysis to locate businesses with lasting earnings growth, good financial condition, and acceptable debt, which he thought could result in significant long-term gains. This method does not use speculative market timing, instead focusing on the inherent characteristics of a company that can provide steady results over many years. A stock screener using his rules can help investors find these companies by searching for particular financial measures that signal quality and value.

Meeting the Lynch Criteria

Urban Outfitters Inc (NASDAQ:URBN) seems to fit several important filters from the Peter Lynch screen. The method favors companies that are increasing their earnings in a lasting way, are making money, and are not priced too high, which helps in creating a durable long-term portfolio. URBN's financial numbers show a good fit across these areas.

- Sustainable Earnings Growth: Lynch preferred companies with earnings per share (EPS) growth from 15% to 30% each year over five years, thinking growth outside these limits was often not maintainable. URBN has a five-year EPS growth rate of 15.50%, putting it directly within Lynch's desired range for constant, dependable growth.

- Reasonable Valuation via PEG Ratio: A key part of the Lynch method is the Price/Earnings to Growth (PEG) ratio, which should be 1 or lower. This measure confirms that the stock's price is not too high compared to its earnings growth. URBN's PEG ratio of 0.82 suggests the market might be pricing its growth path too low, a good indicator for investors looking for value.

- Strong Profitability with High ROE: Lynch searched for a Return on Equity (ROE) over 15% as an indicator of capable management and good profitability. URBN’s ROE of 18.42% is well above this level, indicating the company is good at creating earnings from shareholder equity.

- Exceptional Financial Health: The screen looks for a Debt/Equity ratio under 0.6, with Lynch personally liking a ratio below 0.25. URBN does very well here with a Debt/Equity ratio of 0, showing no debt and a very strong balance sheet. Also, its Current Ratio of 1.48 indicates it has sufficient short-term assets to pay its short-term obligations, meeting the screen's requirement for liquidity.

Fundamental Analysis Overview

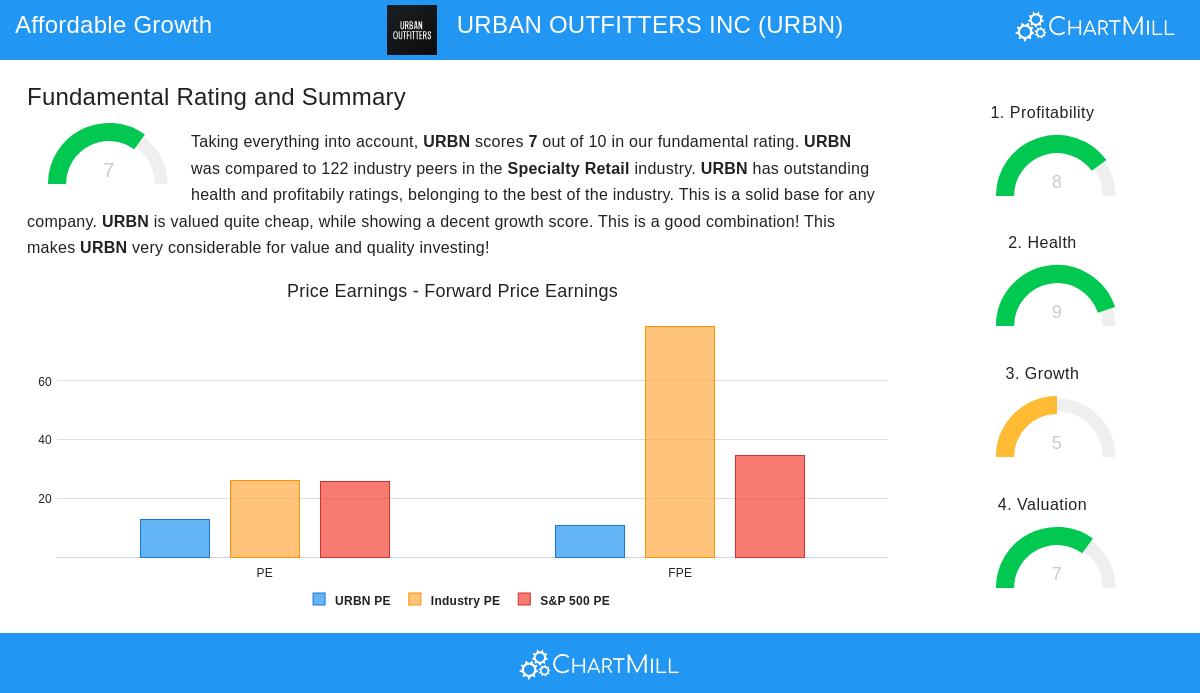

A more detailed examination of the fundamental analysis report for URBN supports the results from the Lynch screen. The company gets a good overall fundamental rating of 7 out of 10. Its financial health and profitability scores are especially high, rated very well in the Specialty Retail industry. The stock price is considered inexpensive, particularly next to wider market measures, while the company continues to display acceptable growth. This mix of high quality, fair price, and constant growth creates a good base for the GARP investing method.

Business Model and Market Position

Urban Outfitters Inc runs a retail business with several brands and sales methods, including well-known stores such as Anthropologie, Free People, FP Movement, and its own Urban Outfitters brand. Its activities are split into Retail, Wholesale, and a more recent Subscription part through its Nuuly clothing rental service. This variety across brands and sales methods, including physical stores, online sales, and a developing subscription model, offers several ways to earn money and helps protect the business from changes in what customers want. The company's attention to specific lifestyle brands lets it build dedicated customer groups, a trait Lynch often liked in "ordinary" but easy-to-understand businesses.

A Starting Point for Further Research

The Peter Lynch screen is made to create a small list of interesting companies, not to give a final signal to purchase. URBN's success in passing the screen’s filters makes it a good option for more detailed investigation. Investors should study the company's competitive situation, the long-term potential of its Nuuly subscription service, and its plans for operating in the wider retail market. For those wanting to look at other companies that fit this careful method, you can view the complete Peter Lynch screen results here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented should not be used as the sole basis for any investment decision. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.