Known for his philosophy of investing in what you know, Peter Lynch looked for companies with consistent earnings growth, low debt, and a competitive edge. Does TOLL BROTHERS INC (NYSE:TOL) meet these key criteria? Let’s find out.

Evaluating TOLL BROTHERS INC (NYSE:TOL) using Peter Lynch’s legendary strategy

- TOL has a healthy Return on Equity(ROE) of 19.36%. This demonstrates the company's efficient utilization of capital and indicates its commitment to driving profitability.

- With a Debt/Equity ratio of 0.35, TOL demonstrates prudent financial management.

- TOL has experienced 27.96 growth in EPS over a 5-year period, demonstrating its ability to generate sustained and positive earnings momentum.

- A PEG ratio of 0.28 positions TOL as a well-valued growth stock in today’s market.

- TOL’s Current Ratio of 3.83 highlights its ability to sustain day-to-day operations without liquidity concerns.

Fundamental Analysis Observations

As part of its analysis, ChartMill provides a comprehensive Fundamental Rating for each stock. This rating, ranging from 0 to 10, is updated on a daily basis and is based on the evaluation of various fundamental indicators and properties.

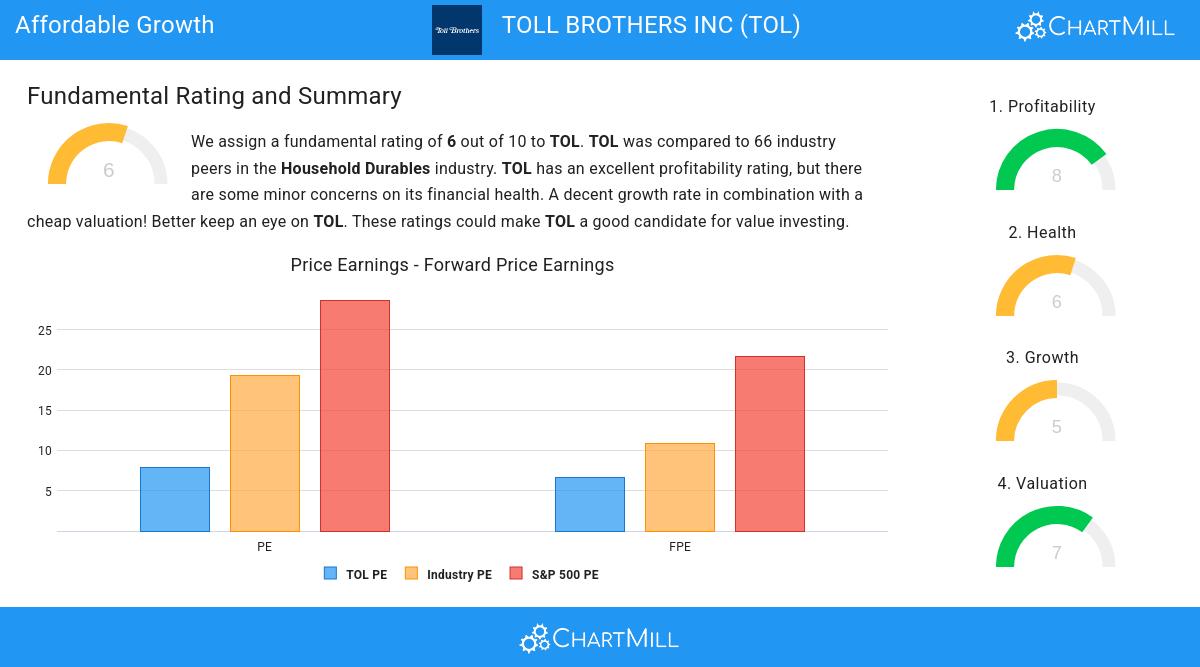

TOL gets a fundamental rating of 6 out of 10. The analysis compared the fundamentals against 66 industry peers in the Household Durables industry. While TOL has a great profitability rating, there are some minor concerns on its financial health. A decent growth rate in combination with a cheap valuation! Better keep an eye on TOL. This makes TOL very considerable for value investing!

Check the latest full fundamental report of TOL for a complete fundamental analysis.

Every day, new Affordable Growth stocks can be found on ChartMill in our Peter Lynch screener.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.