For long-term investors looking for a systematic way to choose stocks, few methods are as respected as Peter Lynch’s approach. The famous manager of the Fidelity Magellan Fund supported investing in familiar companies, concentrating on firms with clear operations, steady expansion, and good finances. His system is frequently called a "growth at a reasonable price" (GARP) method, which steers clear of pure speculation and deep-value picks. It looks for companies increasing earnings at a good rate, typically between 15% and 30% each year, while trading at prices that do not overvalue that future outlook. Important measures include a low price-to-earnings-to-growth (PEG) ratio, good profitability shown by return on equity (ROE), and a solid balance sheet with little debt.

One firm that recently appeared from a filter using these Lynch ideas is Paycom Software Inc (NYSE:PAYC). The Oklahoma City-based supplier of cloud-based human capital management (HCM) software seems to match several central parts of the method, offering a case for review by GARP-oriented investors.

Matching the Lynch Standards

A Peter Lynch filter usually looks for companies with a particular mix of expansion, price, and financial soundness. Paycom’s present numbers show a good match across several of these quantitative checks.

- Steady Earnings Expansion: Lynch preferred companies with solid, but not extreme, past growth, thinking very high rates cannot last. Paycom’s five-year average annual EPS growth of 18.56% fits well within the often-mentioned Lynch span of 15% to 30%. This shows a record of reliable, better-than-average increase without entering a zone of very high growth that might be hard to continue.

- Sensible Price Compared to Growth: Maybe the central part of the Lynch method is the PEG ratio, which measures a stock's price-to-earnings (P/E) ratio against its earnings growth rate. A PEG at or under 1.0 implies the market may not be paying too much for the company's growth path. Paycom’s PEG ratio, using its past five-year growth, is 0.96, meeting this important standard for a sensible price.

- Strong Profitability: Lynch searched for companies that are good at creating profits from shareholder equity. A high ROE is a sign of a good business. Paycom’s ROE of 26.51% is much higher than the 15% minimum often linked to the filter, showing better profitability and efficient use of capital.

- Cautious Financial Soundness: To limit risk, Lynch stressed strong balance sheets. He liked companies financed more by equity than debt, often looking for a debt-to-equity ratio below 0.6. Paycom does very well here with a debt-to-equity ratio of 0.0, meaning it functions with no interest-bearing debt. Its current ratio of 1.22 also shows enough short-term cash to meet responsibilities, passing another basic financial health test.

A Broad Fundamental Look

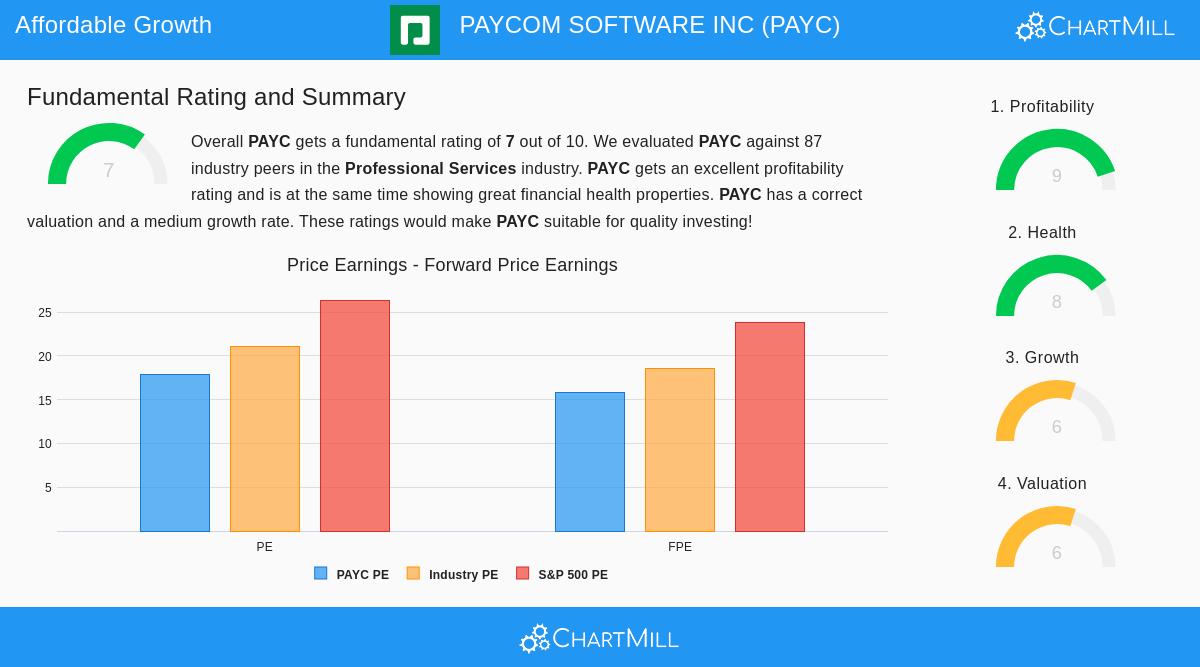

Beyond the specific filter checks, a wider view of Paycom’s fundamental picture supports its position as a high-quality company. According to Chartmill’s detailed fundamental report, which gives PAYC a rating of 7 out of 10, the company’s advantages are clear in two main areas.

First, its profitability is outstanding, getting a score of 9. The company has industry-best margins, including a gross margin above 82% and an operating margin close to 28%. Its returns on assets, equity, and invested capital (ROIC of 19.27%) all place in the highest group of its Professional Services industry competitors, confirming the efficiency and profit generation of its software-as-a-service business model.

Second, the company’s financial soundness is strong, scoring an 8. The lack of debt is a key factor, giving notable stability and options. While its current and quick ratios are average compared to some competitors, the report states this is offset by very good solvency and profitability, and might be viewed considering its specific business model. The company has also been lowering its share count through buybacks, a practice Lynch liked.

The report views price as "correct" and growth as "medium." The forward P/E ratio is seen as sensible compared to both the industry and the wider market. While future revenue and earnings growth are predicted to slow from past levels, the estimated rates remain good, supporting the GARP idea of ongoing, steady expansion.

The Lynch Idea in Use

Paycom’s business model itself fits with the non-quantitative parts of Lynch’s thinking. The company offers a single, cloud-based system for payroll, HR, talent management, and time tracking—services that are essential and "clear" for businesses of different sizes. While not a trendy consumer name, it works in the important, repeating-income area of enterprise software, solving ordinary but critical administrative tasks. This matches Lynch’s liking for companies in commonplace but needed fields that can build earnings over years.

For investors who value the ideas of lasting growth, sensible price, and financial strength, a company like Paycom Software deserves further study. It shows the kind of business a Peter Lynch filter is made to find: one with a established history of profitability, a clear balance sheet, and a price that does not require flawless execution to do well.

You can review the complete Peter Lynch filter and view other companies that currently meet its checks here: Peter Lynch Strategy Stock Screener.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented is based on data provided and should not be the sole basis for an investment decision. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.