Investors looking for growth chances often use both fundamental and technical analysis to find stocks with good business foundations that are also displaying positive price movements. This method helps them locate firms with high growth potential, strong earnings, and sound finances that are at the same time moving out of technical holding patterns, possibly indicating the start of a new rising trend. By concentrating on stocks that show both fundamental quality and technical momentum, investors try to identify companies set for continued price increases.

PAYCOM SOFTWARE INC (NYSE:PAYC) offers a relevant example for this investment strategy. The company delivers cloud-based human capital management tools that assist businesses in handling the full employee cycle using one database system. This Oklahoma City-based company has made a name for itself in the competitive HR technology field with its full-featured software-as-a-service platform.

Fundamental Strength Evaluation

The fundamental examination shows why PAYC meets the criteria as a solid growth possibility. Based on the fundamental analysis report, PAYC receives a total score of 7 out of 10, with notable performance in multiple important categories:

-

High Profitability: The company gets a 9/10 for profitability, with margin levels that are better than most similar companies

- Operating Margin of 28.10% is higher than 93.90% of professional services firms

- Return on Invested Capital of 18.87% is in the top 11% of the field

- Profit Margin of 21.21% is better than 92.68% of rivals

-

Sound Financial Condition: PAYC holds a 9/10 health score with no debt

- A position of no debt offers financial options and lowers risk

- Steady share reduction shows belief in future business

- Good Altman-Z score of 4.84 points to very low bankruptcy chance

-

Steady Growth Path: The growth score of 7/10 shows ongoing expansion

- Revenue has increased 20.62% per year over recent years

- Earnings Per Share has risen 18.56% yearly on average

- Future EPS growth is estimated at 12.55% per year

These fundamental traits match well with growth investment ideas, as firms with high profitability, clear balance sheets, and steady growth often provide better long-term results.

Technical Pattern Examination

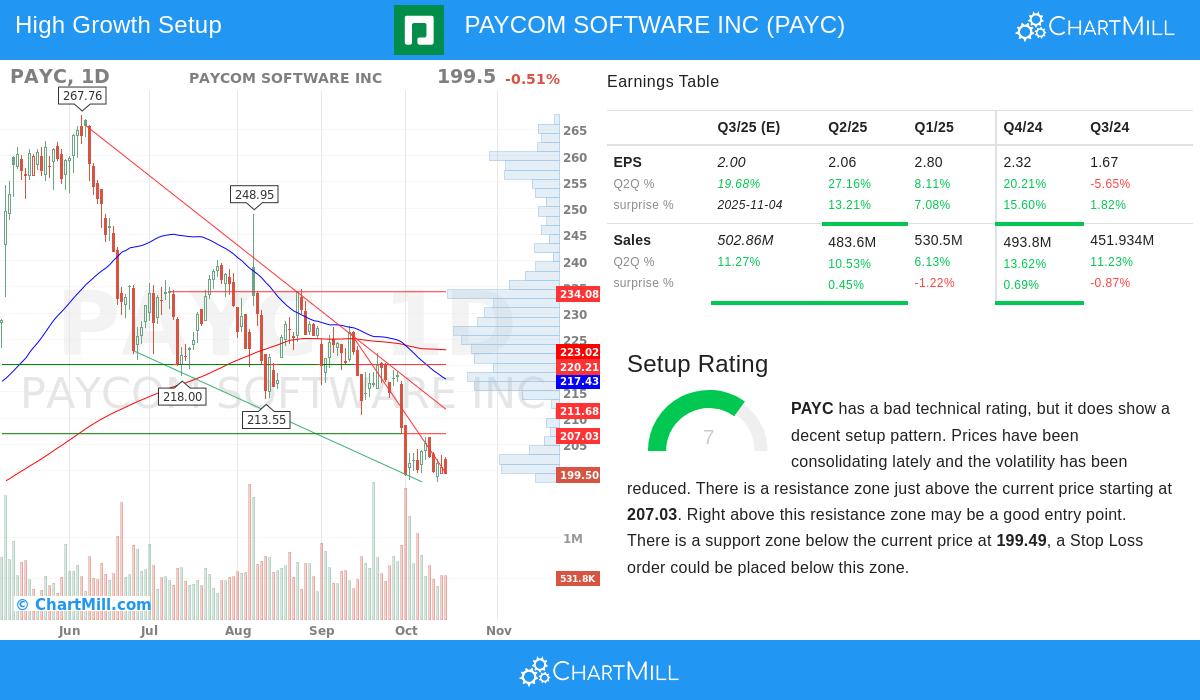

The technical view supports the good fundamental background. PAYC's technical analysis report shows the stock is currently moving within a set area while having a setup score of 7 out of 10. This formation frequently comes before notable price changes.

Important technical points are:

- The stock is priced between a floor at $199.49 and a ceiling starting at $207.03

- Lower price swings during this period suggest energy is building for a possible upward move

- A move past the $207.03 ceiling could indicate the beginning of a new rising trend

- The bear flag formation mentioned in the technical report might offer a reversal chance if the price moves upward

This technical pattern is especially interesting considering the stock's 20% increase over the last twelve months, showing basic strength even during sideways movement.

Growth Investment Viewpoint

From a growth investment angle, PAYC displays multiple features that growth investors usually want. The company works in the growing HR technology industry, serving a wide range of businesses that need complete human capital management tools. Their cloud-based platform meets an increasing demand for unified HR systems, placing them well in a sector going through digital change.

The company's financial numbers support the growth story, with high returns on capital showing effective use of money to create earnings. The absence of debt gives plenty of room to follow more growth projects without the pressure of interest costs or refinancing concerns.

Investment Points

While PAYC displays positive features, investors should be aware that the stock has valuation points that some may view as high. The Price/Earnings ratio of 22.54 is close to industry averages but represents hopes for ongoing growth. The company's very good profitability and estimated earnings growth above 12% could support these valuation levels for investors focused on growth.

The technical pattern indicates that a move above the $207 resistance point could offer a good entry position, with close support near $199 giving a possible stop-loss guide. This setup with defined risk, paired with good fundamentals, forms an interesting possibility for investors using a mixed fundamental and technical method.

For investors wanting to find similar possibilities, more stocks fitting these standards are available through this Strong Growth Stocks with Good Technical Setup Ratings screen.

Disclaimer: This examination is for information only and is not investment advice, a suggestion, or a support of any security. Investors should perform their own research and think about their financial position, risk comfort, and investment goals before making any investment choices.