When looking for reliable dividend-paying stocks, investors often use screening methods that weigh several basic factors. The method applied here finds companies with good dividend traits while keeping acceptable profit generation and financial condition. This tactic helps steer clear of high-yield situations where unmaintainable payments hide basic business problems, instead concentrating on companies with steady dividend records, acceptable payout ratios, and firm operational bases that back ongoing payments.

Dividend Profile Evaluation

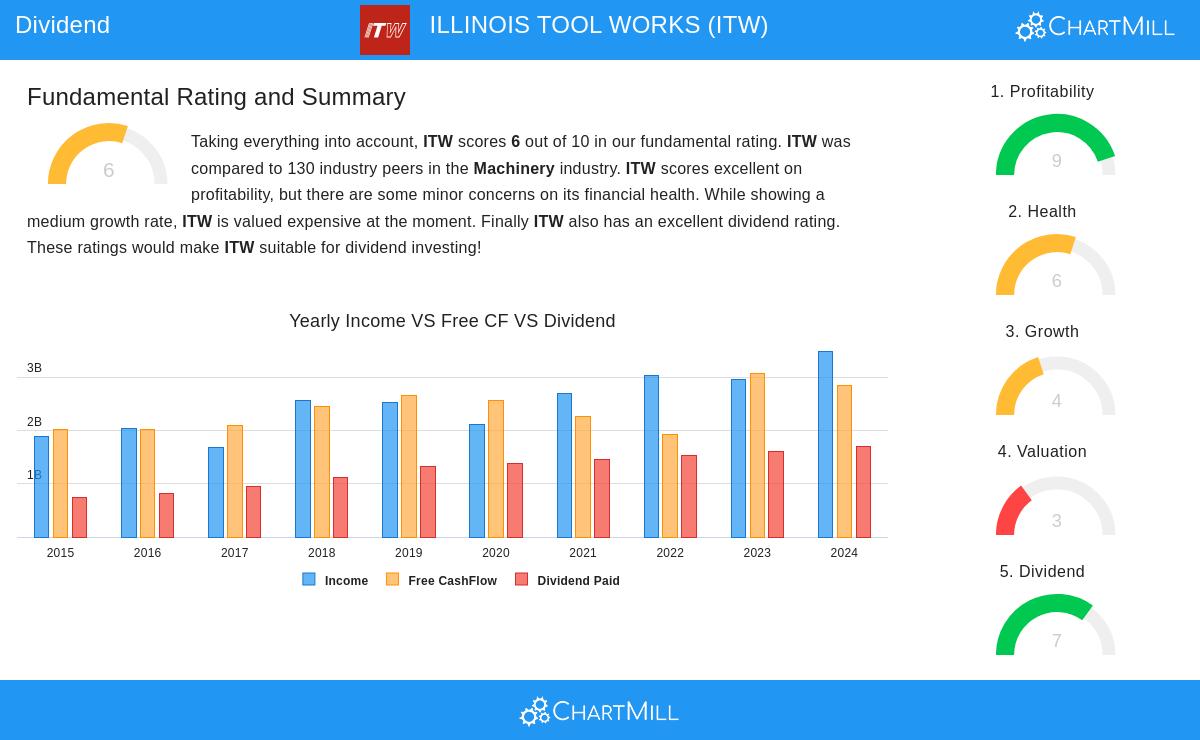

Illinois Tool Works (NYSE:ITW) makes a strong case for dividend-focused investors, receiving a ChartMill Dividend Rating of 7 out of 10. The company displays a number of traits that dividend investors usually look for:

- Dividend Yield: At 2.64%, ITW provides a yield that is higher than the industry average of 1.83% and matches the S&P500 average of 2.40%

- Dividend Growth: The company has kept up a notable yearly dividend growth rate of 6.98% with a dependable history of not lowering dividends for a minimum of ten years

- Payout Sustainability: With 51.65% of earnings used for dividends, the payout ratio is at a workable level that indicates it can be maintained and allows for funds to be put back into the business

The mix of a better-than-average yield and steady growth makes ITW especially interesting for investors wanting both present income and future dividend increases, meeting the main goals of dividend investment approaches.

Profitability Base

Backing the dividend narrative is ITW's excellent profit generation, shown by a ChartMill Profitability Rating of 9. Good profit generation supplies the earnings base needed to continue and increase dividend payments over the long term:

- Return Measures: The company delivers excellent returns with ROA of 20.97%, ROE of 104.83%, and ROIC of 23.99%, all placing in the highest groups within the machinery industry

- Margin Performance: Operating margin of 25.98% and profit margin of 21.31% show effective operations and the ability to set prices

- Historical Steadiness: ITW has reported positive earnings and operating cash flow for the last five years

These profit measures point to a business able to create enough cash flow to pay for both operational requirements and shareholder returns, a key factor for dividend continuity.

Financial Health Review

ITW's ChartMill Health Rating of 6 shows a mostly firm financial standing with some points to watch. For dividend investors, financial health confirms the company can handle economic ups and downs without reducing dividend payments:

- Solvency Position: An Altman-Z score of 7.90 shows very low bankruptcy danger, and a debt-to-FCF ratio of 3.28 points to acceptable debt amounts

- Liquidity Status: Current and quick ratios of 1.59 and 1.15 each offer sufficient short-term financial room to maneuver

- Capital Framework: A debt-to-equity ratio of 2.78 shows increased borrowing, although this is still lower than industry peers

While the higher debt levels deserve notice, the company's good cash flow creation and profit generation offer assurance about its capacity to handle its debts while continuing dividends.

Growth and Valuation Perspective

The company indicates moderate but speeding up growth possibilities, with projected EPS growth of 7.83% and revenue growth of 3.58% per year. Valuation shows a varied image, with P/E ratios a bit above industry averages but supported by the company's outstanding profit generation and dividend traits. For dividend investors centered on long-term income creation, ITW's fair valuation multiples and bettering growth path present a balanced risk-return situation.

Detailed Examination

For investors wanting a thorough basic evaluation of Illinois Tool Works, the full fundamental analysis report provides more depth into all rating parts and their fundamental causes.

Investors wishing to look into similar dividend possibilities can examine more screening outcomes that use similar dividend, profitability, and health criteria to find potential options for more study.

This article offers factual examination using data available to the public and is not meant as investment guidance. Investors should perform their own investigation and think about their personal money situation before making investment choices. Past results do not assure future outcomes, and dividend payments can adjust based on company performance and board choices.