For investors aiming to assemble a portfolio of durable, lasting businesses, the quality investing method provides a structured system. This system centers on finding companies with durable competitive strengths, reliable earnings, and sound financial condition, with the plan of owning them for an extended period. One useful instrument for this hunt is the "Caviar Cruise" stock filter, which selects for measurable signs of quality like high returns on capital, good cash flow production, and a record of earnings growth. A recent run of this filter has identified The Hershey Co. (NYSE:HSY) as a candidate for further review.

A Profile of Profitable Stability

Hershey is widely known as a leading player in the North American candy market, with famous brands like Hershey's, Reese's, and Kisses. The company has moved into savory snacks by buying brands like SkinnyPop and Dot's Homestyle Pretzels, broadening its sources of income. This brand recognition offers a basic competitive edge, often leading to the ability to raise prices and customer retention, important intangible qualities valued by quality investors.

Meeting the Caviar Cruise Criteria

The Caviar Cruise filter uses several strict financial tests to find quality candidates. Hershey's present measurements indicate a good fit with these central ideas:

- High Return on Invested Capital (ROIC): A key part of quality investing, ROIC calculates how well a company produces earnings from its capital. The filter demands a ROIC (leaving out cash, goodwill, and intangibles) over 15%. Hershey performs well here, with a number of 39.09%, showing very good efficiency and a durable economic advantage.

- Solid and Improving Earnings: The method looks for companies where earnings growth is faster than sales growth, a sign of better operational effectiveness. While Hershey's 5-year sales CAGR is a moderate 3.25%, its 5-year EBIT (earnings before interest and taxes) CAGR is a sound 11.34%. This difference shows Hershey's capacity to widen its earnings margins considerably over time.

- Careful Financial Management: Quality companies should not carry too much debt. The filter employs a Debt-to-Free Cash Flow ratio below 5, meaning the company could pay off all debt with under five years of cash flow. Hershey's ratio of 3.05 falls well within this acceptable range, showing a reasonable debt level.

- High-Quality Earnings: The "Profit Quality" measure contrasts free cash flow with net income, revealing how much reported profit becomes actual, usable cash. A 5-year average over 75% is needed. Hershey's average of 97.13% is very high, meaning almost all its stated profits become cash, a signal of financial soundness and less chance of accounting issues.

Fundamental Health Check

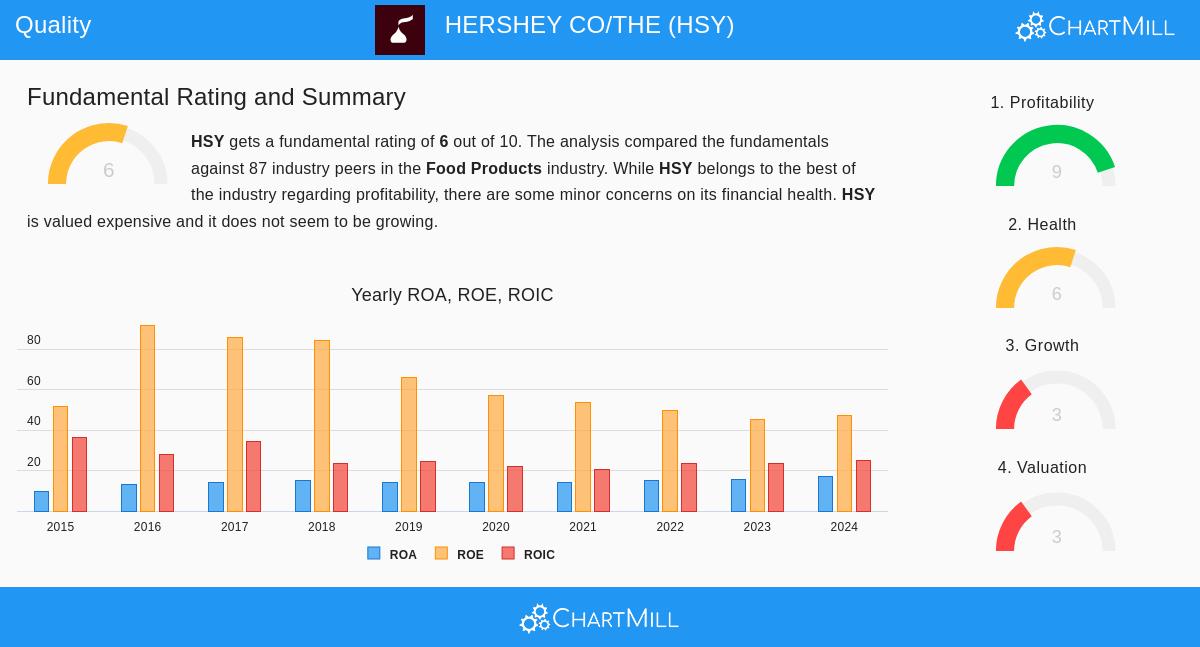

A wider view of Hershey's finances, as shown in its detailed fundamental report, supports its quality standing but also points out items to note. The company receives a very good profitability rating (9/10), fueled by top-tier margins and returns on equity and assets. Its financial condition is acceptable (6/10), helped by a good Altman-Z score and the positive debt-to-cash flow ratio, although it maintains a higher debt-to-equity level than some similar companies.

The main points of caution in the report focus on price and growth. Hershey's stock is considered costly on a Price-to-Earnings basis, and its short-term growth prospect is limited, with analysts predicting only small gains in sales and earnings. For a quality investor, the high price is a common cost for owning a superior business, requiring attention to very long-term timeframes. The slowing growth numbers, however, highlight the significance of Hershey's established capacity to increase profits through wider margins and operational skill, not just higher sales.

Is Hershey a "Forever" Stock?

For an investor using a quality-focused, long-term ownership method, Hershey makes a strong argument. It works in a steady, non-cyclical field and has one of the most prized collections of consumer brands globally. Financially, it satisfies strict filters for capital effectiveness, cash flow quality, and careful borrowing. The company also maintains its reputation for treating shareholders well with a steady and increasing dividend, having raised it for more than ten years.

The Caviar Cruise filter is made to find companies with these lasting traits. Hershey's success in passing its tests indicates it has the basic financial soundness that quality investors look for. For those wanting to see other companies that satisfy these conditions, you can see the present Caviar Cruise filter outcomes here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. Investors should conduct their own due diligence and consider their individual financial circumstances and risk tolerance before making any investment decisions.