In the world of investing, few strategies have lasted as long or shown as much success as value investing. The central idea of this method is to look for companies whose current market price is below a calculated estimate of their true worth. The aim is to find good businesses that are temporarily unpopular or missed by most of the market, offering a "margin of safety" for the investor. One way to find these companies is by searching for stocks that show good basic financial condition and earnings, but are available at a low price, a pairing that points to possible mispricing instead of a lasting problem. This review looks at HNI CORP (NYSE:HNI), a company that recently appeared using this careful search method.

Examining Valuation

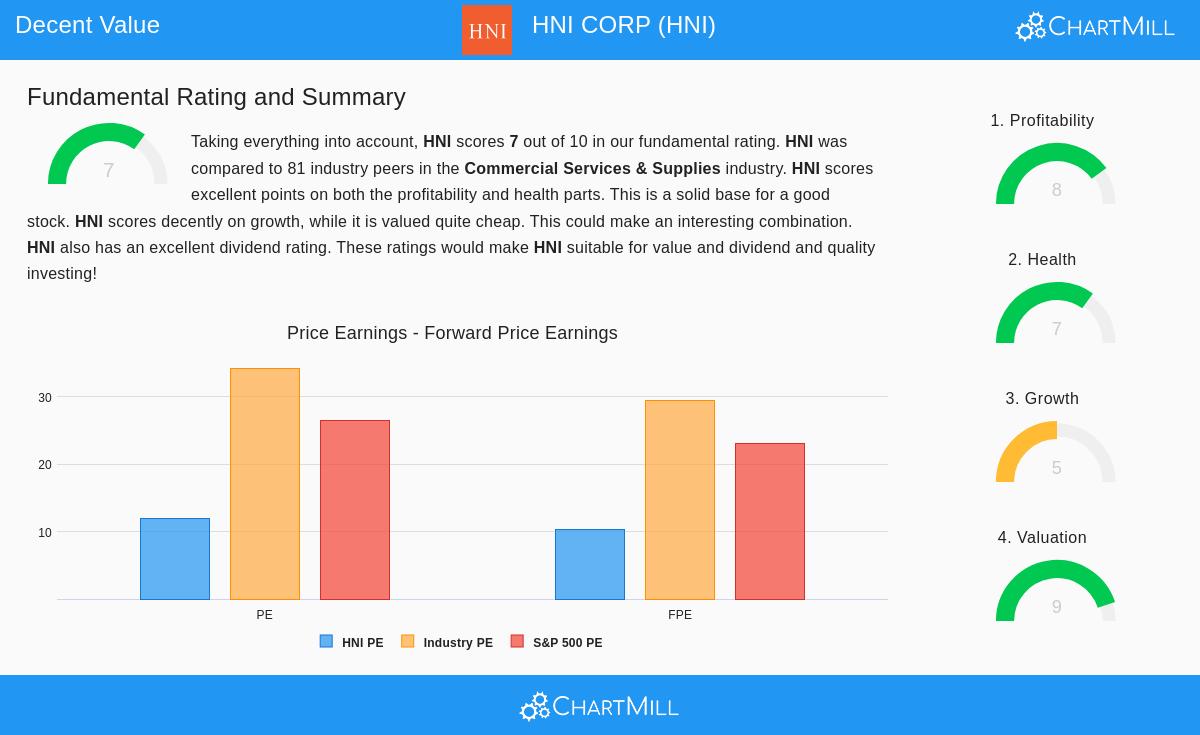

The most persuasive beginning for a value investor is a company's valuation numbers. For HNI, the figures show a possibly mispriced asset. The company's basic report gives it a high Valuation Rating of 9 out of 10, meaning it is priced low compared to its financial results and future outlook.

- Price-to-Earnings (P/E) Ratio: At 11.94, HNI's P/E ratio is sensible on its own and is much lower than the wider market. It is notably below the S&P 500 average of 26.51.

- Industry Comparison: The valuation looks better within its sector. About 85% of companies in the Commercial Services & Supplies industry have a higher P/E ratio than HNI.

- Forward-Looking Metrics: The argument for value is strengthened by future estimates. With a Price/Forward Earnings ratio of 10.25, HNI is priced lower than 90% of similar companies and stays under the S&P 500 forward average.

This low valuation is key for the value plan. It offers the initial "margin of safety" that Benjamin Graham highlighted, implying the market may value the company under its true worth, forming a possible opening for investors.

Reviewing Financial Condition and Earnings

A low price by itself is not a reason to purchase; it might signal a failing company. So, value investing needs verification that the company is fundamentally strong. HNI's report displays high marks in both Financial Health (7/10) and Profitability (8/10), which are necessary foundations for a lasting investment.

The company's earnings strength is a notable positive, placing it near the top in its field.

- It has a solid Return on Invested Capital (ROIC) of 12.16%, doing better than over 82% of similar companies.

- Important margins, like Gross, Operating, and Profit Margin, have gotten better and stack up well against industry norms.

From a condition view, HNI shows good stability, which is protection during economic weakness.

- Its Debt-to-Equity ratio of 0.40 points to a careful balance sheet.

- More notably, its Debt to Free Cash Flow ratio of 1.80 is very good, meaning the company could pay off all debt with under two years of cash flow. This degree of financial stability is a major advantage and lowers the risk of the investment.

For a value investor, these high health and profitability scores are essential. They show the company is not only low-priced, but is a sound business able to produce returns and handle difficulties, which backs the idea that the low price may be short-term.

Future Growth and Dividend Attraction

While some value stocks do not grow, HNI shows a mixed picture. Its Growth Rating is a middle 5/10, but the specific information shows good trends. The company's Earnings Per Share increased by more than 11% last year, and, significantly, analysts think this pace will rise with EPS forecast to grow about 15.6% each year going forward. This predicted rise in earnings growth can support a higher valuation and may help the stock price move toward its true value.

Also, HNI provides a good dividend yield of 3.21%, which is much higher than both its industry norm and the S&P 500. The company has a consistent history of paying and not cutting its dividend for more than ten years. For value investors, a steady and secure dividend gives income while waiting for the market to see the company's complete value, making the period before price gains more productive.

Final Thoughts: A Possibility for the Value Portfolio

HNI CORP presents a situation that fits the rules of value investing. It is a financially stable and profitable company, a leader in its area of office furniture and residential building products, yet it is valued at a clear discount to both the general market and its industry. The mix of a low valuation, strong balance sheet, high profitability, a good dividend, and increasing earnings growth forms a persuasive picture. It indicates the stock may be mispriced instead of fundamentally weak. Naturally, investors should think about wider economic patterns, especially for a company connected to commercial building and housing markets, but the basic "margin of safety" seems to exist.

For investors wanting to find other companies that match this pattern of sound basics combined with good valuations, you can use a ready-made "Decent Value" stock screen here. This screen selects for stocks with good valuation scores while keeping acceptable ratings in growth, health, and profitability.

Disclaimer: This article is for information only and is not financial advice, a support, or a suggestion to buy, sell, or hold any security. Investors should do their own study and analysis, thinking about their personal money situation and risk comfort, before making any investment choices.