US Markets Enter Correction as Trade War Intensifies

U.S. stocks suffered significant losses on Thursday, driven primarily by escalating trade tensions initiated by President Trump's latest tariff threats. The Dow Jones dropped 1.3%, losing 537 points, while the Nasdaq saw an even sharper decline of 2%. The S&P 500 fell 1.4% to close at 5,521.52, marking its entry into correction territory after declining more than 10% from its February peak.

Investor anxiety increased as Trump threatened a 200% tariff on European alcoholic beverages in response to the EU's recent 50% tariff on U.S. spirits. Trump also reaffirmed his commitment to maintain existing tariffs of 25% on steel and aluminum imports, asserting that he wouldn't "bend" despite potential economic repercussions.

Market fears were furth, experts warned these figures didn't account for potential price spikes from new tariffs.

Strategist Paul Stanley from Granite Bay Wealth Management highlighted investor concerns over unpredictable inflationary pressures due to ongoing trade disputes.

Technology stocks were heavily impacted, reversing Wednesday’s brief gains. Meta Platforms (META | -4.67%) fell nearly 5%, Apple (AAPL | -3.36%) and Tesla (TSLA | -2.99%) both declined approximately 3%, and Amazon (AMZN | -2.51%) and Alphabet (GOOGL | -2.60%) dropped around 2.5% each.

Adobe (ADBE | -13.85%) was notably affected, plunging nearly 14% despite reporting better-than-expected earnings, due to disappointing future guidance.

Conversely, Intel (INTC | +14.6%) stood out positively, surging almost 15% after announcing Lip-Bu Tan as its new CEO.

Dollar General (DG |+6.81%) posted fourth-quarter sales that surpassed expectations, boosting shares in discount retail companies. However, the company noted that profitability was affected by an evaluation of its store network and expressed caution regarding future consumer spending habits. Dollar General shares rose by 6.1%, and shares of its competitor, Dollar Tree (DLTR | +6.59%), increased by 6.8%.

Gold reached a record high of $3,000 per ounce, underscoring heightened market uncertainty. Bitcoin slightly declined to around $81,100, while U.S. oil prices dropped 1.4%, trading at $66.75 per barrel.

Overall, market sentiment remains cautious, with investors closely monitoring tariff developments and their potential impact on economic growth.

Daily Market Analysis – March 13, 2025 (After Market Close)

SPY (S&P 500 ETF)

- Short-Term Trend: Down (no change)

- Long-Term Trend: Neutral (no change)

Key Technical Levels:

- Next Resistance: Around 575

- Next Support: Around 550-560

QQQ (Nasdaq-100 ETF)

- Short-Term Trend: Down (no change)

- Long-Term Trend: Neutral (no change)

Key Technical Levels:

- Resistance: Around 500

- Support: Around 445 (potential bounce area)

IWM (Russell 2000 ETF)

- Short-Term Trend: Down (no change)

- Long-Term Trend: Down (no change)

Key Technical Levels:

- Resistance: Around 215

- Support: Around 195-200 (historical buying interest)

Sector Analysis

- Next update (weekly) on friday, march 14 (AMC)

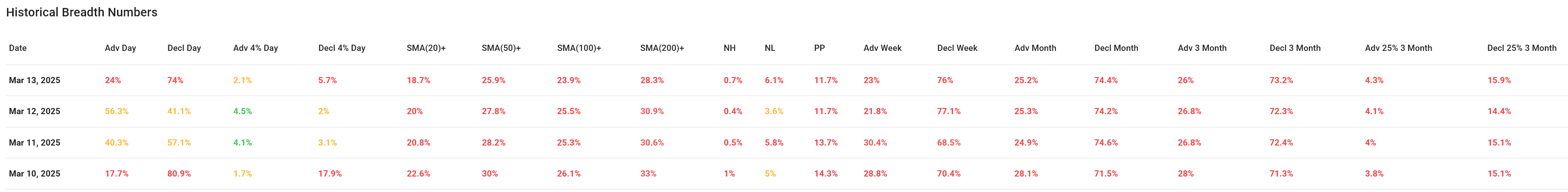

Market Breadth Analysis for March 13, 2025

The market breadth data of March 13 clearly signals an intensified bearish condition, contrasting sharply with the more neutral to positive breadth observed on March 12. This progressive deterioration suggests an increasing bearish bias, with weakening internal indicators indicating heightened caution for investors.