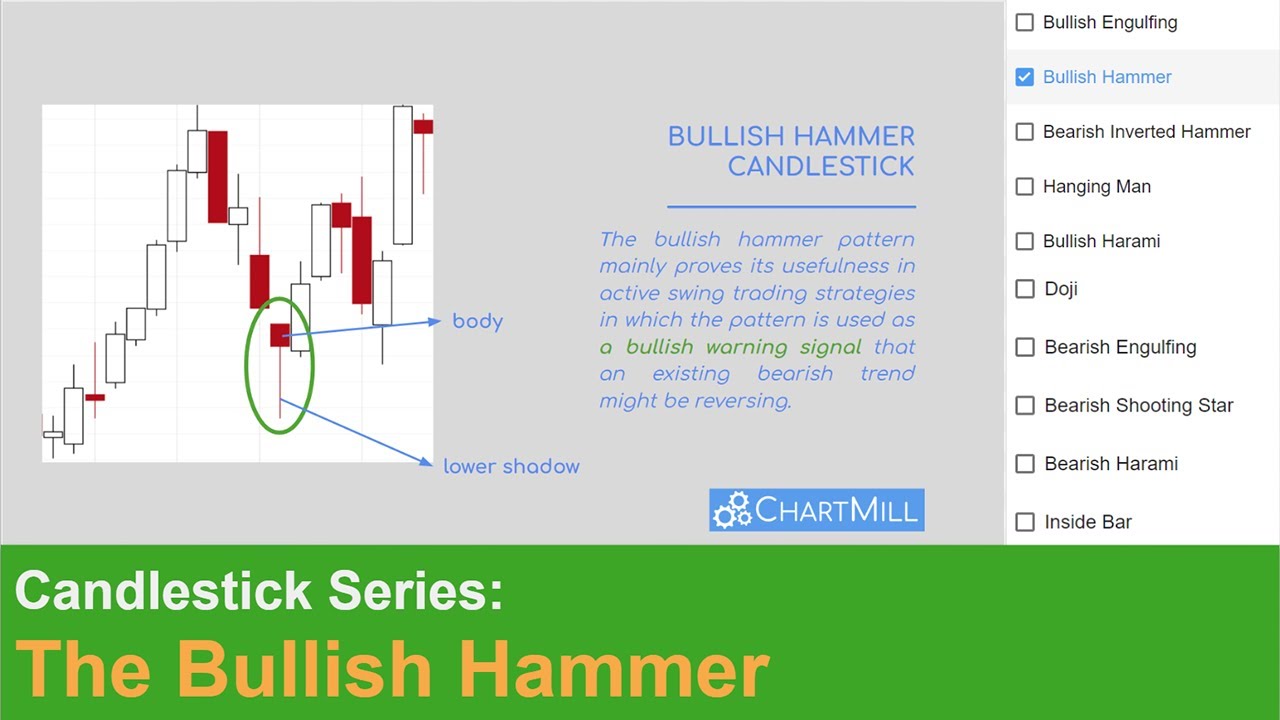

The Bullish Hammer Candlestick Pattern in Technichal Analysis

Screening For Tight Price Ranges | ChartMill Channels

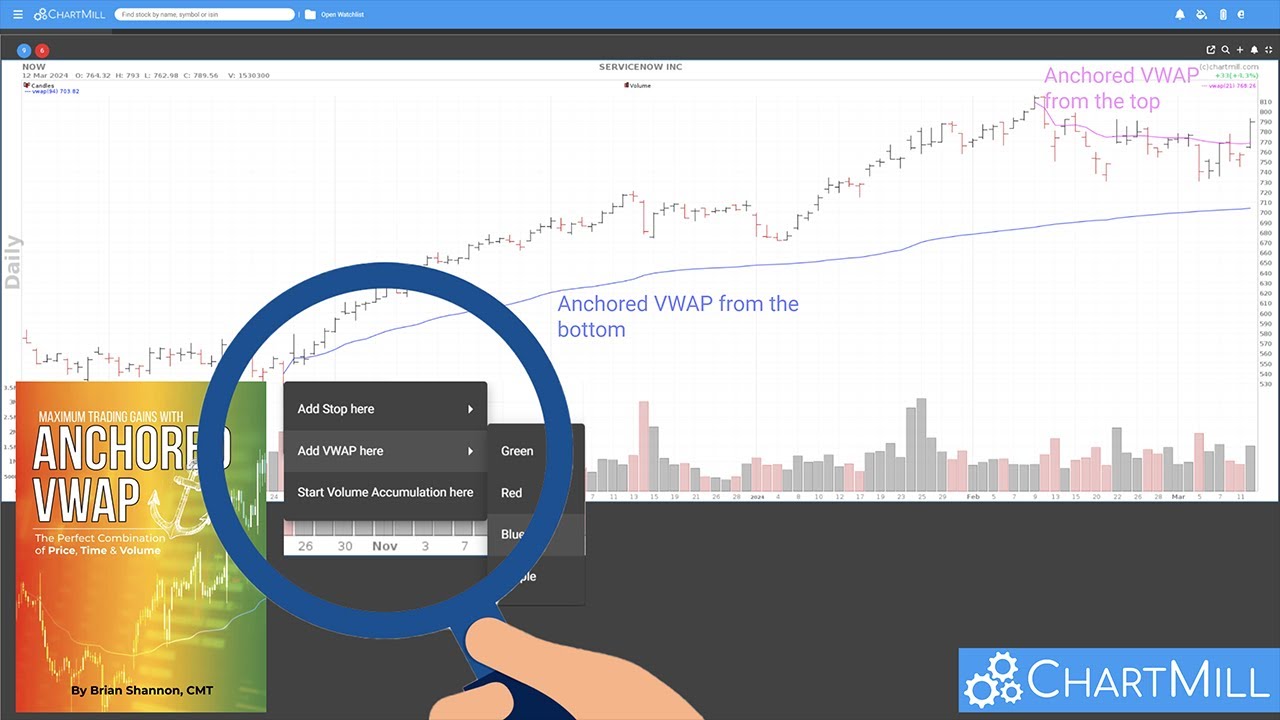

Adding an Anchored VWAP in ChartMill

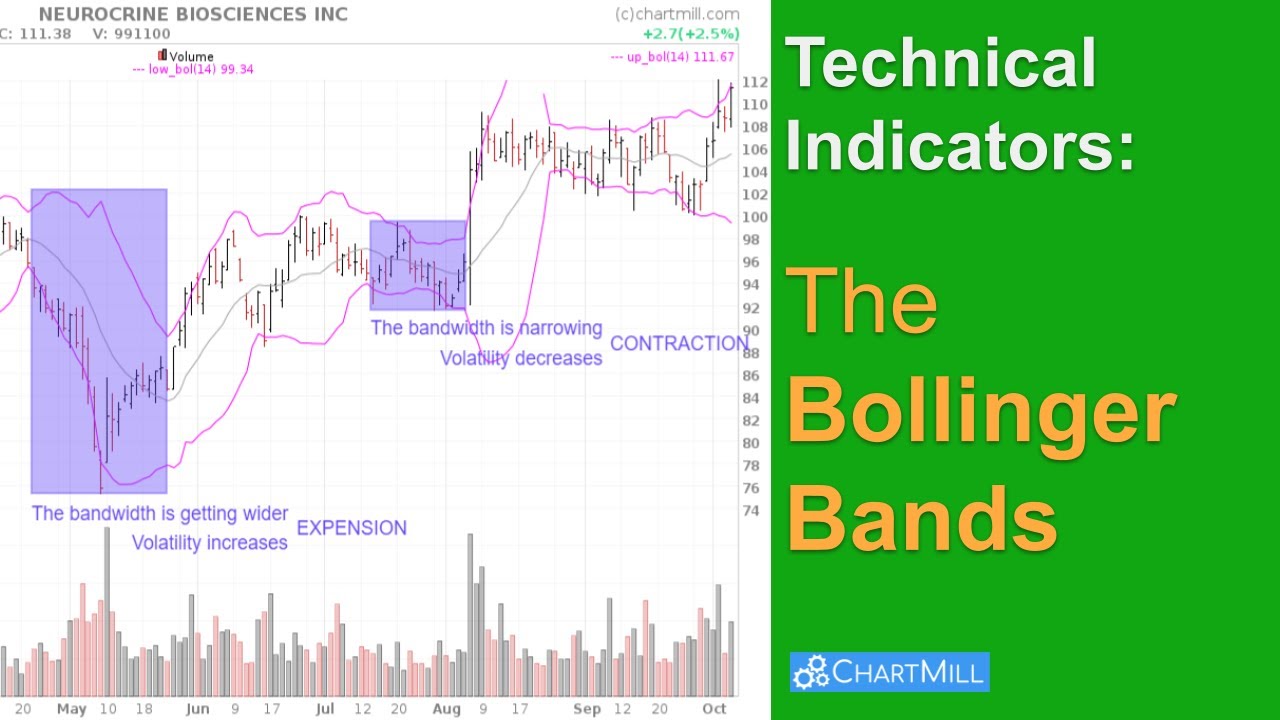

What are Bollinger Bands and how to use this indicator?

Bullish Engulfing Candlestick in Technical Analysis

The Bullish Hammer Candlestick Pattern in Technichal Analysis

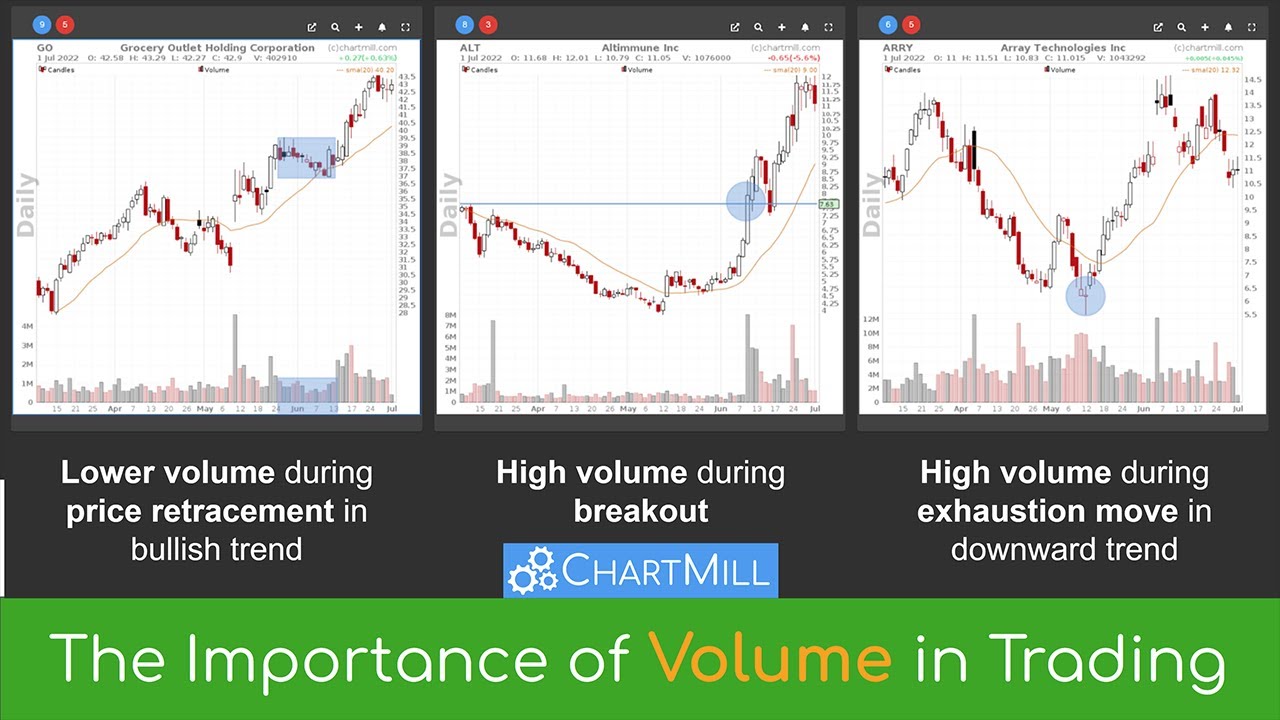

The Importance of Volume in trading (and why it matters!)

Alligator Indicator explained and trading strategy

How to use the Awesome Indicator?

Understanding the Aroon indicator

Understanding the On Balance Volume Indicator (OBV)

The golden cross and death cross explained

Mastering the MACD indicator in your Trading Strategy

How to Trade Bullish and Bearish Engulfing Patterns?

How to trade the bullish flag pattern

Trading strategy for the wedge chart pattern

What is the triangle chart pattern and how to trade it

Candlesticks come in all shapes and sizes, they are used as a component within technical analysis.. One of them is the bullish hammer. This specific candlestick pattern mainly proves its usefulness in active swing trading strategies in which the pattern is used as a warning signal that an existing bearish trend might be reversing. By combining this pattern with other candlesticks before and after the bullish hammer itself, even real reversal signals arise, consisting of several consecutive candlesticks, which benefits the reliability of the signal.