Grupo Financiero Galicia-ADR (NASDAQ:GGAL) is an Argentine financial services holding company with operations in banking, insurance, and certificates of deposit. The CANSLIM investing strategy, developed by William O’Neil, combines fundamental and technical analysis to identify high-growth stocks with strong momentum. Below, we examine how GGAL fits several key CANSLIM criteria.

How GGAL Meets CANSLIM Criteria

C – Current Earnings & Sales Growth

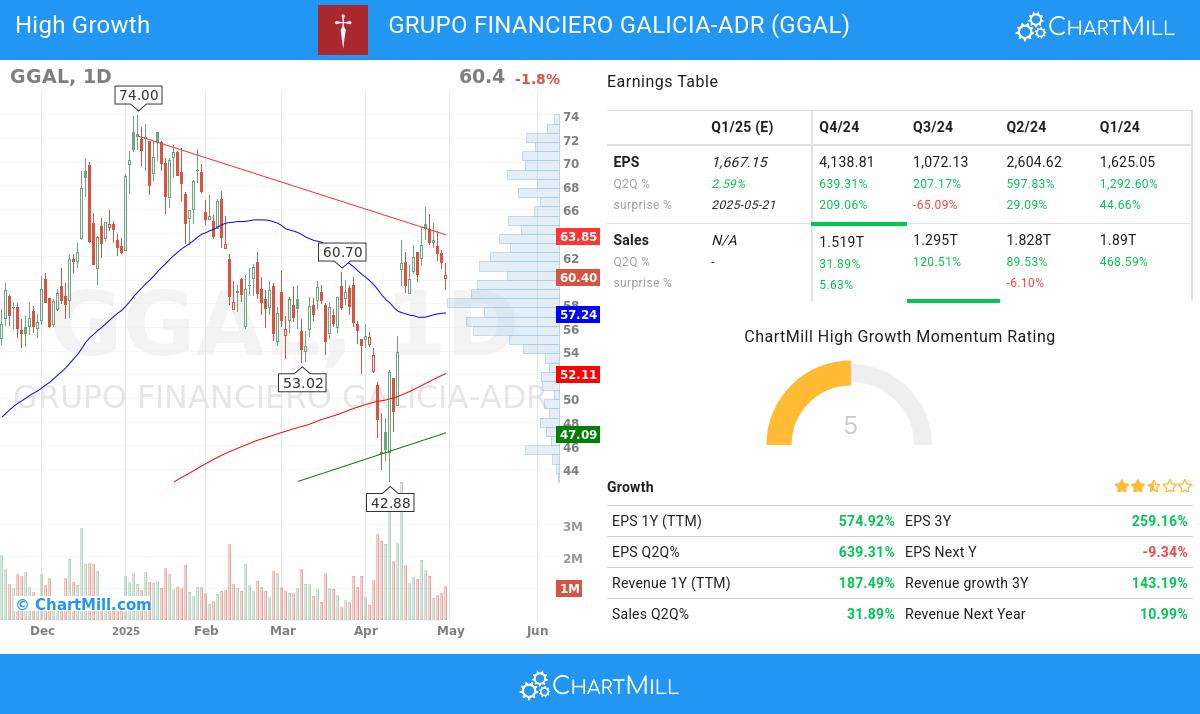

GGAL shows explosive quarterly earnings growth, with EPS up 639.31% year-over-year. Revenue growth is also strong at 31.89%, exceeding the CANSLIM threshold of 25%.

A – Annual Earnings Growth

The company’s 3-year EPS growth stands at 259.16%, far surpassing the 25% minimum recommended by CANSLIM.

N – New Highs & Leadership

GGAL has demonstrated strong relative strength, outperforming 94.63% of all stocks. It trades near its 52-week high, a positive signal for momentum investors.

S – Supply & Demand

GGAL has a manageable debt-to-equity ratio of 0.76, below the CANSLIM-recommended maximum of 2.

L – Market Leadership

With a relative strength of 94.63, GGAL ranks among the top performers in its sector.

I – Institutional Sponsorship

Institutional ownership is 49.88%, well below the 85% threshold, suggesting room for further institutional accumulation.

M – Market Direction

The S&P 500’s long-term trend is negative, but GGAL’s strong technicals suggest resilience.

Technical & Fundamental Overview

Technical Analysis

GGAL has a technical rating of 9/10, with both short- and long-term trends positive. The stock is consolidating near resistance at $63.42-$64.40, presenting a potential breakout opportunity. View full TA report.

Fundamental Analysis

GGAL’s fundamentals score 2/10, reflecting concerns around profitability and valuation. However, its high ROE (31.62%) and strong past growth metrics align with CANSLIM principles. View full FA report.

Conclusion

While GGAL’s valuation raises concerns, its earnings momentum, leadership in its sector, and strong technical setup make it a candidate for CANSLIM investors.