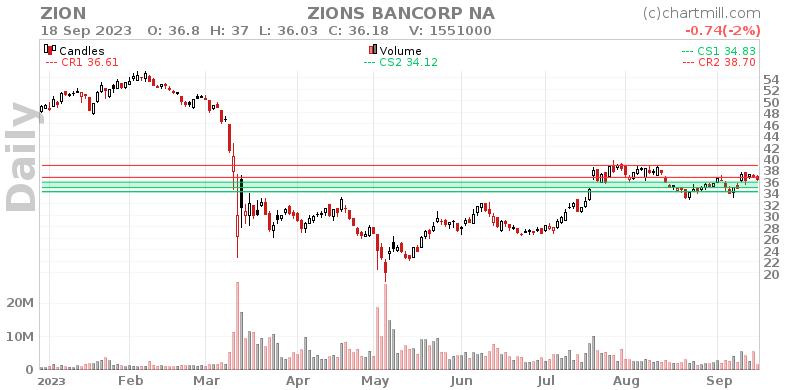

A possible breakout setup was detected on ZIONS BANCORP NA (NASDAQ:ZION) by our stockscreener. A breakout pattern is formed when a stock consolidates after a strong rise up. We note that this pattern is detected purely based on technical analysis and whether the breakout actually materializes remains to be seen. It could be interesting to keep an eye on NASDAQ:ZION.

Technical analysis of NASDAQ:ZION

As part of its analysis, ChartMill provides a comprehensive Technical Rating for each stock. This rating, ranging from 0 to 10, is updated on a daily basis and is based on the evaluation of various technical indicators and properties.

We assign a technical rating of 7 out of 10 to ZION. In the last year, ZION was an average performer in the market. There are positive signs in the very recent evolution, but the medium term picture is still mixed.

- The short term trend is positive, while the long term trend is neutral. So this is evolving in the right direction.

- ZION is part of the Banks industry. There are 418 other stocks in this industry. ZION outperforms 76% of them.

- In the last month ZION has a been trading in the 32.65 - 37.63 range, which is quite wide. It is currently trading near the high of this range.

- When comparing the performance of all stocks over the past year, ZION turns out to be only a medium performer in the overall market: it outperformed 48% of all stocks.

- ZION is currently trading in the middle of its 52 week range. The S&P500 Index however is trading in the upper part of its 52 week range, so ZION is lagging the market slightly.

Check the latest full technical report of ZION for a complete technical analysis.

Why is NASDAQ:ZION a setup?

In addition to the Technical Rating, ChartMill provides a Setup Rating for each stock. This rating, ranging from 0 to 10, assesses the level of consolidation in the stock based on multiple short-term technical indicators. Currently, NASDAQ:ZION has a 9 as its setup rating, indicating its current consolidation status.

Besides having an excellent technical rating, ZION also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. There is very little resistance above the current price. There is a support zone below the current price at 35.79, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

How can NASDAQ:ZION be traded?

A breakout could materialize when the stock breaks out to new highs above the current consolidation zone. One could wait for this to happen and buy when this happens. A stop loss could be placed below the consolidation zone.

Disclaimer: This article is not intended to provide trading advice. It is crucial to conduct your own analysis and consider your own observations and trading style when making investment decisions. The article solely presents technical observations and should not be relied upon as a sole basis for trading.

Every day, new breakout setups can be found on ChartMill in our Breakout screener.

Keep in mind

This article should in no way be interpreted as advice in any way. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.