ZEBRA TECHNOLOGIES CORP-CL A (NASDAQ:ZBRA) has been identified by a systematic screening process made to find possible value chances in the market. The method used concentrates on stocks showing good basic valuation scores while keeping acceptable ratings in profitability, financial condition, and growth. This method fits with traditional value investing ideas, where investors look for companies trading below their intrinsic value but having the basic strength to possibly achieve that value over time. The screen looks for securities with a valuation rating above 7, along with satisfactory scores across other important financial areas, indicating a margin of safety without giving up operational quality.

Valuation Assessment

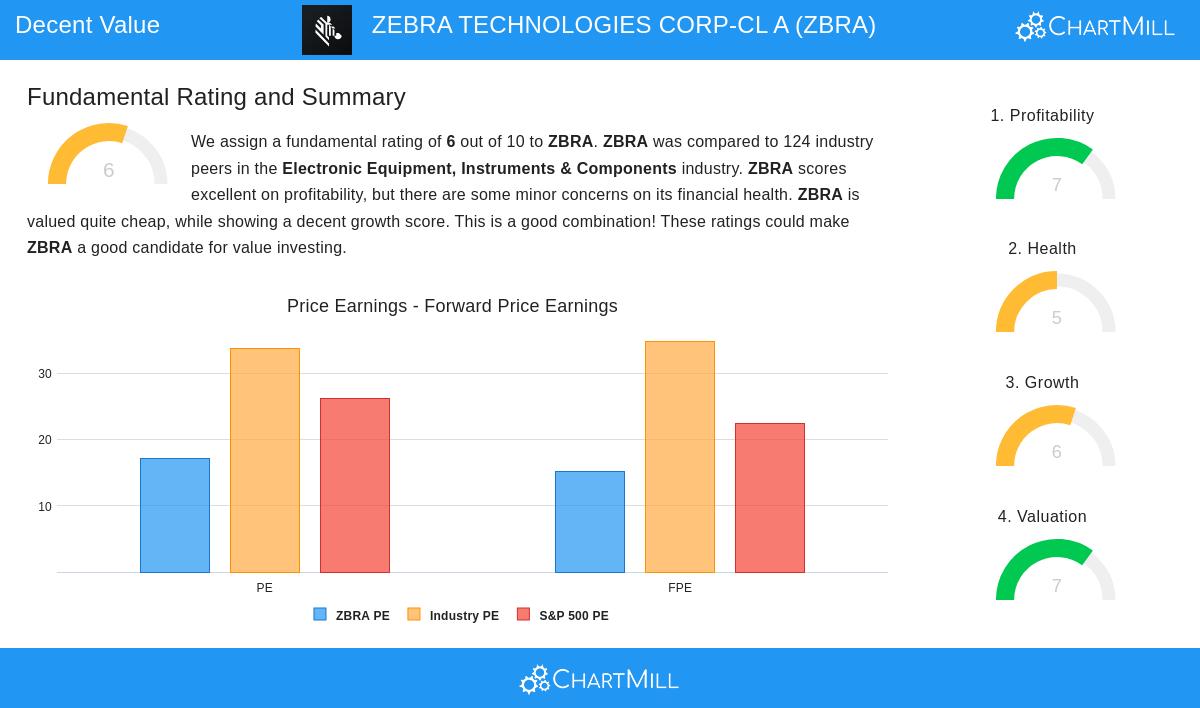

The company's valuation numbers present a strong case for review by value-focused investors. According to the fundamental analysis report, Zebra Technologies receives a valuation rating of 7 out of 10, showing appealing pricing compared to both industry rivals and wider market indexes.

Key valuation points include:

- Price/Earnings ratio of 17.17, much lower than the industry average of 33.68

- Price/Forward Earnings ratio of 15.12, compared to industry average of 34.82

- Enterprise Value to EBITDA ratio placing the company lower than 73% of industry competitors

- Price/Free Cash Flow ratio lower than almost 88% of industry peers

These valuation numbers are especially important in value investing as they indicate the market may be pricing the company's earnings power and cash flow generation below its worth. The lower multiples relative to industry averages give that important margin of safety value investors want, while the forward-looking numbers show continued valuation appeal.

Financial Health Profile

Zebra Technologies shows acceptable financial stability with a health rating of 5 out of 10. While not outstanding, the company keeps enough financial strength to handle market difficulties.

Notable health numbers include:

- Altman-Z score of 3.87, showing low bankruptcy risk

- Debt to Free Cash Flow ratio of 2.74 years, indicating controllable debt levels

- Current ratio of 1.61, giving sufficient short-term liquidity coverage

- Debt/Equity ratio of 0.56, showing moderate leverage

For value investors, financial condition acts as an important filter to avoid value traps, companies that seem low-priced but have underlying financial trouble. Zebra's good solvency numbers and controllable debt levels give confidence that the company can endure economic challenges while working to reduce the valuation difference.

Profitability Strength

The company performs well in profitability with a rating of 7 out of 10, showing efficient operations and good returns on capital.

Profitability points include:

- Return on Invested Capital of 10.71%, higher than 85% of industry rivals

- Return on Equity of 13.66%, one of the best in the industry

- Operating Margin of 15.34%, better than almost 90% of competitors

- Gross Margin of 48.39%, indicating good pricing power

Lasting profitability is necessary for value investments because it confirms the company's business model and provides the earnings power to eventually support higher valuations. Zebra's better margins and returns suggest competitive strengths that could lead to long-term value achievement.

Growth Trajectory

With a growth rating of 6 out of 10, Zebra Technologies shows encouraging momentum in spite of its value features.

Growth signs include:

- Earnings Per Share growth of 38.24% in the past year

- Revenue growth of 12.87% over the same time

- Expected EPS growth of 13.92% each year in coming years

- Increasing growth rates in both revenue and earnings

Growth possibility provides the catalyst that value investors search for to help reduce the difference between market price and intrinsic value. The mix of good recent performance and positive future expectations indicates the company is not inactive, possibly providing the basic improvement required to drive price increases.

The coming together of appealing valuation, acceptable financial condition, good profitability, and positive growth momentum makes Zebra Technologies a noteworthy candidate for more study by value-oriented investors. The company seems to offer that uncommon mix of value features without the usual connected risks of worsening basics.

For investors looking for similar chances, more screening results can be reviewed using the Decent Value Stocks screening tool, which methodically finds companies meeting these balanced basic criteria.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions.