For investors aiming to build a portfolio focused on creating reliable passive income, a disciplined screening process is important. A common strategy involves looking beyond just a high current yield to find companies with sustainable payouts. This often means filtering for stocks that not only have a strong dividend profile but also show solid basic business health and profitability. These core strengths make it more likely that a company can keep and possibly increase its dividend over time, even through different economic periods. One stock that appears from this method is Winnebago Industries (NYSE:WGO), a leading manufacturer of recreational vehicles and marine products.

Examining the Dividend Profile

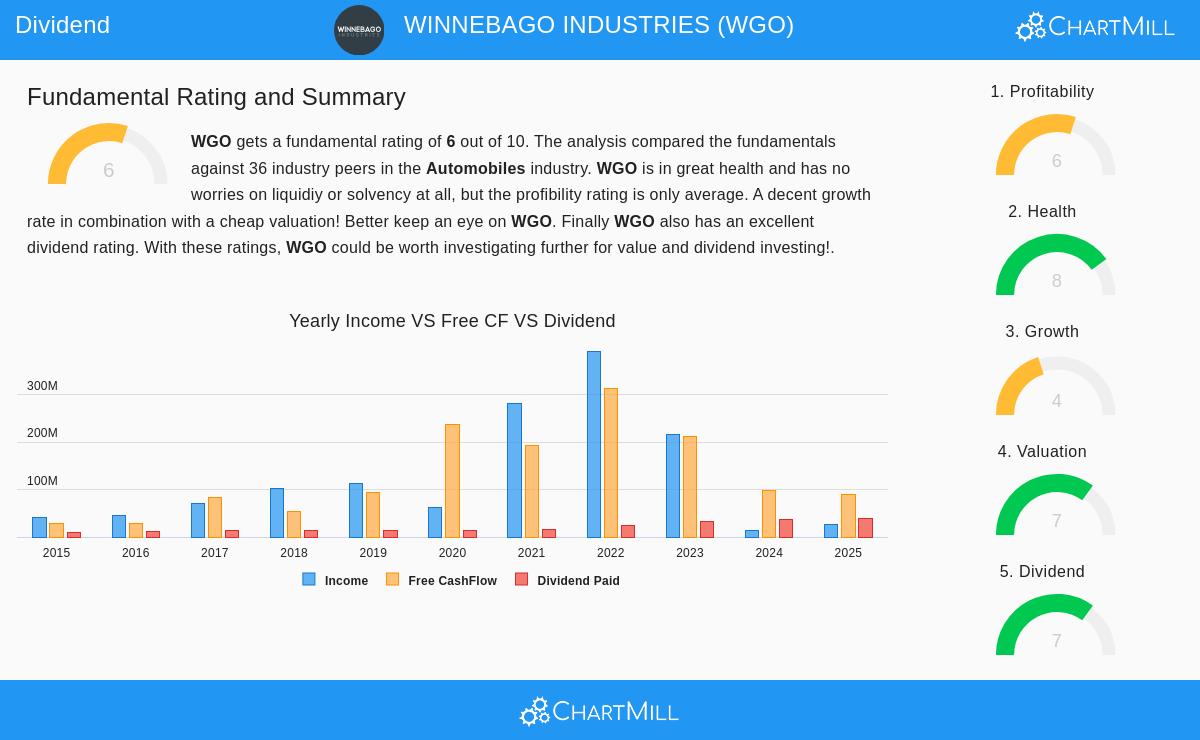

The main attraction of WGO for income-seeking investors is found in its solid dividend characteristics, which are reflected in its ChartMill Dividend Rating of 7 out of 10. This rating combines several key numbers into one score, pointing to a high-quality dividend offering compared to the wider market.

- Attractive and Growing Yield: Winnebago currently provides a dividend yield of 3.71%. While not the highest available, this yield is more than double the S&P 500 average of about 1.87%. Significantly, the company has built a reliable history of regularly raising its payout. The dividend has increased at a notable average yearly rate of 25.02% over the past five years, and the company has not lowered its dividend for at least ten years. This pairing of a good yield and a history of growth is a strong beginning for dividend investors.

- Industry Comparison: Context is key when judging yield. Within the competitive automobiles industry, Winnebago’s dividend yield is notable. The report states that WGO pays more dividend than 91.67% of its industry peers, whose average yield is only 0.81%. This indicates the company is more dedicated to returning capital to shareholders than many others in its field.

- A Note on Sustainability: A detailed look at the fundamental analysis report shows one area for investor attention: the payout ratio. Currently, Winnebago is using about 151% of its earnings on dividends, which is not usually seen as maintainable long-term. However, this number is based on trailing twelve-month earnings, which have been weak. The report also gives important context, stating that "the dividend of WGO is growing, but earnings are growing more, so the dividend growth is sustainable." This forward-looking view, based on analyst forecasts for strong earnings growth, helps balance the perspective on the current high payout ratio.

The Base: Profitability and Financial Health

A high dividend is only as reliable as the company’s capacity to pay for it. This is why the screening criteria stressed acceptable profitability and health, to avoid "yield traps" where a high payout is in danger of being reduced. Winnebago scores a 6 for Profitability and a higher 8 for Financial Health, giving a stable base for its dividend.

- Profitability Facing Challenges, But Still Favorable: The company’s profitability margins have encountered difficulties lately, with both Profit Margin and Operating Margin falling. Even so, Winnebago’s current margins still look good compared to its industry. Its Return on Equity (2.10%) and Return on Invested Capital (1.87%) each do better than 75% of industry peers, showing it creates better returns from its capital than most competitors. This relative advantage is a good sign for the business’s basic efficiency.

- Strong Financial Health: Possibly the most comforting part for dividend investors is Winnebago’s very good financial health rating. The company has a solid Altman-Z score of 3.51, pointing to little near-term risk of bankruptcy and doing better than almost 89% of its industry. Its balance sheet shows a workable Debt/Equity ratio of 0.44 and a very good Current Ratio of 2.42, meaning it has more than enough short-term assets to pay its immediate debts. This financial strength gives an important cushion, letting the company continue funding its dividend and operations even during times of lower earnings.

Valuation and Growth Prospects

From a valuation angle, Winnebago shows a mixed but generally positive picture. Its Price-to-Earnings (P/E) ratio of 24.64 is similar to the wider S&P 500 but is viewed as inexpensive relative to its own industry, where it is cheaper than 83% of peers. More revealing is the forward P/E ratio of 17.26, which is under the S&P 500 average and indicates a more appealing valuation based on future earnings.

This connects directly to the growth story. While past growth in revenue and earnings has been low or negative, analysts predict a important change. Earnings Per Share are forecast to grow by over 43% yearly in the coming years, with revenue growth also speeding up. This expected growth surge helps support the current valuation and, importantly, backs the idea that the high payout ratio is a short-term situation likely to get better as profits improve.

Is Winnebago Suitable for a Dividend Portfolio?

Winnebago Industries represents a possibly interesting choice for dividend investors who use a complete screening strategy. It provides a yield that is appealing both on its own and compared to its sector, supported by a notable ten-year history of reliable and increasing payments. The company’s clear financial health gives trust in its capacity to handle cyclical slowdowns, while analyst forecasts for a sharp earnings rebound speak to worries about the current high payout ratio.

Investors should, as always, balance these positives against the company’s connection to the cyclical recreational vehicle market and watch its progress in improving profitability margins. For those building a varied income portfolio, WGO offers a mix of yield, growth, and financial stability that deserves more study.

This analysis was based on a screen for high-dividend stocks with solid fundamentals. You can find more investment ideas from this "Best Dividend Stocks" screen by clicking here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented is based on data provided and should not be the sole basis for any investment decision. Investors should conduct their own independent research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.