Investors looking for growth chances at fair prices often use screening methods that find companies with good expansion possibilities while keeping acceptable financial condition and appealing prices. The Affordable Growth method focuses on stocks showing good growth paths, firm profitability, and healthy balance sheets without requiring high price multiples. This system helps investors prevent paying too much for growth while making certain companies have the financial soundness to continue their development.

Growth Path

United Therapeutics Corp (NASDAQ:UTHR) shows good growth features that match well with affordable growth standards. The company's revenue increase has been especially notable, with recent results displaying significant speed. The biotechnology company's growth measurements point to lasting development rather than short-lived jumps, which is important for long-term investment assessment.

Important growth measures include:

- Revenue increase of 23.63% over the last year

- Three-year average yearly revenue increase of 14.71%

- Earnings per share increase of 15.90% in the most recent year

- Expected EPS increase of 13.54% each year going forward

These numbers indicate United Therapeutics is effectively growing its pulmonary arterial hypertension treatments while keeping operational effectiveness. The steadiness between past results and future projections gives assurance in the durability of the company's growth story.

Price Assessment

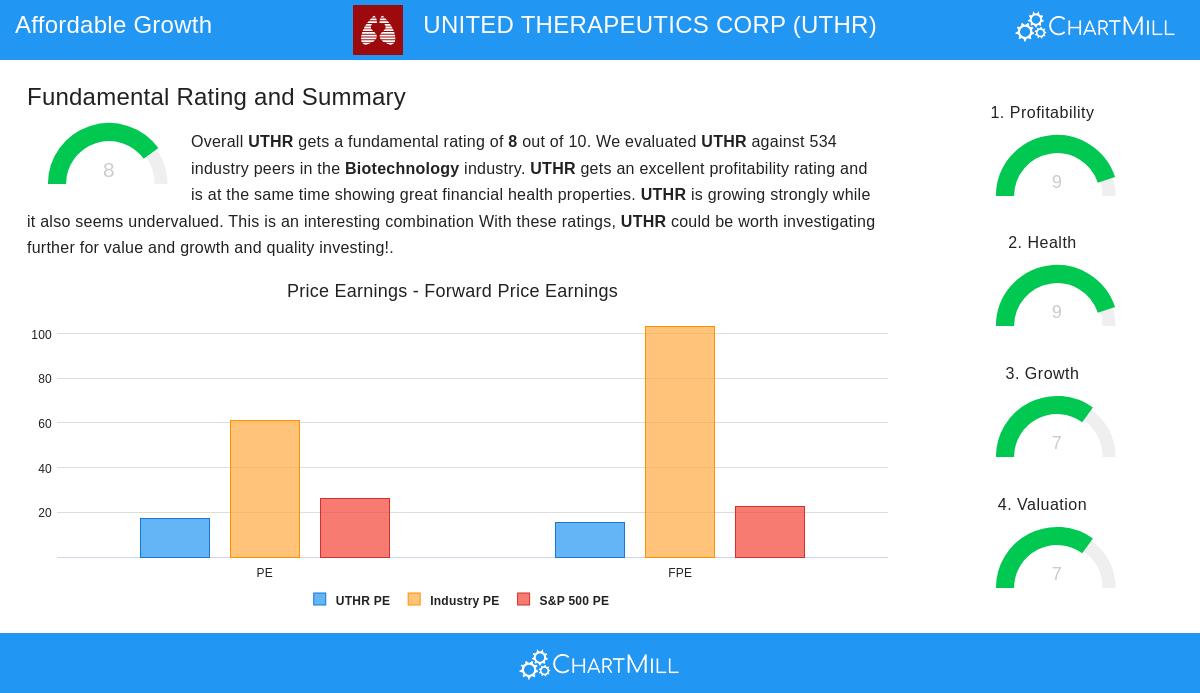

The company's market price offers an appealing situation compared to both industry competitors and wider market measures. In spite of good growth and profitability measurements, United Therapeutics sells at multiples that indicate market underappreciation relative to sector standards. This price difference forms a possible opening for investors looking for growth at sensible prices.

Notable price measurements:

- Price-to-Earnings multiple of 17.19, much under industry average of 61.28

- Forward P/E multiple of 15.44 compared to industry average of 103.37

- Enterprise Value to EBITDA ratio positioned lower than 96.63% of industry competitors

- Price-to-Free Cash Flow multiple more appealing than 95.13% of biotechnology firms

The price view becomes especially interesting when noting that United Therapeutics sells at a lower level than the S&P 500's average P/E of 26.19 even while displaying better growth features and unusual profitability.

Profitability and Financial Condition

Beyond growth and price, United Therapeutics displays unusual operational effectiveness and financial steadiness. The company's profitability measurements place with the industry's best, while its balance sheet soundness gives sufficient buffer for continued spending on growth projects. These elements lower investment risk while supporting the company's capacity to maintain its growth path.

Profitability points:

- Profit margin of 40.36%, doing better than 97.94% of industry competitors

- Operating margin of 50.06%, surpassing 99.63% of biotechnology firms

- Return on invested capital of 16.17%, placing in the high group of the industry

- Steady margin improvement over recent times

Financial condition signs:

- Altman-Z score of 19.68 showing very low bankruptcy danger

- Current ratio of 7.26 displaying good short-term cash availability

- No existing debt allowing financial adaptability

- Positive operating cash flow during the last five years

The mix of unusual profitability and sound financial condition lowers operational risk while giving management strategic choices for chasing more growth chances through research work or strategic purchases.

Investment Points

United Therapeutics forms an interesting example in affordable growth investing. The company's good basic ratings across growth, price, profitability, and condition groups indicate a business operating well functionally while staying fairly valued in the market. The detailed basic examination report gives more understanding into how these elements work together to form the company's complete investment picture.

For investors looking for similar chances, the Affordable Growth screening system can produce other choices that meet these strict standards. The method consistently finds companies displaying the uncommon mix of growth speed, fair price, and financial soundness that usually pushes long-term investment outperformance.

More affordable growth stock options can be found using our specific screening tools, which permit adjustment based on particular growth, price, and basic strength measures.

Disclaimer: This examination is based on basic information and screening systems for learning purposes only. It does not form investment guidance, and investors should do their own study and think about their personal financial situations before making investment choices. Past results do not assure future outcomes, and all investments carry built-in risks including possible loss of original money.